FM Nirmala Sitharaman announces support for micro-and small businesses

Sitharaman dodged critical questions on how the schemes will be funded, and experts say that India's fiscal deficit could rise to 6% of GDP

Finance Minister Nirmala Sitharaman; Image: Prakash Singh/AFP via Getty Images

Finance Minister Nirmala Sitharaman; Image: Prakash Singh/AFP via Getty Images

India’s Finance Minister Nirmala Sitharaman on Wednesday announced a series of measures assisting micro- and small businesses who are starved for cash, steps to boost liquidity for non-banking financial companies (NBFCs) and providing tax measures for individuals and corporates.

All these form part of a larger Rs 20 lakh crore support package, disclosed on Monday by Prime Minister Narendra Modi. The key measure is that the government will provide Rs 3 lakh crore in the form of collateral-free automatic loan for MSMEs (micro, small and medium enterprises) for four years. “The growth capital push is expected to help revive investment activity, as small businesses are likely to use these funds for scaling up business activity,” Barclays chief India economist Rahul Bajoria told Forbes India.

“The loan facility will put cash in the hands of the businesses that need it most. It bears the stamp of Nitin Gadkari, the MSME minister who understands where businesses feel the most pain,” SKV Srinivasan, a former banker at IDBI Bank and an advisor to fintechs in the MSME space, said.

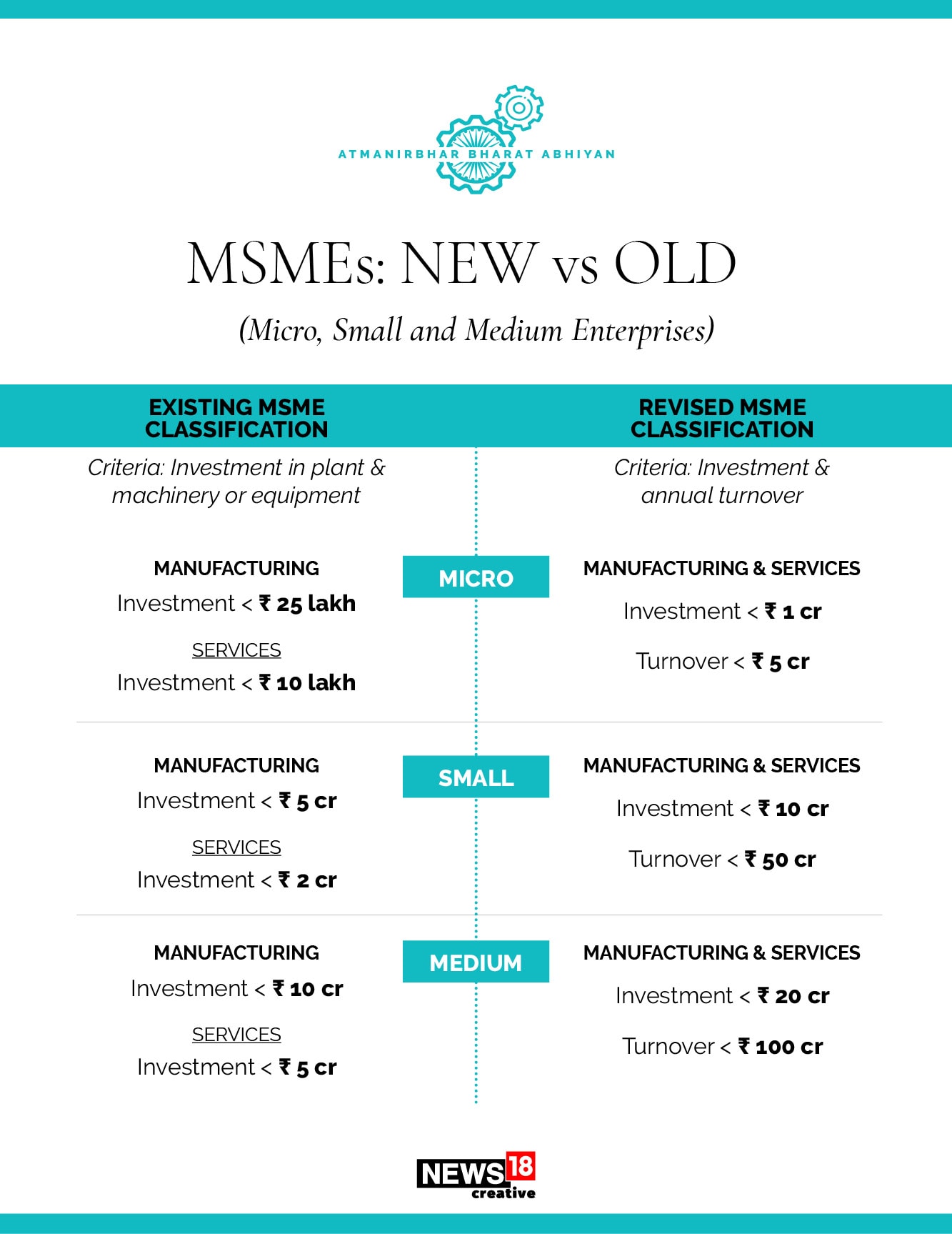

The government has also altered the definition of MSMEs by narrowing down its universe, so that it will be able to provide sops to this category in a more focussed manner.