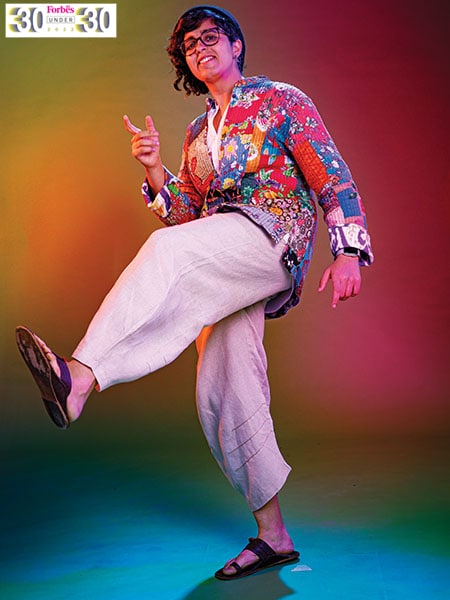

Ria Mirchandani: Building payments for India

The product lead of Whatsapp Payments for India thrives on the challenging and exciting environment of the payments space. Her decisions have led to a 13x growth in user base within a year

Ria Mirchandani thinks the main competition is cash, and not other payment platforms

Ria Mirchandani thinks the main competition is cash, and not other payment platforms

Image: Mexy Xavier

Styling: Juilee Borse And Nidhi Agrawal

Ria Mirchandani, 28

Product lead, WhatsApp Payments

X