Sitharaman announces stalling of fresh insolvency proceedings for a year

Experts caution that this may lead to greater flux and unintended consequences; meanwhile, expenditure on public health has been hiked, MGNREGA allocation increased

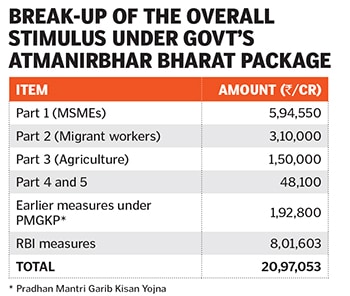

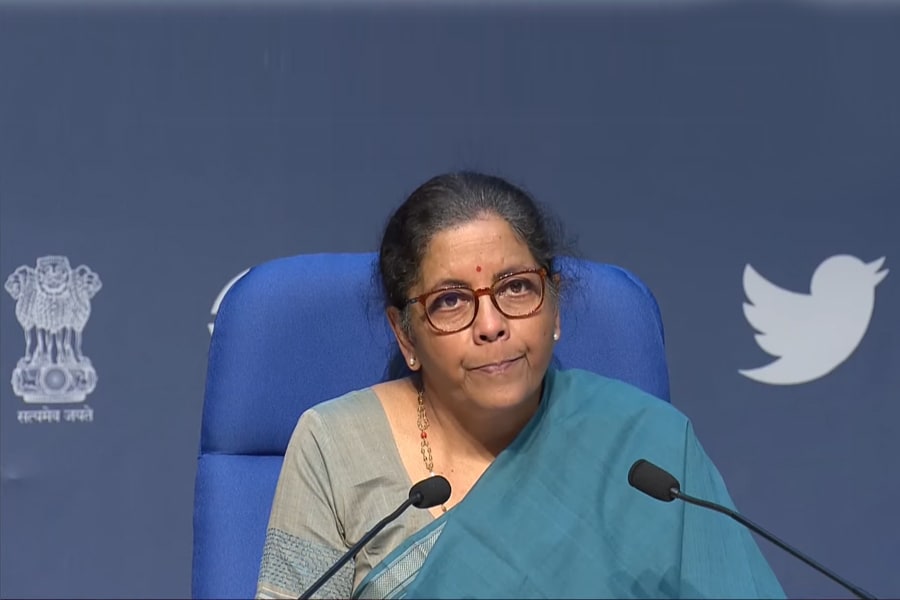

Finance Minister Nirmala Sitharaman on Sunday, in the fifth and final tranche of economic packages announced to curb the damages of Covid-19, announced that there would be not fresh insolvency proceedings against companies for a period of one year. An ordinance will be passed to this effect. She also said that the minimum threshold level to initiate Insolvency and Bankruptcy Code (IBC) process is being raised to Rs 1 crore from Rs 1 lakh.

This will be a major source of help to protect the micro, small and medium enterprises (MSMEs) from being pushed to court under the IBC. In a related measure, Sitharaman said that Covid-19-related debt has been exempted from the definition of ‘default’ under the IBC for the purpose of triggering insolvency proceedings.

Sitharaman also disclosed that a fresh policy will be announced so that private entities will be allowed to participate in all sectors.

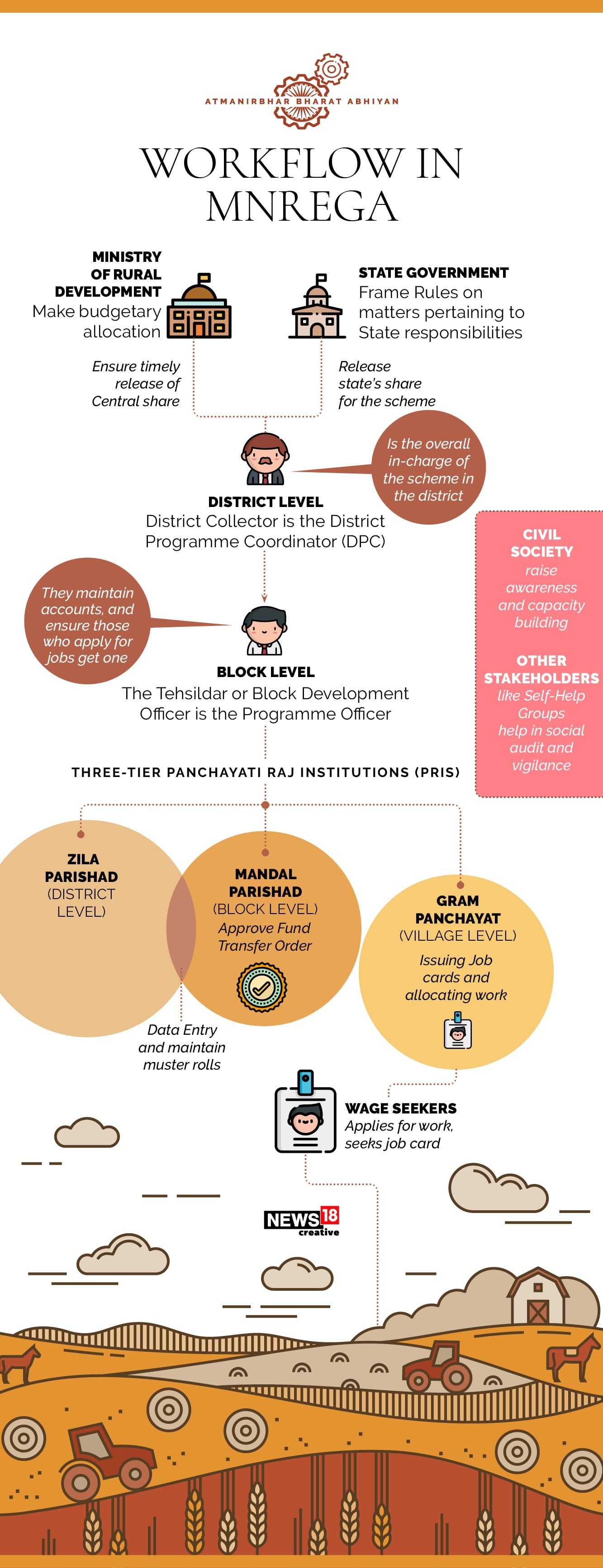

Another important measure was that the budget allocation under MGNREGA (Gandhi National Rural Employment Guarantee Act) is being raised by a further Rs 40,000 crore from the existing Rs 61,000 crore.