Why Lakshmi Vilas Bank needs an urgent dose of capital

The traditional private sector bank was left struggling for capital and supervision in 2019 after a deal for a financial partnership failed. Now it needs both urgently.

It is worrisome when shareholders of a listed entity rebel against the board of directors. That’s what happened in the case of the 93-year-old Lakshmi Vilas Bank (LVB) where shareholders decided, publicly, to vote against the appointment of seven board members in September. But what is even more alarming is that the bank is, even after a year, still struggling to resolve the problems which forced the Reserve Bank of India (RBI) to put operational limitations on the bank in 2019.

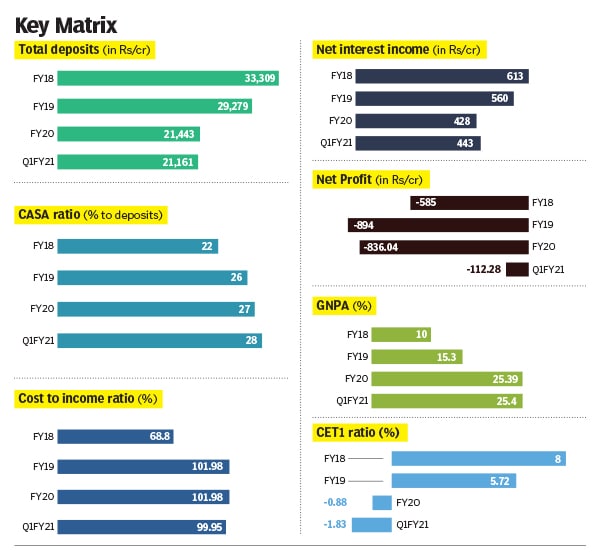

The Chennai-headquartered LVB, in the past three years, has seen a sharp rise in non-performing assets, which has led to higher provisioning and hence an erosion of capital and huge quarterly losses (see table). LVB’s Tier 1 capital ratio has turned negative at -1.83 percent in June and -0.88 percent in March, against the minimum requirement of 8.875 percent.

Deposits continued to fall and the bank once again reported a negative return on assets (-1.65%) in its June ended quarter. LVB has been starved off capital after its proposed merger with Indiabulls Housing Finance was rejected by the RBI last year, without disclosing reasons. But it is believed that an institution with a high exposure to the troubled real estate sector caused concerns for the RBI. The central bank has so far been silent on the troubles being faced by LVB.

All of this means that placing the bank under the prompt corrective action (PCA) scheme of the RBI did not really help. The weak performance finally culminated into decisive shareholder action–in most cases votes against were around 60 percent–against the board directors, including LVB’s managing director and CEO S Sundar.

Three independent directors, Shakti Sinha, Satish Kumar Kalra and Meeta Makhan, were unanimously voted for by the shareholders, with a 99.8 percent approval. There are also two RBI appointed directors on the board. A minority shareholder and a former employee at the bank R Subramanian has filed a public interest litigation at the Madras High Court seeking suspension of the entire board and appointment of an administrator, alleging mismanagement and financial irregularities.