General Atlantic becomes fourth big investor in Reliance's Jio Platforms

Jio has now raised nearly Rs 68,000 crore in under four weeks

After recent investments by Facebook, Silver Lake and Vista Equity Partners, Jio Platforms has now signed a deal with General Atlantic, readying itself for its next phase of growth. The deal takes the parent, Reliance Industries, one step closer to its aim of becoming a zero net debt company by March 2021.

After recent investments by Facebook, Silver Lake and Vista Equity Partners, Jio Platforms has now signed a deal with General Atlantic, readying itself for its next phase of growth. The deal takes the parent, Reliance Industries, one step closer to its aim of becoming a zero net debt company by March 2021.

This is the fourth such stake sale by Jio in the past four weeks and with this latest investment, Reliance Industries has raised a total of Rs 67,194.75 crore for a 14.7 percent stake in Jio Platforms.

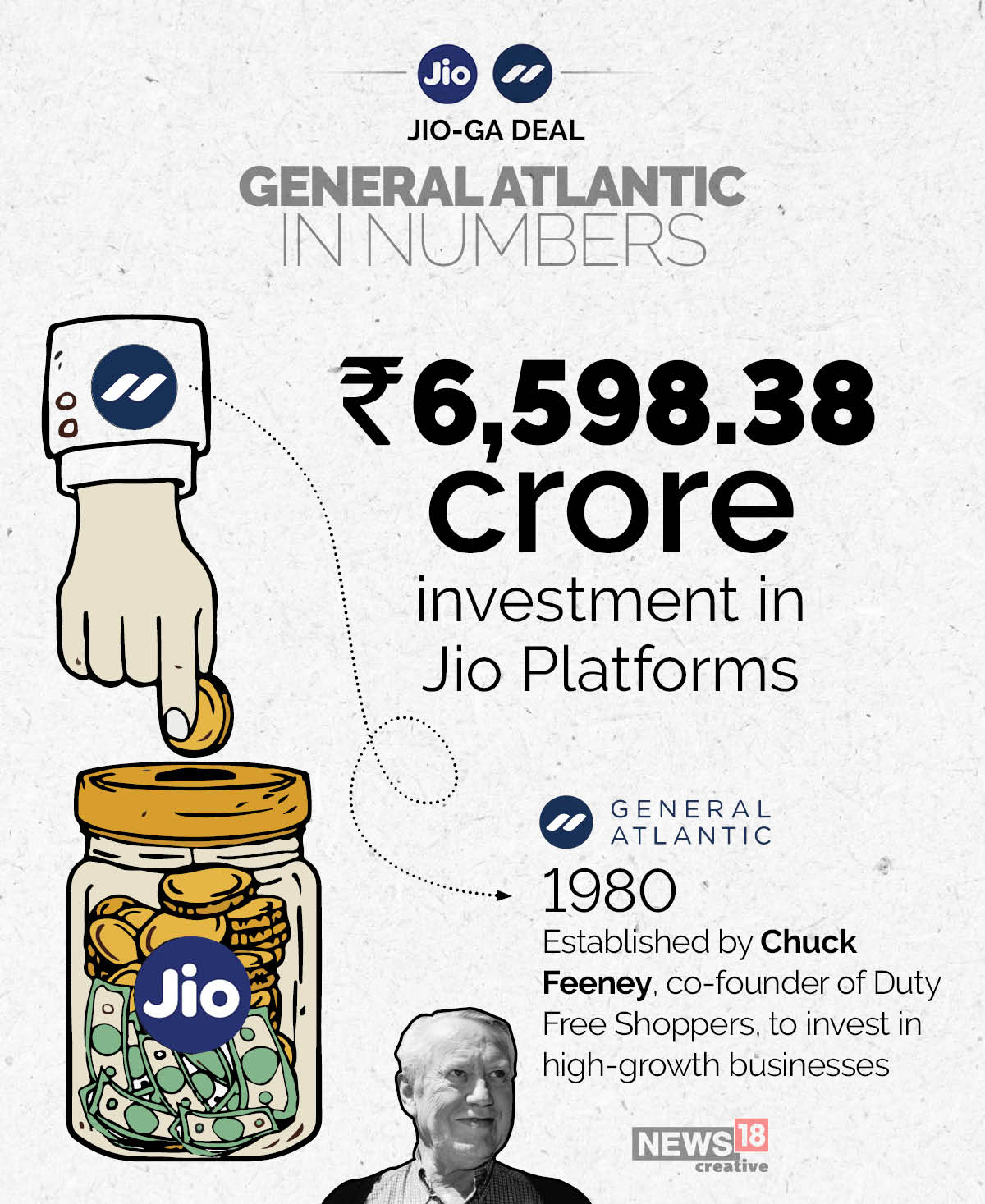

General Atlantic, a specialist growth equity firm, will invest Rs 6,598.38 crore for a 1.34 percent equity stake in Jio Platforms. This investment values Jio Platforms at an equity value of Rs 4.90 lakh crore and an enterprise value of Rs 5.15 lakh crore, which works out to the same valuations determined by Silver Lake and Vista Equity. But it is at a 12.5 percent premium to the price Facebook paid for a 9.99 percent stake in Jio Platforms.

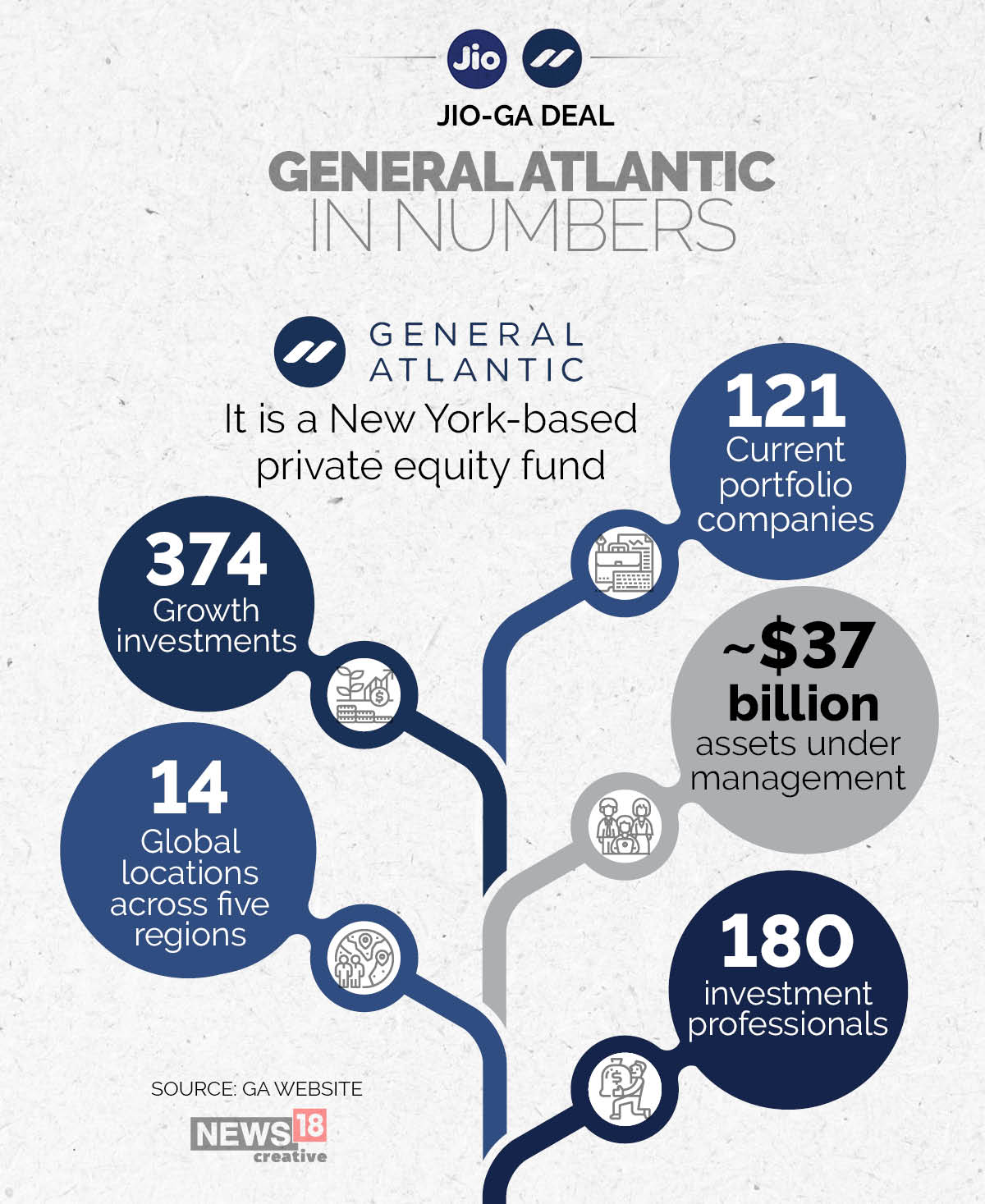

General Atlantic’s other investments include Airbnb, Alibaba, Ant Financial, Box, ByteDance, Facebook, Slack, Snapchat and Uber.

While the General Atlantic deal does not reveal exactly how the two companies will partner, it reaffirms the interest that foreign investors have in the world’s second largest internet market. Jio Platforms, a subsidiary of Reliance Industries, has amassed more than 388 million subscribers.