Why banks are in a sweet spot after almost a decade

Most of India's top private and public sector banks are seeing robust lending growth to retail and housing post the pandemic, leading to revised earnings growth. But a deposit rate push, weak microfinance trends and corporate borrowing patterns need to be monitored carefully

Top bankers echo the bullishness of analysts for retail loan growth

Illustration: Chaitanya Dinesh Surpur

Top bankers echo the bullishness of analysts for retail loan growth

Illustration: Chaitanya Dinesh Surpur

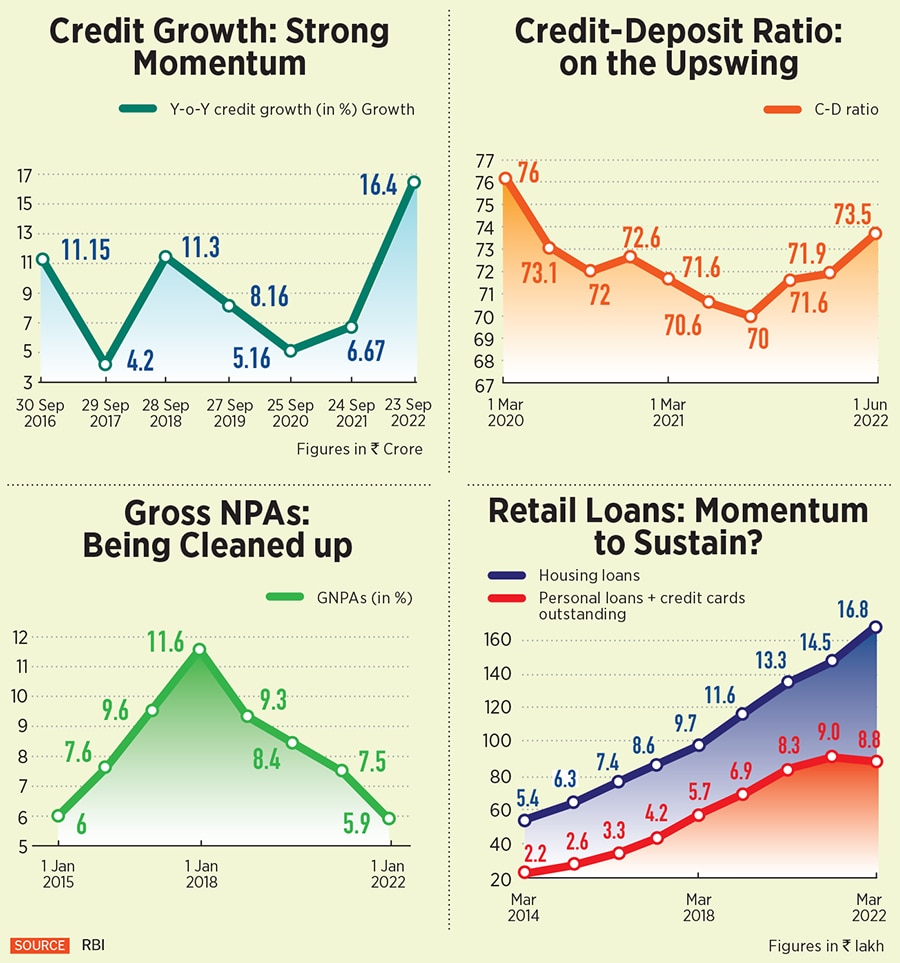

For the first time in almost a decade, India’s banks are in a sweet spot—the balance sheets of several public sector banks and private sector banks have seen a remission of bad loans, led by higher provisions, which were possible due to government-induced recapitalisation. Private sector banks have also seen improved asset quality due to better provision, slippages being brought under control and increased deleveraging by corporates. This has also meant benign credit costs for banks in recent months.

The three months to September saw a strong growth momentum led by a combination of growth in lending to retail, small businesses and working capital loans for corporates. Disbursements have been strong across both secured and unsecured segments—vehicle, home and personal loans. This comes even as interest rates on loans continue to rise.

Retail lending: No letup

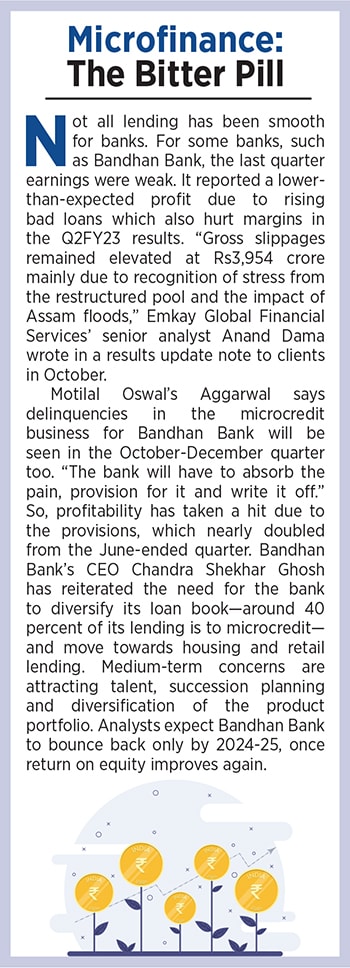

In a still-rising-interest-rate environment, bankers and analysts see retail loans growth likely to continue for at least two more quarters for all banks. “Retail advances are in focus… they now account for just above 30 percent of all credit, up from 25 percent in FY18. There will be no letup, at least for the next two quarters,” says Nitin Aggarwal, banking analyst at Motilal Oswal Securities. Housing demand is getting supported by vehicles and demand for unsecured loans is also coming back, he adds.There could, however, be some uncertain times ahead for the microfinance space, which could hurt an already-ailing Bandhan Bank.

Top bankers echo the bullishness of analysts for retail loan growth. Axis Bank’s Sumit Bali, group executive and head of retail lending and payments, says: “We have seen strong retail loan growth and expect this trend to sustain for the bank and the industry. It is indicative of the improved demand for consumption across most of our retail book.” Axis Bank’s retail book grew 22 percent year-on-year and 3 percent quarter-on-quarter. “Credit card spends have been good across all categories (47 percent growth year-on-year) which imply good consumer sentiment,” explains Bali.

Top bankers echo the bullishness of analysts for retail loan growth. Axis Bank’s Sumit Bali, group executive and head of retail lending and payments, says: “We have seen strong retail loan growth and expect this trend to sustain for the bank and the industry. It is indicative of the improved demand for consumption across most of our retail book.” Axis Bank’s retail book grew 22 percent year-on-year and 3 percent quarter-on-quarter. “Credit card spends have been good across all categories (47 percent growth year-on-year) which imply good consumer sentiment,” explains Bali.

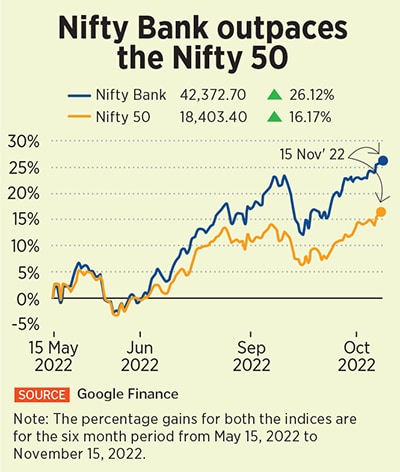

MOFSL estimates an FY23 earnings upgrade for both Axis Bank and ICICI Bank. This could mean a 17.1 percent upgrade for Axis Bank in FY23 estimated earnings, 3.4 percent for Bajaj Finance, 2.5 percent for Kotak Mahindra Bank and 1.4 percent for ICICI Bank. Some of the foreign equity research outfits such as CLSA, Goldman Sachs and Jefferies have all a ‘buy’ rating on Axis, after the September-ended earnings.

MOFSL estimates an FY23 earnings upgrade for both Axis Bank and ICICI Bank. This could mean a 17.1 percent upgrade for Axis Bank in FY23 estimated earnings, 3.4 percent for Bajaj Finance, 2.5 percent for Kotak Mahindra Bank and 1.4 percent for ICICI Bank. Some of the foreign equity research outfits such as CLSA, Goldman Sachs and Jefferies have all a ‘buy’ rating on Axis, after the September-ended earnings.