Bitter Dose & Harsh Reality: Why are online pharmacies and healthtech platforms bleeding?

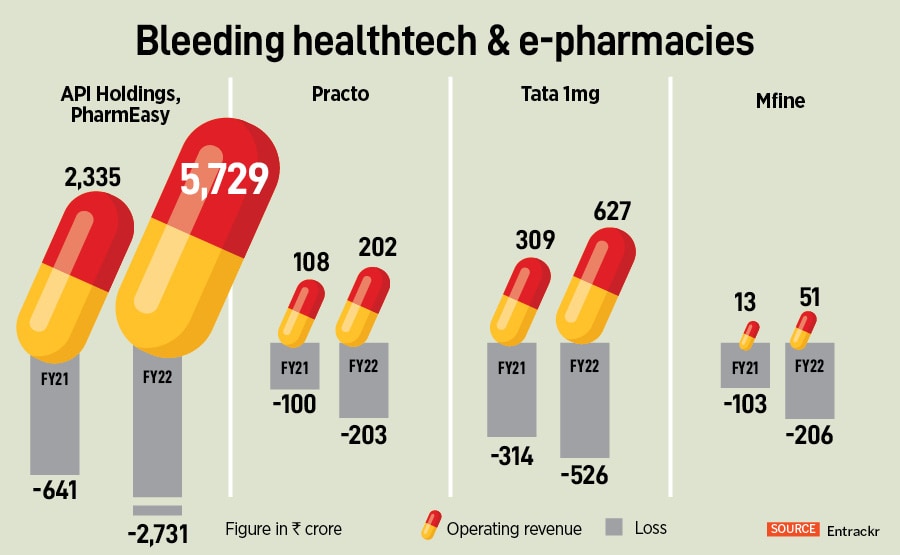

PharmEasy, Practo, Tata 1mg and Mfine are in heavy losses. For offline rivals, though, it's a profitable and healthy story. Can the online players find their magic pill?

Online pharmacies started with a wrong diagnosis. Consumers don’t buy medicines because of discounts.

Image: Shutterstock

Online pharmacies started with a wrong diagnosis. Consumers don’t buy medicines because of discounts.

Image: Shutterstock

Greater Noida, Uttar Pradesh. Alok Singh was unequivocal in his conviction. “I knew it won’t have any impact,” says the 36-year-old entrepreneur. “But I had to do it to make the boys happy,” he says, alluding to the constant pestering by his half-a-dozen young employees—he calls them boys—to hang a big, bold neon display board outside his compact chemist shop. “Paagal ho? (Are you nuts?) Who buys medicines for discounts?” he argued with his boys who were influenced by a battery of online pharmacy players that had bombarded the television, social media and online world with their commercials wooing users with discounts, cashbacks and quick delivery. “We anyway charge less than the MRP,” he tried his best to instil some realism. “And we also deliver for free. Don’t we?” he continued with his futile pitch.

Nothing worked though. Three years ago, Singh yielded, and got a board perched next to the name of his shop ‘Saurishti Pharmacy.’ “12% FLAT DISCOUNT,” the advertising banner screamed, with ‘flat’ and ‘discount’ printed in capital letters. Two more chemist stores at the shopping complex in Gaur City Arcade in Greater Noida West followed suit. Both upped the ante by offering “15 percent” and “20 percent” discounts on prescription medicines. Singh, however, remained composed. “Bhedd chaal hai. Kuch kaam nahin karega (It’s a herd mentality. Nothing will work),” he proclaimed.

Some three kilometres away, in another shopping mall, there are four chemist shops, one of which is Apollo Pharmacy. “All of us are in business,” says Sanjay Gupta, owner of Fit&Cure medicine store, which has three stores in Greater Noida. “There are hundreds of chemist shops in Delhi-NCR,” he claims. There are at least two such stores, he lets on, close to every gated residential society and housing colonies. All chemist stores, he underlines, are open seven days a week, take orders on WhatsApp as well, accept all modes of payments, deliver for free, and have tied-up with diagnostic labs for blood tests.