Tracing Jio's next leg of growth, after Facebook investment

The deal with Facebook, orchestrated by Ambani twins Akash and Isha, gives Jio a technology company valuation and a long runway

RIL chairman Mukesh Ambani has spent an estimated ₹250,000 crore building Jio’s network

RIL chairman Mukesh Ambani has spent an estimated ₹250,000 crore building Jio’s networkIn December and January the Ambani twins Isha and Akash were hard at work on a potential deal with Facebook. Over multiple trips to the US they negotiated the deal with Facebook executives, with Mukesh Ambani and Mark Zuckerberg coming in once it was almost ready to be signed. In late March the SARS Cov2 outbreak and a ban on international travel slowed things down. But nearly a month into the India lockdown Reliance Industries and Facebook Inc, in the last week of April, announced a $5.7 billion (₹43,574 crore) partnership with Facebook, buying 9.9 percent of Jio Platforms. For Isha who looked after the customer experience at the groups retail and telecom businesses, and Akash who was in charge of the technological aspects of both businesses, the deal marked a clear acceptance of Jio as a tech business.

It followed up on May 4 by announcing a ₹5655.75 crore deal with Silver Lake, a global technology investor, for a 1.1 percent stake in Jio Platforms at a 12.5 percent premium to the price Facebook paid.

Unlike its rivals, Jio never saw itself as just a telecom company. The subsidiary of flagship Reliance Industries was acutely aware that while telecom giants Verizon and Vodafone had spent billions laying out ‘dumb pipes’ to carry data, it was the tech majors Google, Netflix, Facebook and Amazon that had reaped the benefits. It was not a position Reliance’s Chairman Mukesh Ambani, who had spent an estimated ₹250,000 crore building Jio’s network, wanted to find himself in. Monetising the customer was top on his mind.

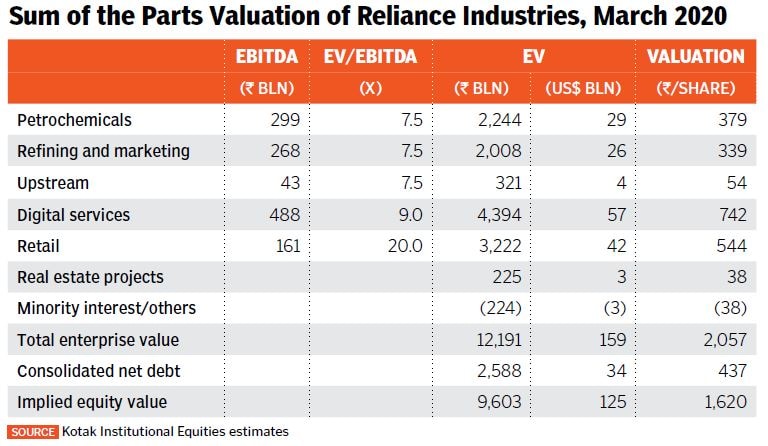

In analyst meets around 2016-17, the company had begun to push this narrative. They wanted Jio to be valued as a technology business, according to an analyst familiar with the briefings. At that time there was plenty of skepticism and the market was unwilling to see beyond how the company could sell anything more than cut-priced voice and data. Jio (as a part of Reliance Industries) was accorded the relatively low multiple that telecom companies trade at. “There was little appreciation for the platform that Jio said it planned to create,” the analyst says pointing out that even today the company has neither been able to significantly monetise the movies its customers can watch on the platform nor Jio Pay.

There was, however, a small group of investors who saw it differently. The world over platforms—Google, Amazon, Alibaba—have been able to monetise seemingly disparate businesses. These companies, listed in the US market, had seen their valuations soar and been responsible for a large part of the outperformance of the US market over the last decade. And unlike the first dot-com bubble, this time investors had picked a narrow set of stocks to ride the rally.

Facebook CEO Mark Zuckerberg has been denied permission to launch WhatsApp Pay in India

Facebook CEO Mark Zuckerberg has been denied permission to launch WhatsApp Pay in IndiaImage: Aurelien Meunier / Getty Imaes

If Jio could place itself at the center of a technology platform story, Reliance Industries, which had spent a decade in the ₹400,000 crore market cap range, would rerate. Global investors also did not have much choice. Though India was a vast and untapped internet market, it presented no investible opportunities in the internet space except for the tiny, by global standards, $3.55billion (₹27,000 crore) market cap Info Edge that owns Naukri.com and has a stake in Zomato.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

Isha and Akash Ambani had been working on the deal since December

Isha and Akash Ambani had been working on the deal since December