Art as an investment: How to build an art collection from scratch

Learning about the works, data-backed decision making are some of the things you should do before investing in art. Here's how you can go about it, according to experts

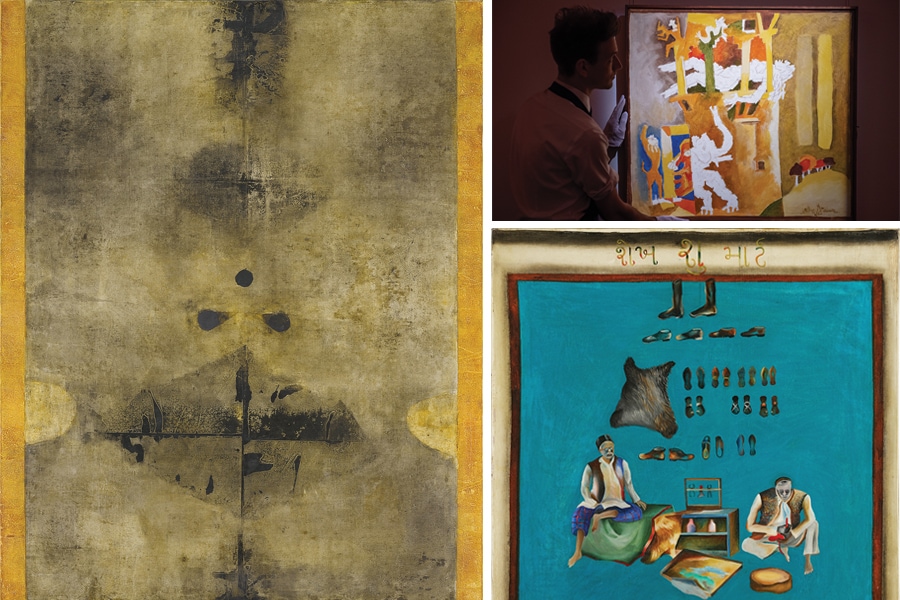

Preview ahead of a Spring Live Auction at the Saffronart Gallery in Mumbai

Image: Punit Paranjpe / AFP

Preview ahead of a Spring Live Auction at the Saffronart Gallery in Mumbai

Image: Punit Paranjpe / AFP

The idea of a global pandemic driving purchases of fine art may sound absurd, but that is exactly what occurred during the lockdown. Dinesh Vazirani, CEO and co-founder of Saffronart, an international auction house with nearly five hundred auctions to its credit, chalks it down to the fact that people were more involved in their living spaces and collectors had more time to focus on what to add to their repertoire, given that art is a highly involved purchase.

Besides collectors, many new buyers, those with new tech money and a disposable income, too came into the market. Indian Art Investor, an independent market intelligence firm focussed on Indian Art, in a private art market survey that included 158 galleries in 2021, found that among the new buyers there has also been an increase in the number of women buying art.

Curiosity and the desire to explore art as an investment, as well as technology, have helped grow and give this creative industry a boost. “We have seen a significant growth in new buyers in recent years who have expressed an interest in purchasing art across various categories. These are buyers who are comfortable with buying art online and are, therefore, not limited by geographical spaces,” says Vazirani. “We’ve also seen the presence of more mature collectors than speculators in the market in recent years.”

There have been significant developments in the Indian art market over the last two decades and the market is only expected to grow. Experts point out that for buyers, it helps to know the trends in the market as well as to keep some basic indicators in mind when investing in an artwork.

(Clockwise from right) Raja Ravi Varma’s ‘Draupadi Vastraharan’, circa 1888 -1890, oil on canvas; Dinesh Vazirani, founder and director of Saffronart; Tyeb Mehta’s ‘Untitled (Bull on Rickshaw)’, 1999, Acrylic on canvas

Images: Arts: Saffronart, Spring live auction: Modern Indian art, 6 APRIL 2022; Vazirani: Abhijit Bhatlekar Mint via Getty Images

(Clockwise from right) Raja Ravi Varma’s ‘Draupadi Vastraharan’, circa 1888 -1890, oil on canvas; Dinesh Vazirani, founder and director of Saffronart; Tyeb Mehta’s ‘Untitled (Bull on Rickshaw)’, 1999, Acrylic on canvas

Images: Arts: Saffronart, Spring live auction: Modern Indian art, 6 APRIL 2022; Vazirani: Abhijit Bhatlekar Mint via Getty Images

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)