Payments banks: Why they'll be tested as they aim to become bigger & stronger

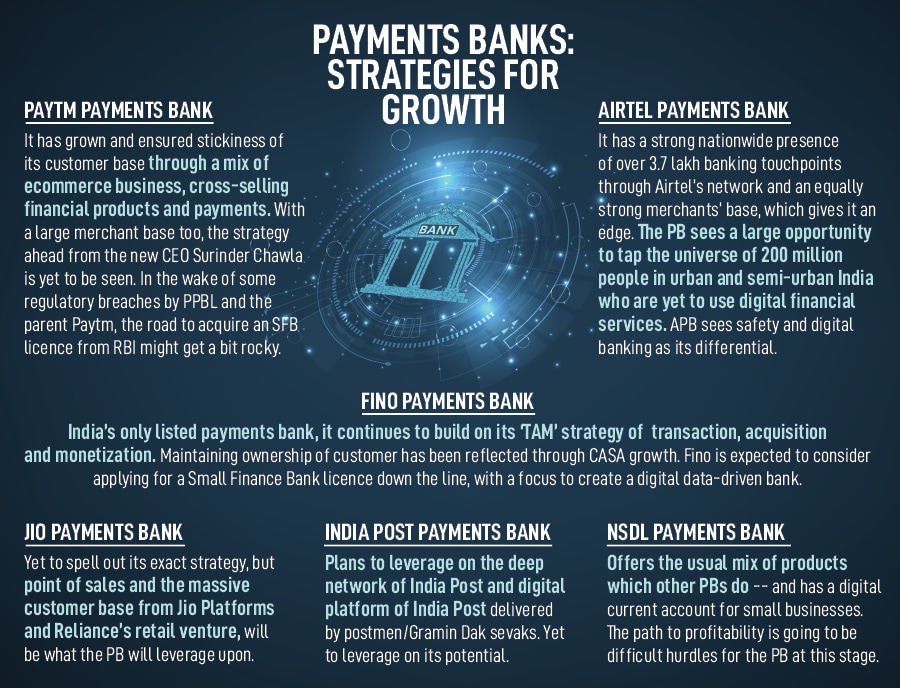

Nearly seven years since starting operations, some payments banks have emerged profitable. While question marks over their model remain, they have adopted innovative strategies to acquire and retain customers. The path to convert to small finance banks beckons for some

Anubrata Biswas, Managing director and CEO, Airtel Payments Bank

Anubrata Biswas, Managing director and CEO, Airtel Payments Bank

The success of India’s open, free and real-time payment platform, the Unified Payments Interface (UPI), which provides for inter-bank peer-to-peer and person-to-merchant transactions, has been well-documented. UPI currently operates 75 percent of the retail digital payments volume in India, Reserve Bank of India (RBI) data shows, and this will only continue to grow.

Adopting digital financial services to further the goal for financial inclusion remains paramount for the RBI. It has to be achieved under the overarching need to provide a seamless payment experience while ensuring financial security and minimising privacy risks. But in a crowded world where payment aggregators, payment gateways and fintechs are trying to boost transaction volumes to be relevant, it is payments banks (PB) that have an edge over them by owning the customer account.

PBs were set up as niche entities to facilitate small savings, and to provide payments and remittance services to migrant labour, low-income households, small businesses and other unorganised sector entities.

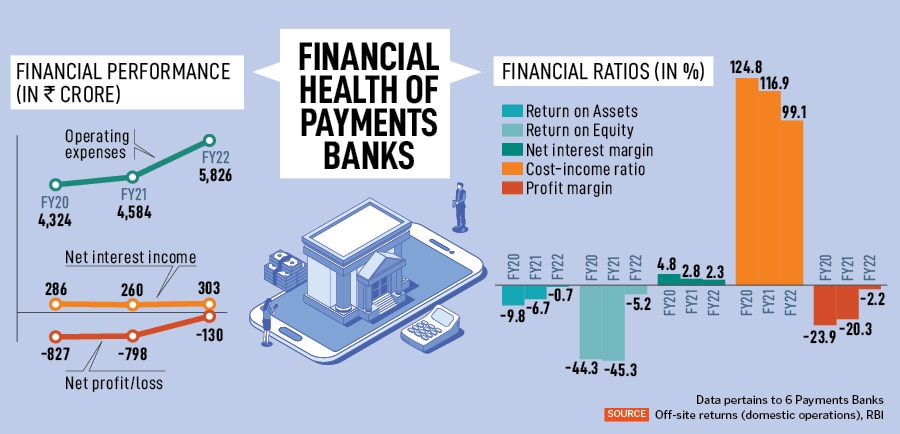

Around six years after most payments banks went live in India, three of the existing six—Airtel Payments Bank, Paytm Payments Bank and Fino Payments Bank—are profitable, according to data available from them and the RBI. India Post Payments Bank is likely to break-even by FY24. The RBI continues to restrain PBs from issuing loans directly, which impacts the ability to earn more interest and their ability to build a sizeable balance sheet.

Further, 75 percent of the deposits earned (a maximum end-of-day limit of Rs2 lakh per individual customer) has to be parked with government securities of one-year maturity and the balance can be kept with commercial banks. The higher interest rate regime has meant improved yields from these bonds. The PBs also need to maintain the statutory cash reserve ratio (CRR), as decided by the RBI.