A tax cut to fight inflation

By reducing levies on petrol and diesel, the government has signalled a clear intent to fight inflation through tax cuts. Power, fertiliser and CNG prices will be closely watched

An announcement of a duty cut on petrol and diesel on Saturday made it clear which side the government is on—cut duties and risk a dent in government finances while keeping inflation in check.

Image: Narinder Nanu / AFP

An announcement of a duty cut on petrol and diesel on Saturday made it clear which side the government is on—cut duties and risk a dent in government finances while keeping inflation in check.

Image: Narinder Nanu / AFP

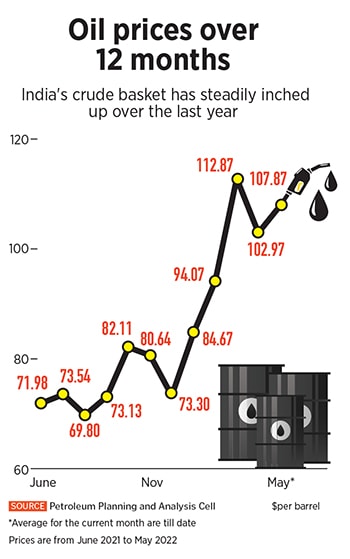

Over the last quarter, rising energy prices had put policymakers in a dilemma: Raise them and risk an upsurge in inflation or cut them and risk a dent in government finances.

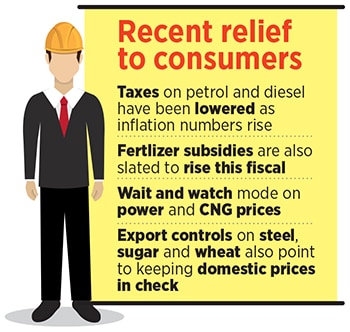

An announcement of a duty cut on petrol and diesel on Saturday made it clear which side the government is on—cut duties and risk a dent in government finances while keeping inflation in check. With this, it is unlikely that the full extent of rising petrol and diesel prices will be passed on. Several states also moved to cut levies.

While it’s still early days in the government’s move to keep prices under control (and a tax cut could be one of the many strategies it adopts), what’s clear is that a repeat of an extended period of high prices like 2011-14 is what policymakers want to avoid at all cost. Once inflation gets out of hand and inflation expectations become entrenched, it becomes that much harder to fight.

Since fuel levies were cut on May 21, an export duty on steel has been introduced and an annual limit of 10 million tonnes on sugar exports imposed to keep domestic prices under check. Wheat exports were also banned this month as the war in Ukraine is expected to result in a global shortage.

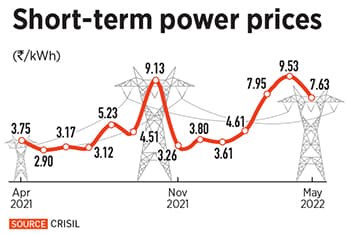

In India’s energy basket, key to watch will be power, fertiliser and CNG prices. It’s still unclear how relief will be provided for them and who will pay the bill.

In India’s energy basket, key to watch will be power, fertiliser and CNG prices. It’s still unclear how relief will be provided for them and who will pay the bill.

Lastly, there’s fertliser, where increasing input prices have necessitated a 55 percent increase in subsidy to Rs 250,000 lakh crore for FY23. While the government has made clear that farmers will not be made to pay higher prices, the manner in which this will be paid for remains to be seen.

Lastly, there’s fertliser, where increasing input prices have necessitated a 55 percent increase in subsidy to Rs 250,000 lakh crore for FY23. While the government has made clear that farmers will not be made to pay higher prices, the manner in which this will be paid for remains to be seen.