All is not well in the economy, say the most optimistic soothsayers

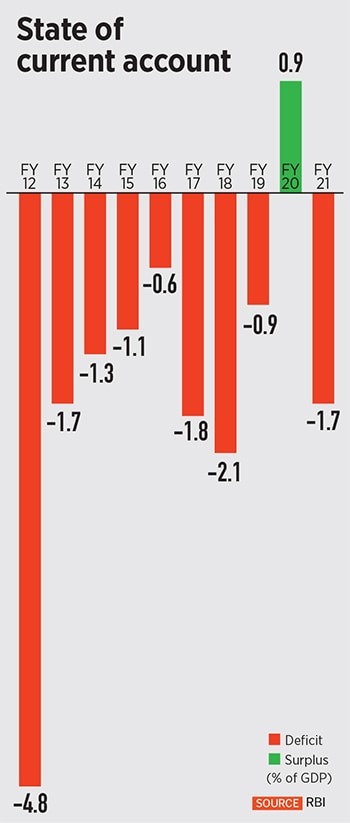

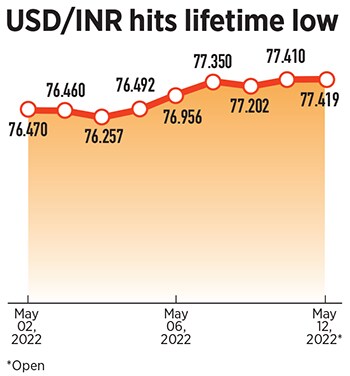

Surging crude oil prices amid escalating geopolitical conflict in Ukraine has cast a shadow on the country's macroeconomic stability with the rupee touching a lifetime low, widening trade deficit, and stubborn inflation at around 7 percent level

The havoc caused by the once-in-a-lifetime pandemic notwithstanding, the escalating war between Russia and Ukraine has shaken the global economy, in turn, shackling domestic growth with multiple risks. Image: Danish Siddiqui / Reuters

The havoc caused by the once-in-a-lifetime pandemic notwithstanding, the escalating war between Russia and Ukraine has shaken the global economy, in turn, shackling domestic growth with multiple risks. Image: Danish Siddiqui / Reuters

The storm clouds perilously gathering over the Indian economy are now starting to worry the most optimistic of the soothsayers. The havoc caused by the once-in-a-lifetime pandemic notwithstanding, the escalating war between Russia and Ukraine has shaken the global economy, in turn, shackling domestic growth with multiple risks.

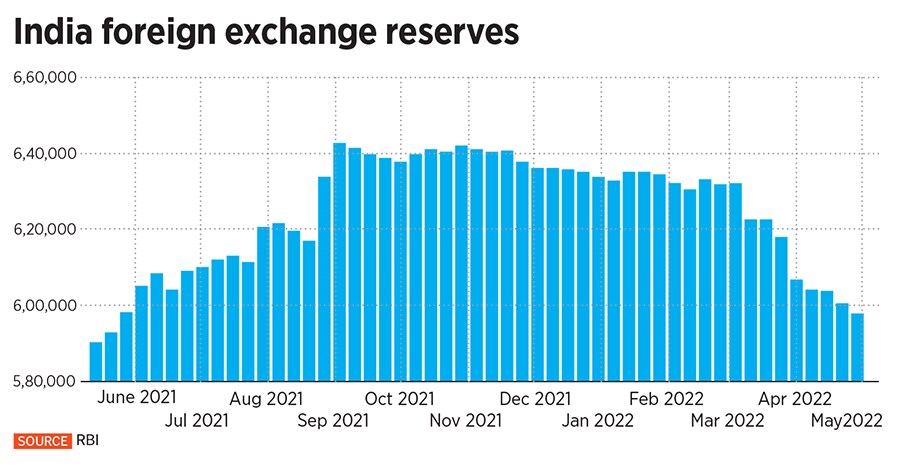

The growth headwinds have intensified, and the country finds itself in the midst of growing challenges. The Reserve Bank of India (RBI), of course, had not bargained for stubborn inflation and its cascading impact on core macroeconomic objectives as it was confident of a ‘soft landing’ that is ‘well timed’.

But the central bank’s ultra-accommodative monetary policy—of historic low rates for two years to support durable recovery—has not exactly panned out as it may have hoped.

Why?

Most central banks worldwide have turned the liquidity tap off—bursting the bubble of inflated asset prices. Since March, the US Federal Reserve has hiked rates by 75 basis points to battle the worst inflation the country has witnessed in 40 years.