India's seeing a flurry of new unicorn startups. What's going on, and what's next?

Close to half of India's billion dollar-plus tech ventures—26 till mid-August—have emerged in 2021. Two dozen unicorns have emerged in just eight months. Can they keep galloping?

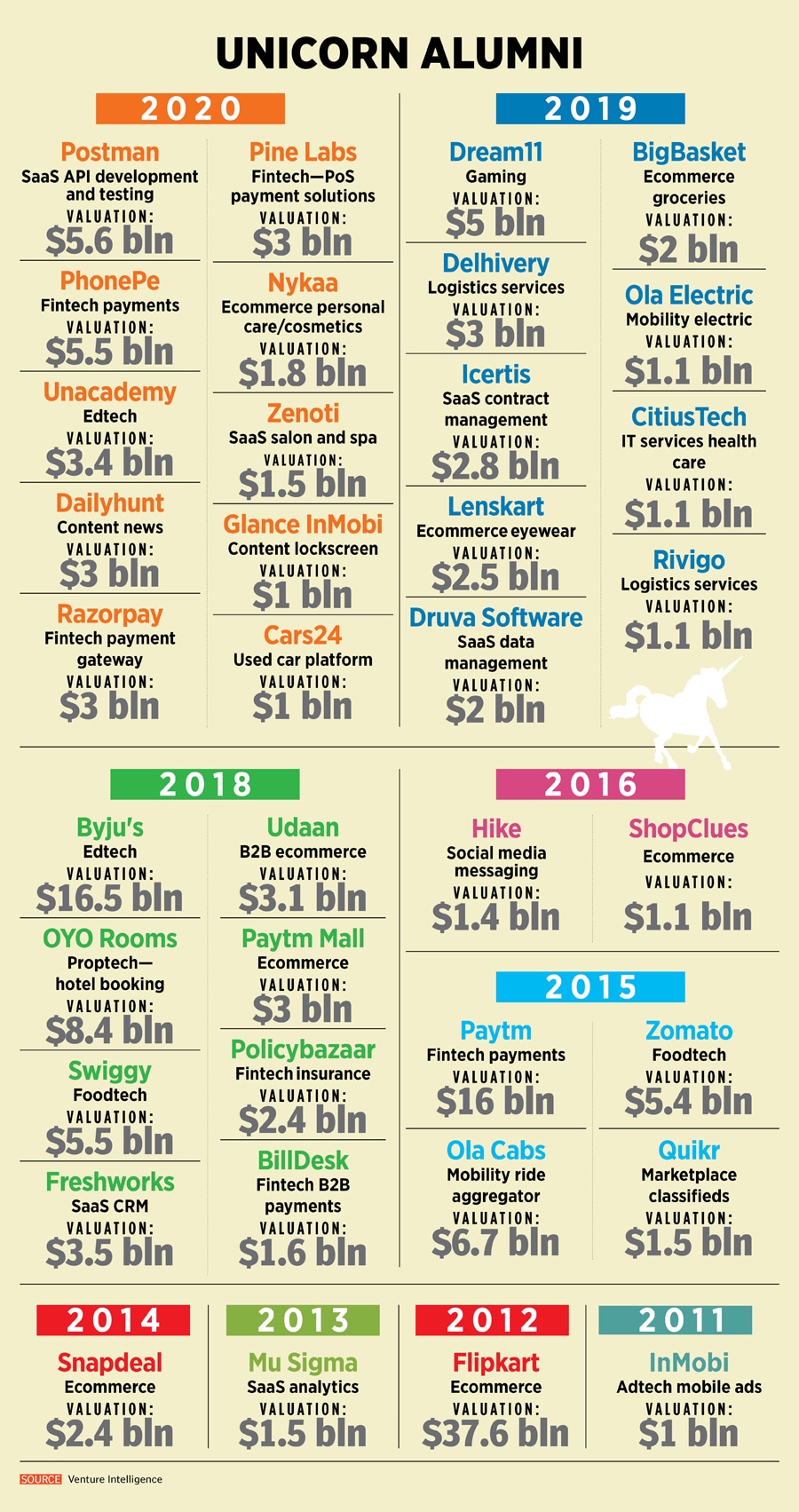

In 2016, India had five unicorns in the elite club—a breakout moment considering that between 2011 and 2015, the country had produced six unicorns

In 2016, India had five unicorns in the elite club—a breakout moment considering that between 2011 and 2015, the country had produced six unicorns

Krishna Depura is blessed with an elephant’s memory. What he prefers to talk about, though, is a mythical animal, and an unprecedented moment, which he witnessed a decade ago. In 2011, InMobi, a privately-held mobile adtech startup, turned unicorn with a value of over a billion dollars. “It was like wow,” recalls the co-founder of sales readiness platform Mindtickle. In September that year, SoftBank had handed InMobi a hefty cheque of $200 million, making it India’s first unicorn. Around the same time—August 2011—Depura, along with three friends, turned entrepreneur by embarking on a virtual treasure hunt. The engineers rolled out Mindtickle, which started as a gamification platform for corporates.

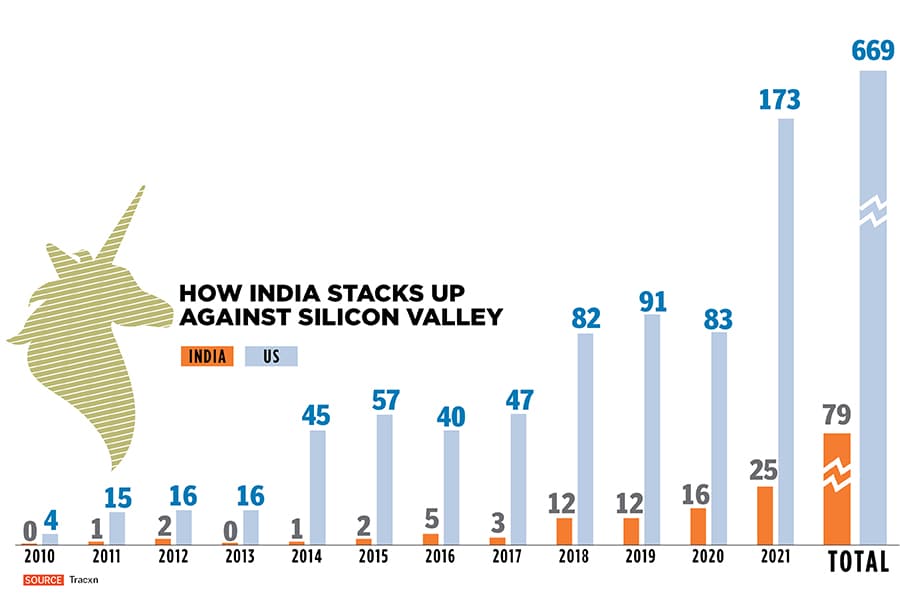

Five years later in Bengaluru, Prem Pavoor was witnessing the birth of more unicorns. “We saw a few companies getting to a billion-dollar valuation,” recalls the partner and head of India at Eight Roads Ventures, a VC fund that backs growth-stage firms. In 2016, India had five unicorns in the elite club—a breakout moment considering that between 2011 and 2015, the country had produced six unicorns.

Fast forward to 2021. It’s a déjà vu moment for Depura, who has now joined the party. Mindtickle is one of the 26 unicorns that have emerged in just eight months this year. Depura first mimics the reaction of the people who are flabbergasted with the charge of unicorns. “It is like, OMG! Every Tom, Dick and Harry is becoming a unicorn,” he says. The common sentiment echoing, he adds, is like “arey iska bhi ho gaya, uska bhi ho gaya, hum bhi kar lete toh hamara bhi ho jaata… (everybody is becoming a unicorn. Had we tried, we would have also become one).”

Depura is at pains to point out that it “didn’t happen overnight”. It took Mindtickle 10 years to get to the prized valuation. Ditto with most of the other unicorns, which have slogged for years. Some of them, adds Depura, have been there for seven, eight, nine years, and had been silently working. Now when people see unicorns raining, they think it’s a sudden thing. “It’s not,” smiles Depura, who uses the analogy of a bamboo to explain the unicorn rush. Nobody notices bamboos during their formative years. They grow, but stay under the radar. And suddenly, one fine day they just shoot through the roof, and start getting attention. “Startups are like bamboos,” he smiles.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

The investor starts with a hard-hitting Q&A session. Are the valuations high? “Indeed, some of them are. There is no denying that,” he says. Second question: Are people giving value for future promise and potential of each of these companies? “Of course, they are. It’s also the truth,” he underlines. Third: Is this for real? “Indeed it is. It’s not an aberration,” he asserts. And lastly, what next for the unicorns? “More unicorns, IPO, mergers and acquisitions, and more growth—sustainable growth.”

The investor starts with a hard-hitting Q&A session. Are the valuations high? “Indeed, some of them are. There is no denying that,” he says. Second question: Are people giving value for future promise and potential of each of these companies? “Of course, they are. It’s also the truth,” he underlines. Third: Is this for real? “Indeed it is. It’s not an aberration,” he asserts. And lastly, what next for the unicorns? “More unicorns, IPO, mergers and acquisitions, and more growth—sustainable growth.”

Along with decacorns, another trend to emerge strongly is startups taking the primary market route with initial public offerings (IPOs). Those with a revenue of $100 million are more likely to hit the public market as companies in such a revenue bracket have a more predictable growth, reasonable unit economics and are either profitable or have a path to profitability. Alongside, secondary exits will continue to remain a healthy way to exit as larger funds look to invest in market-leading companies. “Markets decide valuations,” says Ravishankar, underlining that in a buoyant market, more companies will benefit from rich valuations. But companies, he stresses, don’t become unicorns without exhibiting leadership in their segment or through scale or growth.

Along with decacorns, another trend to emerge strongly is startups taking the primary market route with initial public offerings (IPOs). Those with a revenue of $100 million are more likely to hit the public market as companies in such a revenue bracket have a more predictable growth, reasonable unit economics and are either profitable or have a path to profitability. Alongside, secondary exits will continue to remain a healthy way to exit as larger funds look to invest in market-leading companies. “Markets decide valuations,” says Ravishankar, underlining that in a buoyant market, more companies will benefit from rich valuations. But companies, he stresses, don’t become unicorns without exhibiting leadership in their segment or through scale or growth. The trend is not confined to India. Look at Silicon Valley. After seeing a dip from a high of 57 unicorns in 2015 to 47 two years later, the numbers have seen a heady growth since then. While last year, the US had 83 unicorns, the number for the first eight months this year has shot up to 173.

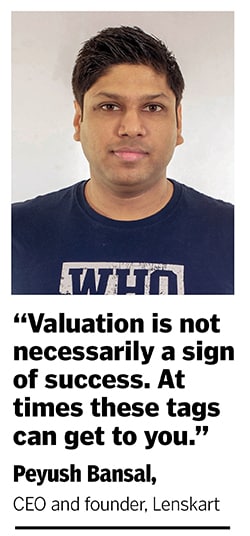

The trend is not confined to India. Look at Silicon Valley. After seeing a dip from a high of 57 unicorns in 2015 to 47 two years later, the numbers have seen a heady growth since then. While last year, the US had 83 unicorns, the number for the first eight months this year has shot up to 173.  Peyush Bansal sounds a word of caution. “Valuation is not necessarily a sign of success,” says the founder and CEO of Lenskart, which turned unicorn in 2019 and is now reportedly valued at $2.5 billion. Bansal explains why it is crucial to stay grounded. “At times these tags can get to you,” he says, questioning if being valued at over a billion dollars has anything to do with the value that an entrepreneur is creating. The sign of success, he underlines, is when the company is generating value for shareholders and building a brand for customers.

Peyush Bansal sounds a word of caution. “Valuation is not necessarily a sign of success,” says the founder and CEO of Lenskart, which turned unicorn in 2019 and is now reportedly valued at $2.5 billion. Bansal explains why it is crucial to stay grounded. “At times these tags can get to you,” he says, questioning if being valued at over a billion dollars has anything to do with the value that an entrepreneur is creating. The sign of success, he underlines, is when the company is generating value for shareholders and building a brand for customers.

The fear of unicorpses—dead unicorns—might also loom large once the strong funds flow begins to ebb. Take, for instance, what happened in the US towards the end of 2015 and 2016. The bullishness got tempered, lofty valuations became a thing of the past, and fund managers started writing down their investments. Marc Benioff, founder and chief executive of Salesforce, raised the red flag. “There are going to be lots of dead unicorns,” he reportedly said at the World Economic Forum in Davos in 2016. Some did fail, and from a high of 57 unicorns in 2015, new additions dipped to 40 in 2016, according to data shared by Tracxn.

The fear of unicorpses—dead unicorns—might also loom large once the strong funds flow begins to ebb. Take, for instance, what happened in the US towards the end of 2015 and 2016. The bullishness got tempered, lofty valuations became a thing of the past, and fund managers started writing down their investments. Marc Benioff, founder and chief executive of Salesforce, raised the red flag. “There are going to be lots of dead unicorns,” he reportedly said at the World Economic Forum in Davos in 2016. Some did fail, and from a high of 57 unicorns in 2015, new additions dipped to 40 in 2016, according to data shared by Tracxn.