BSNL and Vodafone Idea: It's time to perform

The government has done enough to assist these two debt burdened, loss-making telcos. As both continue with their different 4G expansion journeys, all their stakeholders are watching. There may not be more relief

Loss making and debt burdened telecoms BSNL and VI need more than government assistance to revive their fortunes. Image: AFP; Getty Images

Loss making and debt burdened telecoms BSNL and VI need more than government assistance to revive their fortunes. Image: AFP; Getty Images

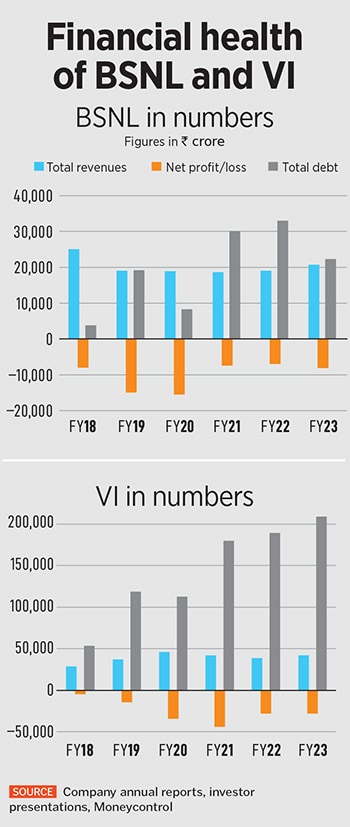

A flurry of encouraging news in recent weeks should have got the fortunes for the government-owned, debt burdened telecom operators Bharat Sanchar Nigam (BSNL) and Vodafone Idea (VI) to be on the mend. The government has, since 2019, announced three revival packages for BSNL, the latest of Rs89,047 crore coming in June. In May, BSNL placed a $1.83 billion (near Rs15,000 crore) order with a TCS-led consortium, for the rollout of its 4G network services.

For cash-strapped VI, reports came in June that its promoters UK’s Vodafone Group Plc and the Aditya Birla Group are likely to infuse up to Rs9,000 crore of fresh capital into the company to revive its business. But a closer look indicates these announcements are just too little to move the needle.

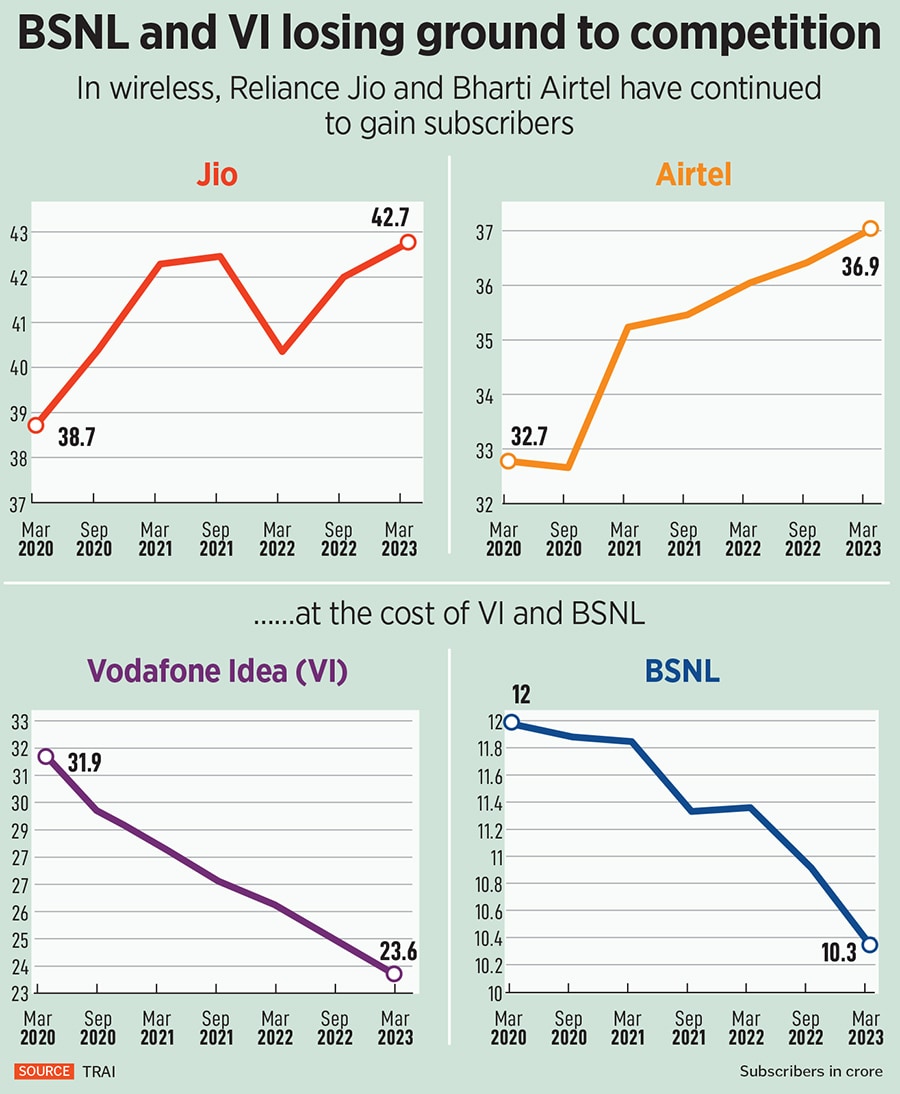

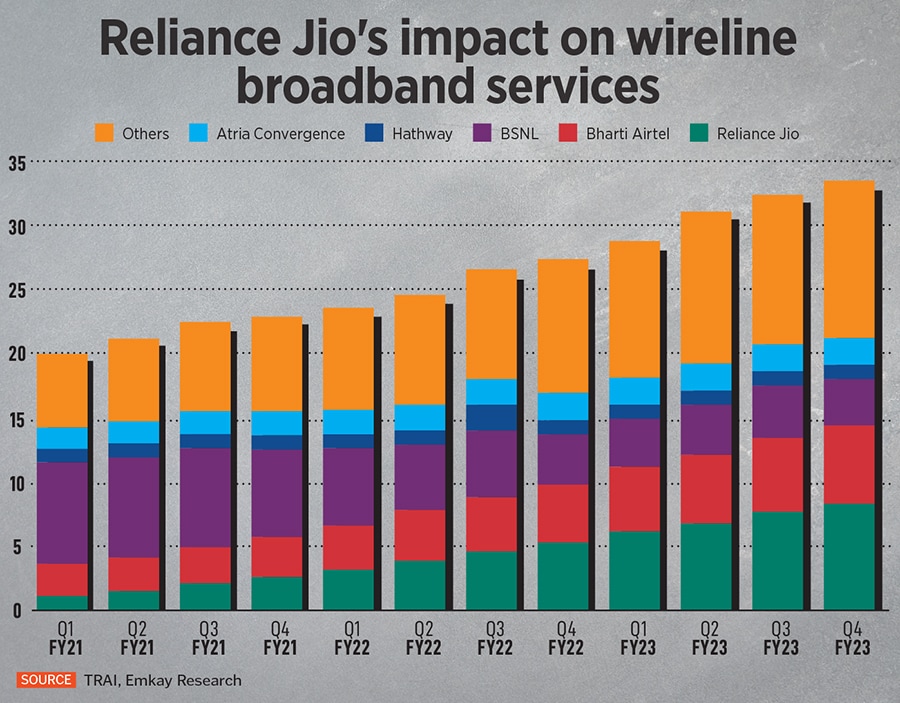

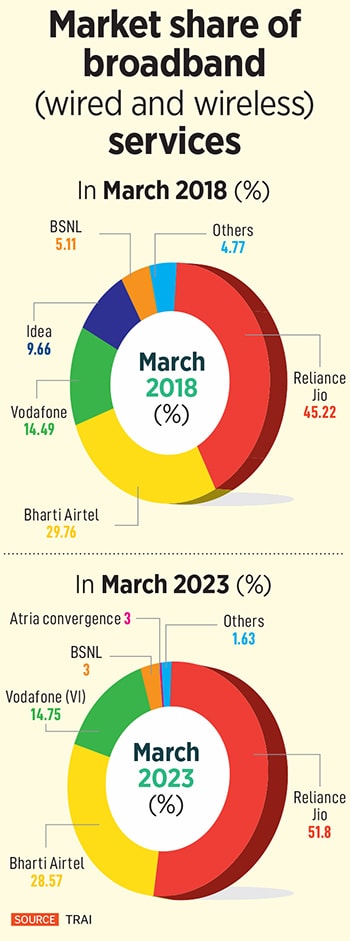

Both have little time on their hands; they need to be battle-ready to take on larger, well-funded rivals Reliance’s Jio Platforms and Bharti Airtel, who have been aggressively rolling out their 5G services across India. BSNL and VI have continued to lose market share and subscribers to Jio and Airtel, for years now. [Disclaimer: Reliance Industries is the owner of the Network18 group, which publishes Forbes India].

There then appears to be little to cheer the government or investors in each company respectively.

When Tata Consultancy Services (TCS) announced in May this year, of a consortium which it led, to bag an Rs15,000 crore ($1.83 billion) advance purchase order from BSNL to build a 4G network across India, it signaled a synergic win-win for several parties in India’s telecom ecosystem.

When Tata Consultancy Services (TCS) announced in May this year, of a consortium which it led, to bag an Rs15,000 crore ($1.83 billion) advance purchase order from BSNL to build a 4G network across India, it signaled a synergic win-win for several parties in India’s telecom ecosystem. To understand how much of a ‘strong third’ player VI will emerge behind Jio and Airtel, one has to assess the company from the standpoint in 2025-26 by when the moratorium period ends and it needs to start paying the government its dues.

To understand how much of a ‘strong third’ player VI will emerge behind Jio and Airtel, one has to assess the company from the standpoint in 2025-26 by when the moratorium period ends and it needs to start paying the government its dues. Hemang adds that it is different for the enterprise business where there are “several use cases in manufacturing, automobiles, retail, warehousing, healthcare, education, smart cities, data centres, cloud computing etc. which can drive significant value creation, albeit it will take a few years for use cases to reach maturity and be monetized.”

Hemang adds that it is different for the enterprise business where there are “several use cases in manufacturing, automobiles, retail, warehousing, healthcare, education, smart cities, data centres, cloud computing etc. which can drive significant value creation, albeit it will take a few years for use cases to reach maturity and be monetized.”