Climate risk is becoming a core boardroom discussion in real estate sector: Accacia's Annu Talreja

Accacia helps asset managers, developers, owners and operators track and report their emissions, and its AI recommends projects to invest in for decarbonisation

Annu Talreja, Founder, Aspeen Venture (Accacia)

Image: Amit Verma

Annu Talreja, Founder, Aspeen Venture (Accacia)

Image: Amit Verma

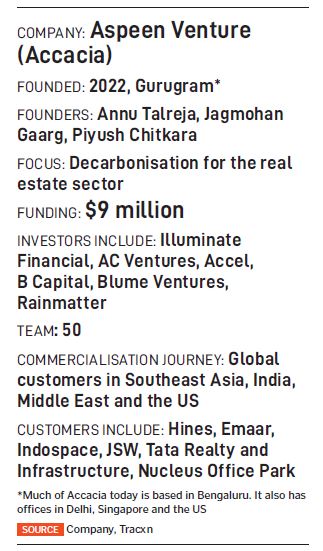

Annu Talreja is a second-time founder with her company Aspeen Venture, better known as Accacia for its eponymous carbon tracking and decarbonisation recommendation engine, primarily for the real estate and infrastructure sector. Talreja is an architect and urban planner, whose experience spans design, construction, investments, asset management, and operations.

Globally, the top-tier of the industry is undergoing a “mindset shift”, Talreja says, with the realisation that the impact of climate change on real estate is here and now, and that it’s no longer simply an ESG (environmental, social, and governance) reporting requirement.

Before turning entrepreneur with her first venture Oxforcaps, a Singapore-based student housing startup, Talreja worked for some 15 years in real estate with companies such as hospitality chain Marriot International and AECOM, a multinational engineering company that provides design, consulting, construction, and management services to a wide range of industries.

“Climate risk is becoming a core boardroom conversation, and the regulatory environment too is changing around the world,” says Talreja, who’s also the CEO of Accacia.

She started the company in 2022 with two co-founders Piyush Chitkara, CTO, and Jagmohan Gaarg, who leads sales and business development.

She started the company in 2022 with two co-founders Piyush Chitkara, CTO, and Jagmohan Gaarg, who leads sales and business development.