BharatNXT: The bridge to effective payments solutions for SMEs

The promoters have made a successful pivot from being a supply chain financier to a profitable business payments platform for SMEs. It now has bigger plans

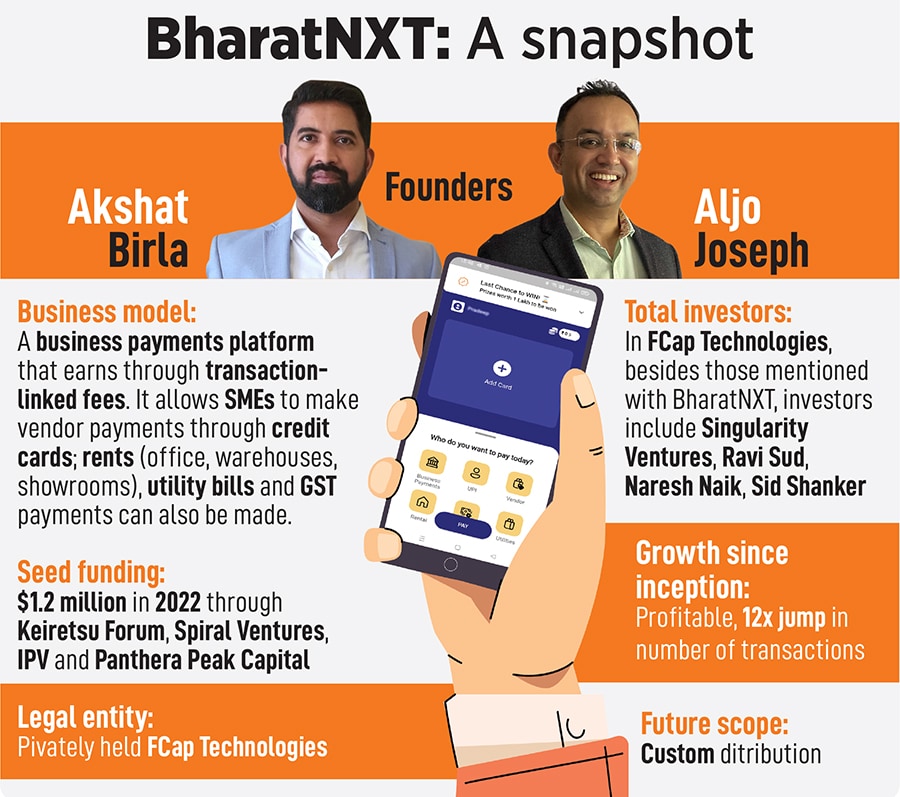

Akshat Birla (left), Founder and CEO of BharatNXT and Aljo Joseph, Founder & Chief Business Officer of BharatNXT

Akshat Birla (left), Founder and CEO of BharatNXT and Aljo Joseph, Founder & Chief Business Officer of BharatNXT

Rarely do startups manage to pivot to a new business model successfully, with the former promoters and investors well entrenched in the new setup. In most cases, the founders either decide to take separate ways or the investors find exit routes.

But none of this happened in the case of fintech company Finovate Capital, which, after successfully building a supply chain financing platform for small and medium enterprises (SMEs) in India, decided to halt that business and pivot to a business payments platform for the SME universe, which founders Akshat Birla and Aljo Joseph understood very well.

The rationale for a supply chain financing platform was a no-brainer. Despite their wide reach, micro, small and medium enterprises (MSMEs) had always struggled to get access to finance from large lenders. Prior to the introduction of the Goods and Services Tax (GST), voluminous paperwork and the need for physical verification of services to be provided meant that smaller suppliers were serviced by micro-finance companies and moneylenders, and rarely by large banks.

“Supply chain finance is a great concept and a secure way to ensure SMEs get liquidity, but we realised that while we created operational efficiency, and at zero percent NPAs, it was reliant on lenders to relax their credit policy. There was no differential strategy, which was creating value for everyone,” Joseph, founder and chief business officer of BharatNXT, tells Forbes India.

Pivoted, still servicing SMEs

Finovate Capital was well entrenched in the SME ecosystem: It had financed more than 4,300 borrowers, 18 anchors and had processed 24,000 invoices between March 2020 and December 2021.