Land of plenty: The Piramals' three-pronged realty strategy

Ajay Piramal and son Anand are marrying property development with high finance

Ajay Piramal’s (left) Piramal Group is involved in realty development through Piramal Realty, founded by son Anand (centre), and Piramal Finance, helmed by Khushru Jijina

Ajay Piramal’s (left) Piramal Group is involved in realty development through Piramal Realty, founded by son Anand (centre), and Piramal Finance, helmed by Khushru Jijina

Image: Mexy Xavier

In 2011, the Piramal Group flagship Piramal Enterprises Ltd (PEL), through its real estate investment platform Piramal Fund Management, made a ₹200-crore, early-stage investment in Omkar 1973, a luxury project by Mumbai-based Omkar Realtors & Developers. In 2015, the fund made a roughly ₹500-crore exit—clocking a neat return of 146 percent.

In the same year, Piramal Fund Management lent ₹1,200 crore to Omkar for the same project—₹400 crore to part-refinance existing senior lenders and ₹800 crore for construction finance. What’s more, Brickex, Piramal’s B2B sales and research arm, got into an exclusive tie-up with real estate veteran Anuj Puri-owned ANAROCK Property Consultants to sell about 70 apartments worth ₹1,100 crore in the project, according to media reports.

Piramal Fund Management has also advised Omkar to convert one of the three apartment towers in the project to a commercial property, to draw better value.

Though not commonly associated with realty financing, investing in projects like Omkar 1973 is a major focus area of the Piramal Group. In fact, it’s just one component of the conglomerate’s three-pronged real estate strategy. “We have a unique strategy to deal with real estate,” says group chairman Ajay Piramal, 62.

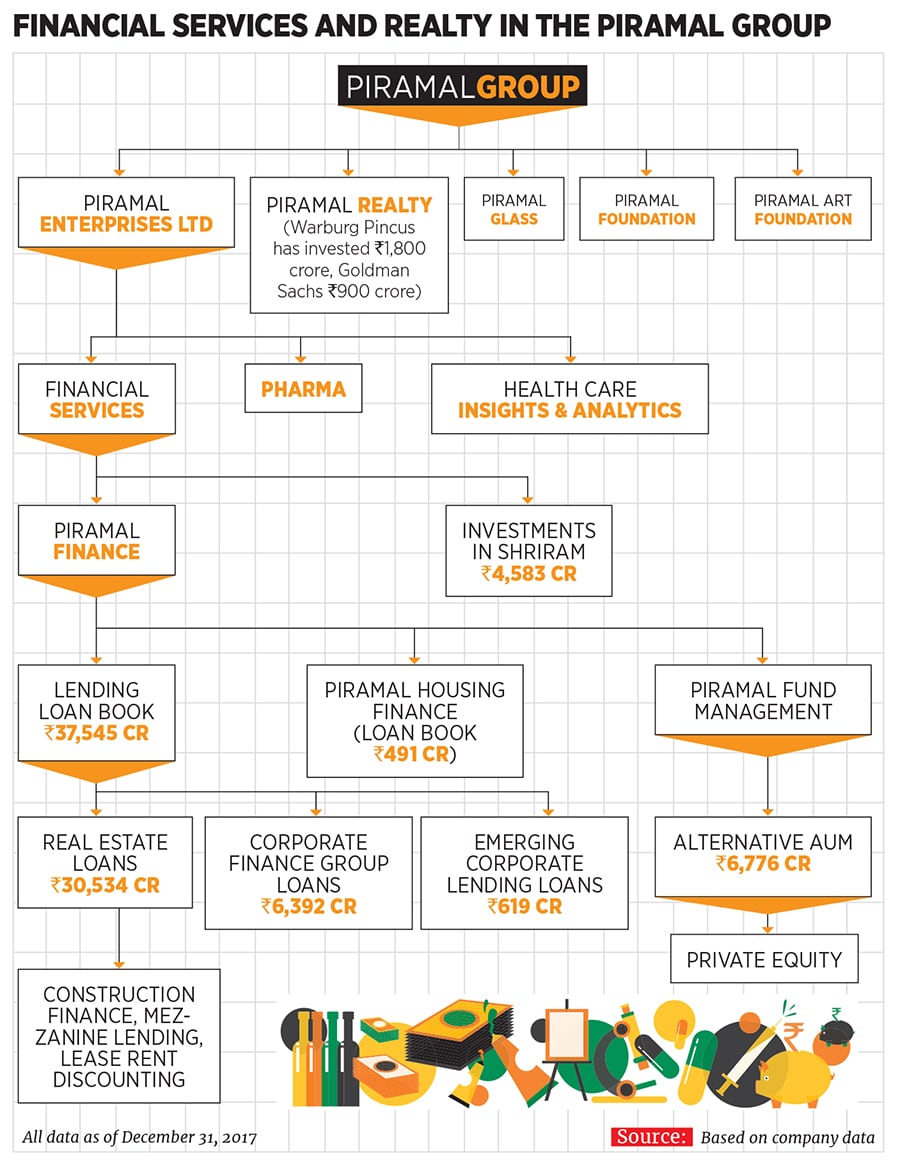

The biggest component of this strategy involves PEL’s non-banking financial arm Piramal Finance, which runs Piramal Fund Management. Piramal Finance provides financing solutions to developers across a range of activities: Capital to purchase land, mezzanine lending, construction finance and lease rental discounting.

The second component of the group’s real estate strategy involves property development through the unlisted Piramal Realty, founded by Ajay Piramal’s son Anand.

The group’s third and latest move has been to enter housing finance with the venture Piramal Housing Finance—set up in September 2017 after securing the requisite licences.

“We provide a complete solution to the developer. And we are customer-centric; this is the common thread running through our two real estate businesses—Piramal Realty and Piramal Finance,” Ajay Piramal adds.

His group’s financial services business—which also includes alternative asset management and investments into the Shriram Group, besides Piramal Finance and the new housing finance venture—contributed 47 percent to PEL’s FY18 revenues (April-December) of ₹7,648 crore. PEL’s pharma business accounted for 42 percent of revenues, while the Healthcare Insights & Analytics division the rest (See table).

While relatively new to realty financing, the real estate sector is no unfamiliar terrain for the Piramals, who have, since the 1990s, been involved in building some of Mumbai’s landmark properties like Peninsula Corporate Park and the erstwhile shopping mall Crossroads. So it was perhaps only natural that the businessman in Ajay Piramal saw the potential of a diversified real estate play.

The Piramals’ foray into realty financing took off in 2010, after the $3.72 billion sale of Piramal Healthcare’s branded generic drug business to Abbott that year.

At the time, regulations severely restricted banks from lending in a major way to developers. Spotting the demand-supply gap, Piramal decided to create an integrated financing platform, which started with structured debt and has since expanded to equity lending to purchase land, mezzanine lending, construction finance, lease rent discounting, and now housing finance.

Since then, they have financed several projects and developers like the Wadhwa Group, into which Piramal Fund Management recently announced a roughly ₹2,000 crore investment. Likewise, in early 2017, Piramal Finance had extended ₹1,100 crore financing to the Embassy Group across residential and commercial projects in Bengaluru, Chennai and Hyderabad.

Khushru Jijina, MD of Piramal Finance, says the NBFC’s strategy of catering to developers and offering end-to-end solutions under a single roof is paying dividends. (HDFC Bank and IndiaBulls also offer some of these products but operate as silos).

Piramal Finance’s wholesale lending book of ₹37,545 crore (excluding housing finance and Piramal Fund Management) generates a healthy return on equity of 21.2 percent and has a low gross NPA of 0.4 percent. There is also a strong pipeline of ₹22,940 crore of loans that are approved but not disbursed, a PEL investor relations presentation shows.

“We feel we will soon be able to effectively utilise the equity that we will deploy in this business and generate good returns for all our stakeholders, while maintaining a healthy asset quality,” Piramal told analysts in January 2018.

Image: Mexy Xavier

Financing a large loan book to developers requires leverage and the question for any lender is how much leverage is prudent and how rapidly it is growing. As for Piramal’s financial businesses, the leverage has more than quadrupled to ₹12,079 crore on March 31, 2017 from ₹2,796 crore on April 1, 2015 (as mentioned in PEL’s 2016-17 annual report). These loans are either payable at call or within one year of disbursement.

While a company as large as PEL will not have a problem rolling over its credit lines, rising interest rates and a tightening of liquidity might make it vulnerable. It is not a situation that worries Ajay Piramal. “There is a good matching of assets and liabilities. Some of the loans could be short-term, but we have enough lines with banks,” he says.

It is this confidence in the company’s fundamentals that exhorted Piramal to launch Piramal Housing Finance (PHF), as an arm of Piramal Finance, last year. It has since grown smartly with assets under management of ₹757 crore as on February 28. But even as it grows in size, PHF has to function in an already crowded housing finance space, with about 90 rivals.

To counter the challenges, it has started to innovate in its product lines. It recently introduced what it calls a ‘Super’ loan, which, Jijina says, pegs the loan repayment to the current income of the individual in the first few years. Then the credit parameters factor in a rise in future income and a higher installment will have to be paid by the customer after five years. The product is being offered for only those projects where Piramals have funded the developer.

While PHF’s business is in the growth lane, it will have to constantly work with developers to introduce customised products. “[Constantly innovating] is not everybody’s cup of tea. The fact that we understand real estate, makes it possible,” says Jijina. PHF’s home loans start at an 8.35 percent rate of interest.

The Byculla region of South Mumbai, once home to textile mills and workers’ low-rise quarters, is fast transforming into a tony neighbourhood.

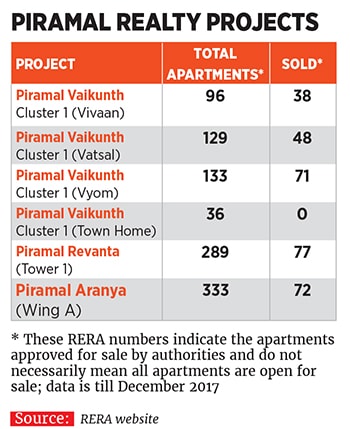

It will soon house the 3.7 million square feet Piramal Aranya, a project by Piramal Realty. The premium, three-towered property, is one of the three residential properties being constructed by the company in the Greater Mumbai region, the others being Piramal Revanta in Mulund (two towers of 60 storeys each) and Piramal Vaikunth, a residential community in Thane. There is also one commercial property, Piramal Agastya, under construction.

Anand Piramal, an economics graduate from the University of Pennsylvania who started Piramal Realty in 2012, was certain he wanted to come back to India and “be involved” in the country’s economic growth. He found his calling in the real estate sector, which his father and himself had identified as a key engine for growth beyond the group’s traditional expertise in pharmaceuticals.

It was a time when the sector was in the midst of what would become a multi-year slump, hit by factors like lengthy approvals, unfavourable taxation, project delays and cost overruns.

Piramal Realty’s strategy, since the beginning, has been to be conservative and consciously remain a regional real estate company. It currently has just about 15 million square feet of area under development, across its four properties, all of which are expected to be completed in three to four years.

Piramal Realty has chosen to develop few large projects (rather than several small ones), most of which are located approximately an hour’s drive from its newly-constructed corporate office at Agastya Corporate Park in Mumbai’s Kurla. “The idea is to monitor the developments,” says Anand Piramal, 33, executive director, Piramal Group and founder of Piramal Realty.

In terms of capital, the company has utilised only about 55 percent (or about ₹1,500 crore)—towards development of existing projects and new land acquisitions—from the total investments made by Warburg Pincus (₹1,800 crore) and Goldman Sachs (₹900 crore) in 2015. “We are disciplined investors, but when times are right, we can double or triple down very quickly,” says Anand.

The Piramals forayed into realty financing after the $3.72 bln sale of their generic drug business to Abbott

In the space of about five years, privately-held Piramal Realty has become a force to reckon with in the group. “In terms of valuation, Piramal Realty is the second largest business vertical and could contribute 15-20 percent to group revenues, after financial services. In terms of return on investment, it is the highest since inception,” a group insider tells Forbes India on condition of anonymity.

Though smaller in size, compared with peers Godrej Properties, Oberoi Realty, Hiranandani Developers or the Lodha Group, Piramal Realty is growing at a fair pace and aims to be one of the top three of its type in terms of valuation, by 2020.

“The next two to three years offer a great opportunity to double the size of the company (in developable area and valuation) and also acquire land at fair to distressed prices,” says Anand, while declining to provide the revenue growth data of his business.

Though much of the business is limited to building residential properties, Piramal Realty plans to have a bigger play in the commercial space as well. Besides Piramal Agastya, a 16-acre corporate park in Kurla, there are more plans ahead. “We are thinking of starting a commercial fund, where we will buy greenfield/ brownfield developments and complete them. Once complete, we would have the option to sell this to a large PE player,” Anand says. The returns, in terms of premium, are seen to be better and faster in commercial developments, compared with residential, in India.

The real estate market, he says, is currently “decent” for good developers. “There is no major price appreciation, but at the right price and unit mix, sales are pretty good,” he adds. Sales for Piramal Realty have already risen 81 percent to ₹811 crore (year-to-date in FY18), against ₹447 crore in FY17 (See table).

Anuj Puri, chairman of ANAROCK, says the consolidation is already underway. “Smaller developers are becoming land manufacturers, offering land to larger players such as Godrej, Larsen & Toubro (L&T), Shapoorji Pallonji or the Piramals for development,” he says. “The larger developers are in a position to sell it faster and at a premium. The smaller ones are not selling their companies, but getting into tie-ups or in some cases going out of business with a smile.”

Ajay Piramal agrees: “Many builders have land but they are not in a position to develop and sell it. So they are willing to get into joint development and we put the money only for the construction. So with a brand as strong as ours, it can be sold well. We will see more of such cases.” He adds that his group not only provides money, but also strategies for the builder (whose strength could be land aggregation but not necessarily funding in the post-RERA era).

In January this year, Piramal Realty entered into an agreement with Omkar to develop a 12-acre luxury housing project at Mahalaxmi in South Mumbai, where it intends to invest ₹2,600 crore. It will pay a deposit of ₹400 crore and will have a 60 percent revenue share in the project.

Interestingly, to maintain a high degree of governance ethos with the group, the Piramal Group ensures that Piramal Finance does not fund Piramal Realty, even as it funds its sister concern’s rivals.

The company’s strategy at this stage (residential vs commercial) is on the right track, says Naaman Atallah who took charge as Piramal Realty’s CEO in March this year. “I would want to shorten the learning curve and accelerate growth for the company,” adds the civil engineer-turned-real estate developer who headed various projects in the US and UK and was formerly the CEO of Dubai Properties. He was also the COO of Emaar Properties, where he worked on some of the world’s most iconic projects such as Burj Khalifa and the Dubai Mall.

The road ahead

According to the Piramals, India’s real estate sector could see a “golden period” over the next three to five years, where demand (and prices) would start to look up.

Puri concurs, saying demand for housing could see a quicker turnaround, in around 18 months from now. The strongest demand for property would be in the affordable housing space, followed by homes below ₹2.5 crore. “But those costing over $1 million [₹6.5 crore] could find it difficult,” he says.

“The key for Piramal Realty will be to offer products at the right price points and ticket size,” says Anish Saraf, Warburg Pincus’s India MD.

Ankur Sahu, MD and co-head private equity (Asia Pacific) at Goldman Sachs, who had advised the Piramals to build a world-class company instead of “a collection of discrete independent projects”, also forecasts that demand will pick up in the next two to three years.

It looks like Ajay Piramal has played his cards right. And the time is ripe for him to seize what may well be the next big business opportunity.

(With inputs from Samar Srivastava)

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)