They built crypto unicorns out of India. Now they need to diversify

The present puts to haze the story of India's only two crypto unicorns—Coindcx and CoinSwitch Kuber. But these entrepreneurs have honed their skills and businesses by tackling adversities headon in the new world of volatile, unregulated digital assets that operate in a complex ecosystem

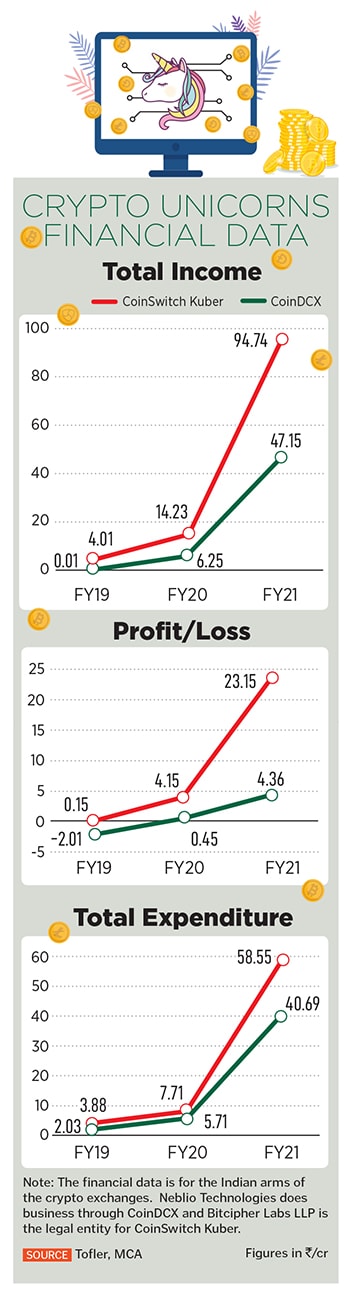

Most of India’s large crypto exchanges saw a boost to their total income and profitability from 2019 onwards—led by a surge in interest and the adoption of crypto trading in India

Image: Shutterstock

Most of India’s large crypto exchanges saw a boost to their total income and profitability from 2019 onwards—led by a surge in interest and the adoption of crypto trading in India

Image: Shutterstock

Pain is probably the only emotion that founders of crypto currency exchanges and retail traders in crypto coins share at this moment. The businesses of intermediaries have been impacted by a sustained shrinking of trading volumes and undue attention from investigation agencies over contravention of forex guidelines. Investors have been hurt by discomforting taxes and significant losses, which threaten to make the future of crypto trading uncertain.

The present puts into haze the story of India’s only two crypto unicorns—CoinDCX and CoinSwitch Kuber. But just a few years ago, these entrepreneurs had, even while creating the exchanges, muscled their way through adversities as these are new-world, volatile, unregulated, digital assets operating in a complex ecosystem. Not a friendly environment for regulators and policy makers to deal with.

While data on adoption and access to crypto currency differs wildly, India ranked second in the world in Chainalysis’s 2021 global crypto adoption index and sixth in the global decentralised finance (Defi) adoption index. Technology and the lure of quick money got Indians to leap towards crypto trading. After all, investing in stocks could take days to start, involving stringent KYC documentation. But for cryptocurrencies, it could take just a few hours.

Pivoting after the RBI ban overturn

All successful corporate and entrepreneurship journeys have their moments of serendipity and events attached to them. Prior to launching CoinSwitch, Ashish Singhal had been participating in several hackathons—most of them Sequoia-led—and was looking to launch his own venture, after working at Amazon and interning at Microsoft. “There was this one critical moment that wasn’t planned. It was how Vimal, our co-founder and COO, joined us in the journey,” says Singhal, CEO of CoinSwitch.

In 2017, Singhal had just returned from the US and, with friend Govind Soni, had plans for a new product. This was a global aggregator service to help discover the best crypto prices on a metasearch platform.

Soni and Singhal launched a Facebook page to promote the product, which was spotted by Vimal, who reached out and joined them. “They came across as a very clever, enterprising and energetic team, which was a strong signal for us. Their coin exchange business was always profitable,” says Shailesh Lakhani, managing director of Sequoia India. “They got more ambitious with time. If you had suggested in 2018 that they would become as big and successful as they are today, I don’t think they would have believed it, but they kept on pushing themselves to see what they could achieve.”

Soni and Singhal launched a Facebook page to promote the product, which was spotted by Vimal, who reached out and joined them. “They came across as a very clever, enterprising and energetic team, which was a strong signal for us. Their coin exchange business was always profitable,” says Shailesh Lakhani, managing director of Sequoia India. “They got more ambitious with time. If you had suggested in 2018 that they would become as big and successful as they are today, I don’t think they would have believed it, but they kept on pushing themselves to see what they could achieve.”  “When these exchanges were set up, crypto prices were bullish, which helped them acquire customers very fast,” says Sidharth Sogani, founder and CEO of Crebaco Global, a crypto and blockchain market research and ratings firm. Bitcoin and Ethereum prices were nearing their lifetime highs before CoinSwitch announced its series C funding.

“When these exchanges were set up, crypto prices were bullish, which helped them acquire customers very fast,” says Sidharth Sogani, founder and CEO of Crebaco Global, a crypto and blockchain market research and ratings firm. Bitcoin and Ethereum prices were nearing their lifetime highs before CoinSwitch announced its series C funding.