Lending troubles at banks persist

Demand for cars, housing and consumer durables is starting to pick up, but it's been a tough financial year for banks to lend in these segments due to job losses and salary cuts

Image: Shutterstock

Image: Shutterstock

It’s been five months since business activity was unlocked in India, but the pandemic continues to hurtjobs and lives. While the high-frequency economic indicators suggest that the economy is on the mendfrom improved auto sales and home purchases and power consumption to railway freight from mid-September onwards, lending activity to individuals and small businesses—a key indicator of recovery inthe ongoing festive season—has been trailing poorly in the current financial year.

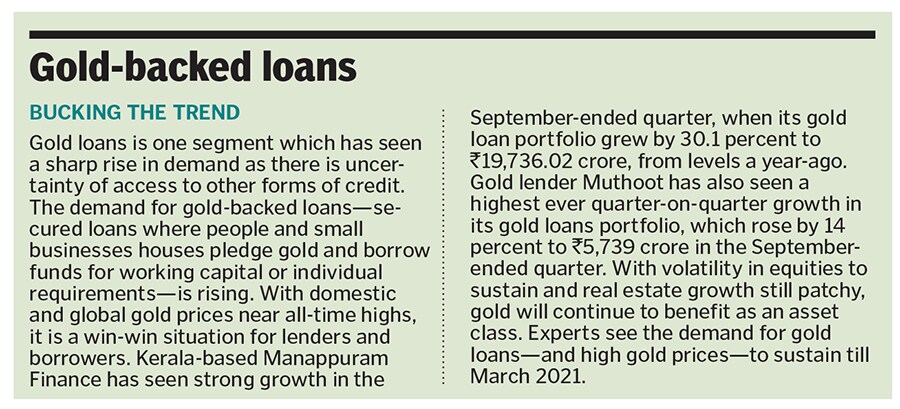

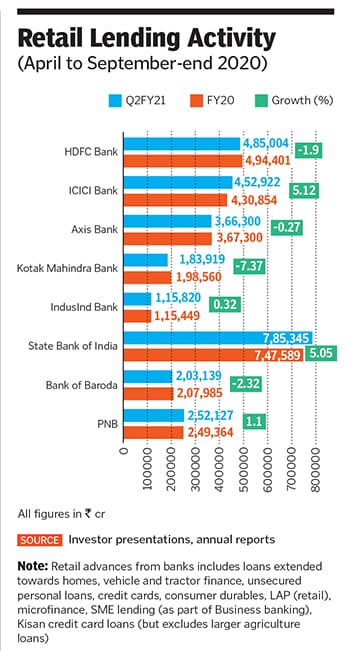

Most banks and non-banking financial companies (NBFCs) reported an improvement in retail lending inthe September-ended quarter, but only when compared to levels last year and the sequentially previousJune-ended quarter. But in the lockdown and after the phase-wise unlocking, credit flow for leadingbanks has been negative, flat or just edged up marginally in the April to September-end period (see table).

The Reserve Bank of India (RBI), in its November 2020 bulletin, now says India has entered a technicalrecession in the first half of 2020-21 for the first time in its history with Q2FY21 likely to record thesecond successive quarter of GDP contraction of 8.6%. Most rating agencies had earlier projectedde-growth of around 10 to 12% for the Q2 period.

The central bank has now presented an economic activity index, which incorporates 27 high frequencyindicators, which will help “nowcast” the real GDP for coming quarters.

Fall in loans towards consumer durables, to ₹6,661 crore as of September 25, as per RBI data

Fall in loans towards consumer durables, to ₹6,661 crore as of September 25, as per RBI data

Total loan growth for the April to September period was around 0.9%, says Krishnan, while for thefull year till March 2021, it is forecast at 0 to 1%. Crisil now estimates India’s GDP to shrink by 9percent in the full financial year.

Total loan growth for the April to September period was around 0.9%, says Krishnan, while for thefull year till March 2021, it is forecast at 0 to 1%. Crisil now estimates India’s GDP to shrink by 9percent in the full financial year.