LIC lists at 8.6 percent discount to issue price

Analysts expect the stock to bounce back in three to six months

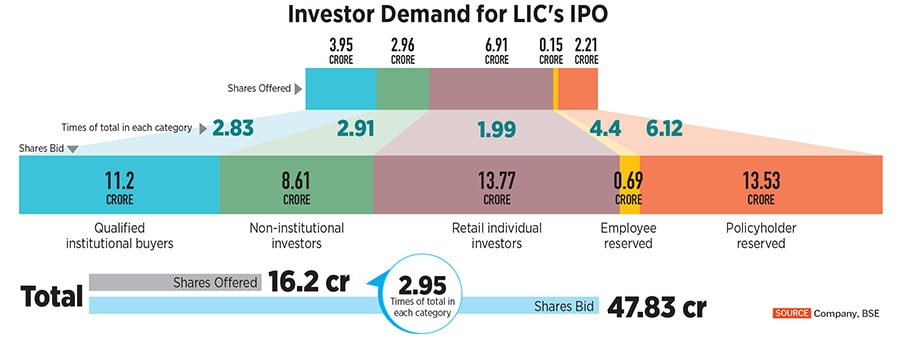

State insurance giant Life Insurance Corporation of India (LIC) on Tuesday listed at an 8.6 percent discount to its issue price of Rs 949 at the BSE. The offering, which was the largest initial public offering (IPO) in India, of Rs 21,000 crore, had closed strong on May 9, being oversubscribed 2.95 times, with bids for 47.83 crore shares, against an IPO size of 16.2 crore shares.

The LIC stock finally closed at Rs 875.45 at the BSE, down 7.75 percent over its issue price. Over 27.5 lakh shares were traded at the exchange. The stock was seen at Rs 872 in pre-open trade at the NSE.

LIC’s shares failed to list at a high premium due to sustained weakening stock prices and volatility, caused by rising inflation, commodity and raw material prices due to the continuing Russia-Ukraine war. These concerns have spooked foreign investors, who have been net sellers of Indian equities since last October, weakening sentiment further.

Also, fears of sustained interest rate hikes have increased after the Reserve Bank of India (RBI), on May 4, surprised investors with an out-of-cycle monetary policy 40 basis points repo rate hike, in a move to curb inflation.

All of these factors made the grey market premium for LIC slide prior to its listing, to a negative (discount) of Rs 10 per share on May 13, from Rs 90 premium on April 30 in the unlisted territory. But for LIC policyholders the pain would be less, having got shares at a discount of Rs 60 if they bid through the policyholders quota. Employees and retail investors got a discount of Rs 45 per share.