RBI's signal to PPI holders: Use licence for only what is mandated

The latest note to stop UPI in a co-branded arrangement will hurt some fintechs, who will have no option but to disallow this feature to users, according to experts

‘PPI holders shall be on-boarded for UPI by their own PPI issuer only.

Image: Shutterstock

‘PPI holders shall be on-boarded for UPI by their own PPI issuer only.

Image: Shutterstock

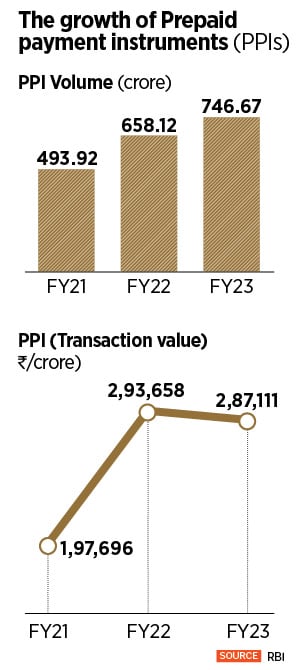

The Reserve Bank of India (RBI) has just got more stringent on the usage of prepaid payment instruments (PPIs) and the accountability of funds being transferred into these mobile or payment wallets, smart cards and magnetic chips. This week, the issuers of PPIs—which include banks and non-banks—received a circular from the National Payments Corporation of India (NPCI), which directed them “to discontinue any issuance of PPI wallet on partner or a co-branded app for PPI on UPI, with immediate effect”.

They have been given time till June 30 to stop this activity. The circular does not explain the rationale for the move or whether it is a temporary or permanent move.

In most cases, a PPI licensed holder—largely banks or non-banks—offer the UPI facility to its users. But if the PPI user has partnered with a fintech or another enterprise for a co-branded prepaid instrument (wallet), it will now not be allowed to offer UPI to make payments, to its users.

The latest NPCI notice includes the following details: ‘PPI holders shall be on-boarded for UPI by their own PPI issuer only. We hereby direct all the PPI issuers on UPI to discontinue any issuance of PPI wallet on partner/co-branded app for PPI on UPI with immediate effect. Customer communication and closure of PPI wallet on partner/co-branded app should be completed by June 30.’

The note further says that the PPI issuer will need to share an official confirmation to the NPCI, discontinuing the partner or the co-branded model for PPI on UPI.

Some of the fintech companies Forbes India spoke with said it is difficult to assess the number of players involved in the co-branding exercise, but estimated it could be somewhere between 30 and 50. Some of the names who might be impacted could be DreamX (a subsidiary of Dream11), Fampay, Muvin, and Akudo.

Some of the fintech companies Forbes India spoke with said it is difficult to assess the number of players involved in the co-branding exercise, but estimated it could be somewhere between 30 and 50. Some of the names who might be impacted could be DreamX (a subsidiary of Dream11), Fampay, Muvin, and Akudo.