Asish Mohapatra and Ruchi Kalra: How this power couple spins profitable unicorns

In an era of inflated valuations and unicorn clubs, Mohapatra and Kalra are a part of a rare breed that insists on standing out of the crowd with an unflinching focus on growth and profitability. The result: two profitable unicorns—OfBusiness and Oxyzo Financial Services

Asish Mohapatra, co-founder and CEO, OfBusiness; co-founder, Oxyzo and Ruchi Kalra, co-founder and CEO, Oxyzo; co-founder, OfBusiness Image: Neha Mithbawker For Forbes India; Location Courtesy: Magic Carousel, Imagicaa Theme Park

Asish Mohapatra, co-founder and CEO, OfBusiness; co-founder, Oxyzo and Ruchi Kalra, co-founder and CEO, Oxyzo; co-founder, OfBusiness Image: Neha Mithbawker For Forbes India; Location Courtesy: Magic Carousel, Imagicaa Theme Park

Sector 26, MG Road, Gurugram. This was the first masterclass of the year. On a drenched Tuesday afternoon in August, 50-odd people cram into a dull conference room. There is no visual relief, white walls stare into your face, and over two dozen black chairs are placed around a long horseshoe-shaped table. The unostentatious corporate office of OFB Tech is hosting two bright speakers for their half-yearly motivational session for budding entrepreneurs and the ones slogging in the corporate world.

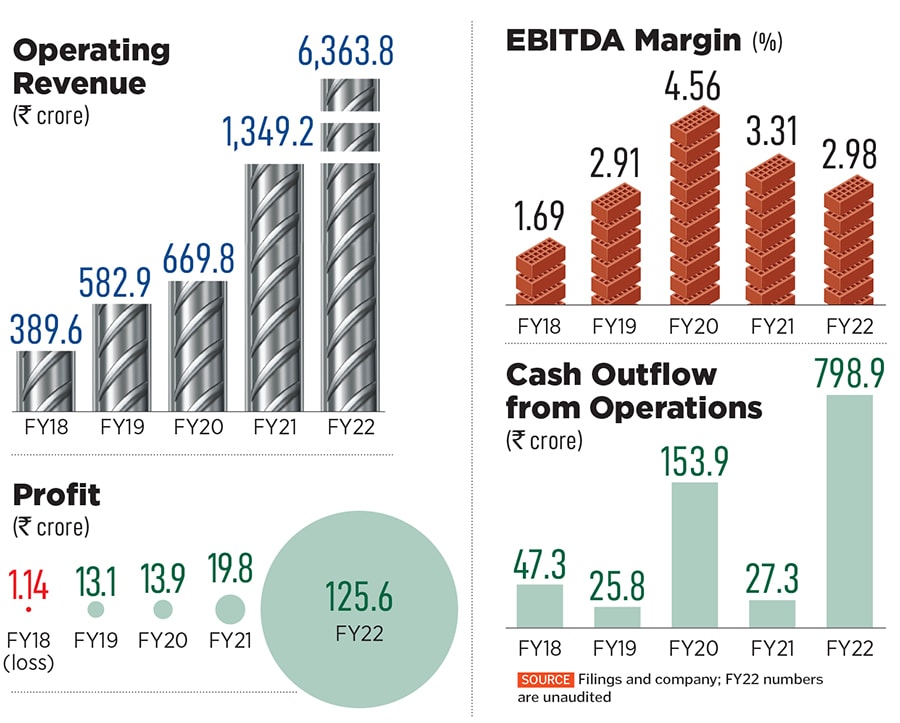

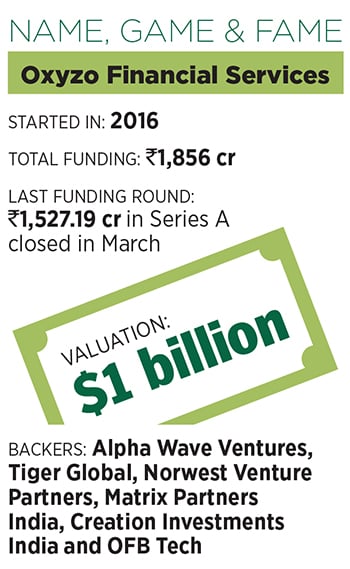

The first presenter completed his mechanical engineering from IIT-Kharagpur, finished his MBA from the Indian School of Business (ISB), and then spent a little over four years with venture capital (VC) fund Matrix Partners. In August 2015, he left the VC world and took a leap of faith by starting a venture that got funded by SoftBank. The pedigree of the 41-year-old and his inspirational journey make him a great catch to stimulate the young audience.

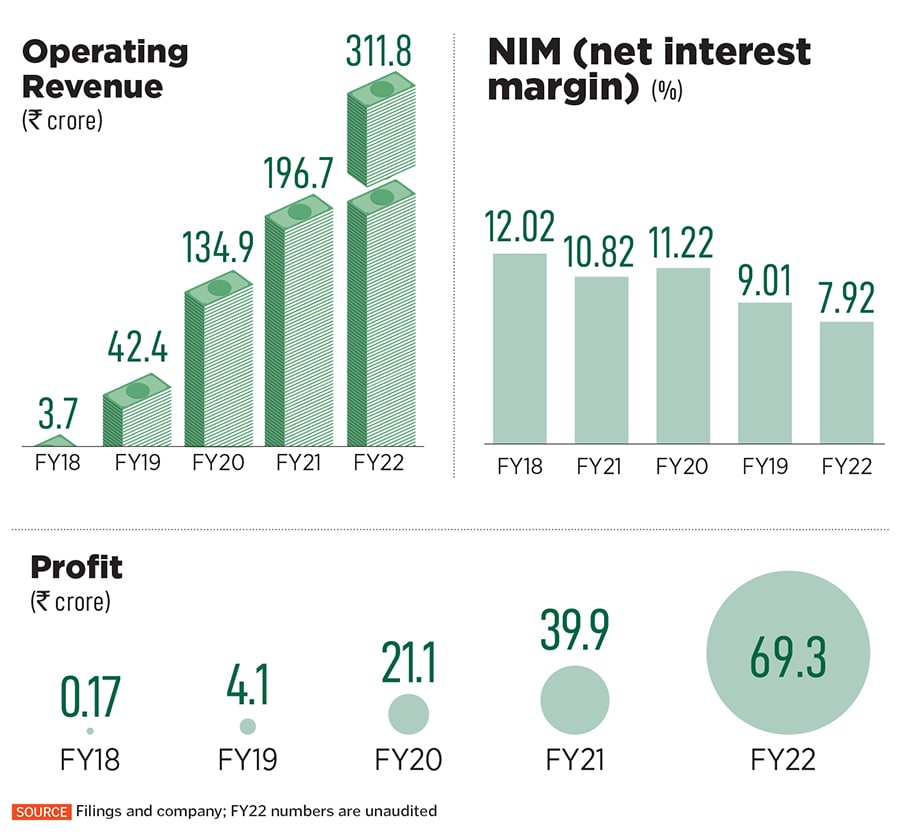

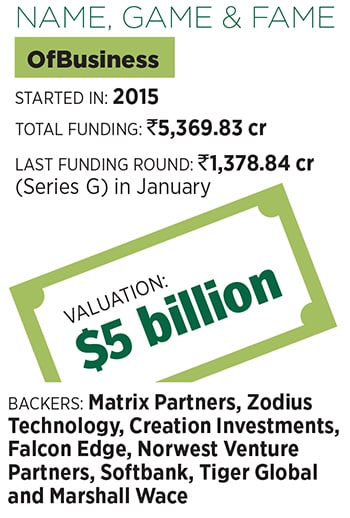

The second speaker has an equally impressive track record. She completed her BTech from IIT-Delhi, went to ISB for her MBA and worked with McKinsey in Mumbai for close to nine years. In 2015, she started her own venture, which grew at a blistering pace and managed to get the backing of marquee investors such as Alpha Wave Global, Tiger Global, Norwest Venture Partners and Creation Investments. The accomplishment of the 39-year-old founder and chief executive officer has fast become the talk of the town.

As the participants settle down, Asish Mohapatra starts the session on ‘Finding Happiness’. “Let me start with a quick disclaimer,” the guru underlines. “I am not going to talk about the ‘Open Happiness’ campaign of Coca-Cola,” he says. The crowd erupts into laughter. “Today I will talk about four forms of happiness that entrepreneurs must strive for,” he underlines. “Happiness starts when your venture posts its maiden profit. That’s the beginning of happiness,” he says. The second stage comes when it keeps growing the profit. “This is real happiness,” he stresses. The onlookers are amused with the nuanced definition.

As the participants settle down, Asish Mohapatra starts the session on ‘Finding Happiness’. “Let me start with a quick disclaimer,” the guru underlines. “I am not going to talk about the ‘Open Happiness’ campaign of Coca-Cola,” he says. The crowd erupts into laughter. “Today I will talk about four forms of happiness that entrepreneurs must strive for,” he underlines. “Happiness starts when your venture posts its maiden profit. That’s the beginning of happiness,” he says. The second stage comes when it keeps growing the profit. “This is real happiness,” he stresses. The onlookers are amused with the nuanced definition.

Mohapatra now tries to make the lecture engaging. “What comes after happiness?” he throws the question at the audience. “Is it more happiness?” shouts a viewer standing near the the door. “No, my dear friend,” says Mohapatra. What comes after happiness, he explains, is delight. “And delight is when people look at your P&L and exclaim ‘Arey wah, mazaa aa gaya (Wow! It’s great),” he says with a smile. What every founder must strive for is the last stage. “It’s ‘aha’. And it comes when your business ticks three boxes,” he says. The first is that the venture needs to grow continuously. Second is profit must become meaty. And last is nobody else can copy what you are building. This is ‘aha’. “In general, anybody who doesn’t make money should shut down very soon,” he maintains. The crowd bursts into rapturous laughter.

The former McKinsey honcho points out three business components that work in tandem. First comes growth. It is followed by profitability. And the third crucial part is health. The health of a business, she points out, means that the venture meets all compliance norms, and follows the rules and laws of the land. India is not an easy place to do business. “So always keep a sharp eye on costs,” she advises.

The former McKinsey honcho points out three business components that work in tandem. First comes growth. It is followed by profitability. And the third crucial part is health. The health of a business, she points out, means that the venture meets all compliance norms, and follows the rules and laws of the land. India is not an easy place to do business. “So always keep a sharp eye on costs,” she advises.

Eventually, there was one guy who understood the vision. But he declined to fund in 2018. “Back then, OfBusiness was not profitable,” recalls Niren Shah, managing director at Norwest India. The VC presented his case. “If you are not profitable,” he told Mohapatra, “you don’t get a better credit rating.” What this means is that your cost of debt does not come down, which again means you can’t actually grow. The entrepreneur understood what the VC was trying to impress upon him. “I am very profit-focussed and working on it,” was the assurance.

Eventually, there was one guy who understood the vision. But he declined to fund in 2018. “Back then, OfBusiness was not profitable,” recalls Niren Shah, managing director at Norwest India. The VC presented his case. “If you are not profitable,” he told Mohapatra, “you don’t get a better credit rating.” What this means is that your cost of debt does not come down, which again means you can’t actually grow. The entrepreneur understood what the VC was trying to impress upon him. “I am very profit-focussed and working on it,” was the assurance.