RBI pulls the trigger on inflation, finally

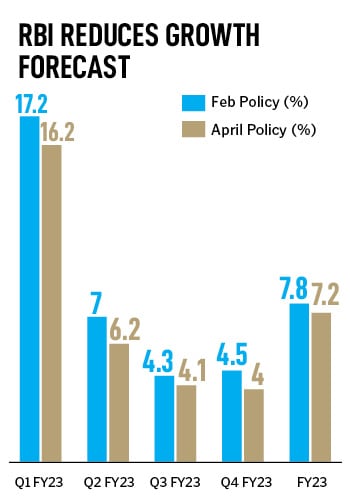

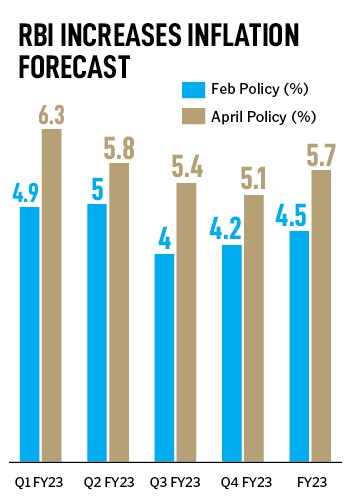

In a surprise move, the central bank increased repo rate by 40 bps and the cash reserve ratio by 50 bps, rattling equity and bond investors. Many economists see inflation around 7 percent levels in the near-term and do not rule out a 25 bps rate hike in June

Economists had widely expected the central bank to change its stance to neutral before ushering in rate hikes of 100 to 125 basis points in the current calendar year

Image: Punit Paranjpe / AFP

Economists had widely expected the central bank to change its stance to neutral before ushering in rate hikes of 100 to 125 basis points in the current calendar year

Image: Punit Paranjpe / AFP

After nearly two years, the Reserve Bank of India (RBI) has partly come full circle on interest rates. In a surprise move on Wednesday, its Monetary Policy Committee (MPC) unanimously voted to hike the benchmark repo rate by 40 basis points (bps) to 4.4 percent with immediate effect in an off-cycle meeting.

The rate setting panel, however, decided to remain accommodative even as it said it will focus on gradual withdrawal of liquidity to tame inflation while supporting growth. In line with the objective of policy normalisation, the central bank increased the cash reserve ratio (CRR) by 50 basis points to 4.5 percent with effect from May 21, which will drain out close to Rs 87,000 crore from the system.

“By remaining accommodative, monetary policy continues to foster congenial financial conditions to support growth and mitigate the adverse effects of the geopolitical crisis,” said RBI Governor Shaktikanta Das.

The MPC finally pulled the trigger on inflation after holding benchmark rates for eleven consecutive times. The MPC had slashed rates by 75 basis points in response to the coronavirus pandemic in March 2020. In less than a month, the MPC had further cut rates by 40 basis points in May 2020.

“Accordingly, the decision of the MPC today to raise the policy repo rate by 40 bps to 4.40 percent may be seen as a reversal of the rate action of May 22, 2020 in keeping with the announced stance of withdrawal of accommodation set out in April 2022,” Das said.

Economists had widely expected the central bank to change its stance to neutral before ushering in rate hikes of 100 to 125 basis points in the current calendar year. However, true to his words, governor Das has demonstrated the central bank’s resolve to” not be bound by any rulebook” and deploy “conventional and unconventional tools” to meet macroeconomic objectives.

Economists had widely expected the central bank to change its stance to neutral before ushering in rate hikes of 100 to 125 basis points in the current calendar year. However, true to his words, governor Das has demonstrated the central bank’s resolve to” not be bound by any rulebook” and deploy “conventional and unconventional tools” to meet macroeconomic objectives.  Ahead of the US Federal Reserve’s meeting on Wednesday, Das observed, “The normalisation of monetary policy in major advanced economies is now expected to gain pace significantly – both in terms of rate increases and unwinding of quantitative easing as well as rollout of quantitative tightening.”

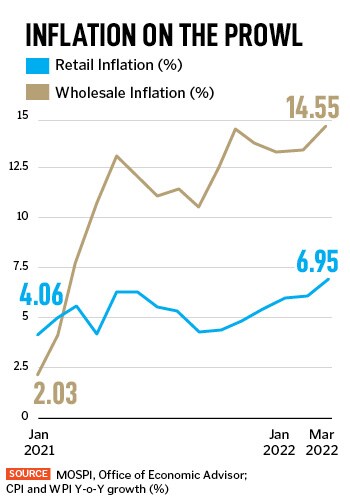

Ahead of the US Federal Reserve’s meeting on Wednesday, Das observed, “The normalisation of monetary policy in major advanced economies is now expected to gain pace significantly – both in terms of rate increases and unwinding of quantitative easing as well as rollout of quantitative tightening.” The domestic economy is already reeling under the spillover effects of rising global food and crude oil prices. Escalating geopolitical tensions have led to export bans, supply disruptions and shortages, stoking price volatility. The marked increase in edible oil and fertiliser prices have steeply pulled up food prices in the country. High fuel costs plus dearer raw materials have accentuated price pressures and could potentially drive

The domestic economy is already reeling under the spillover effects of rising global food and crude oil prices. Escalating geopolitical tensions have led to export bans, supply disruptions and shortages, stoking price volatility. The marked increase in edible oil and fertiliser prices have steeply pulled up food prices in the country. High fuel costs plus dearer raw materials have accentuated price pressures and could potentially drive