Post-5G auctions: What plays out now?

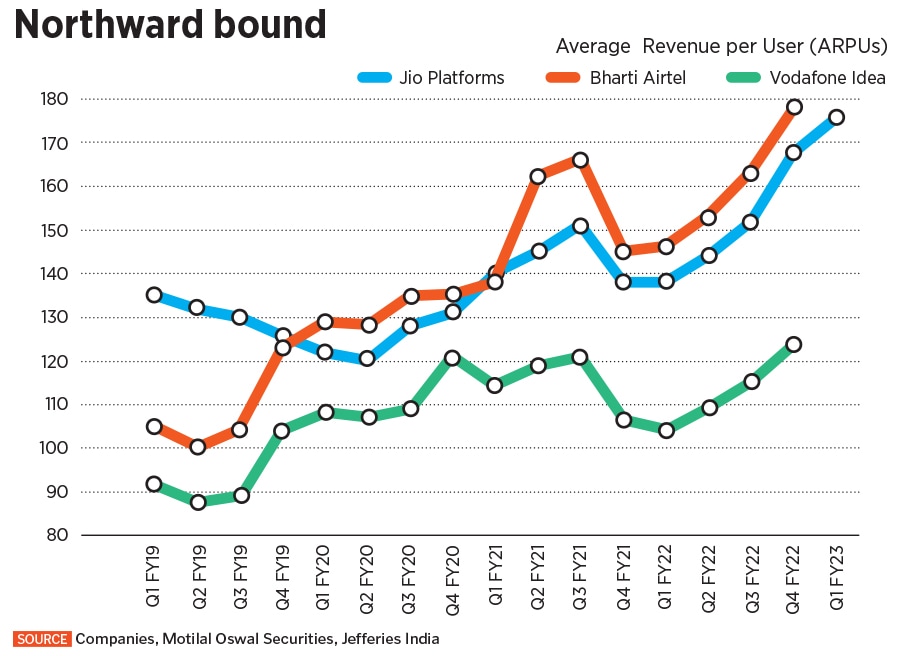

The auctions saw record demand, but rollout of 5G stacks is expected only in late-2022 as infrastructure support is not complete. Giants Jio and Bharti likely to face two to three tough quarters due to higher capex spend; ARPUs will, however, get a boost as products start rolling out

The infrastructure to support 5G technology is not ready, starting with fibreisation of towers. Existing radio towers need to be connected by optic fibre cables. Currently, only about 33 percent of telecom towers in India are connected by fibre

Image: Debarchan Chatterjee/NurPhoto via Getty Images

The infrastructure to support 5G technology is not ready, starting with fibreisation of towers. Existing radio towers need to be connected by optic fibre cables. Currently, only about 33 percent of telecom towers in India are connected by fibre

Image: Debarchan Chatterjee/NurPhoto via Getty Images

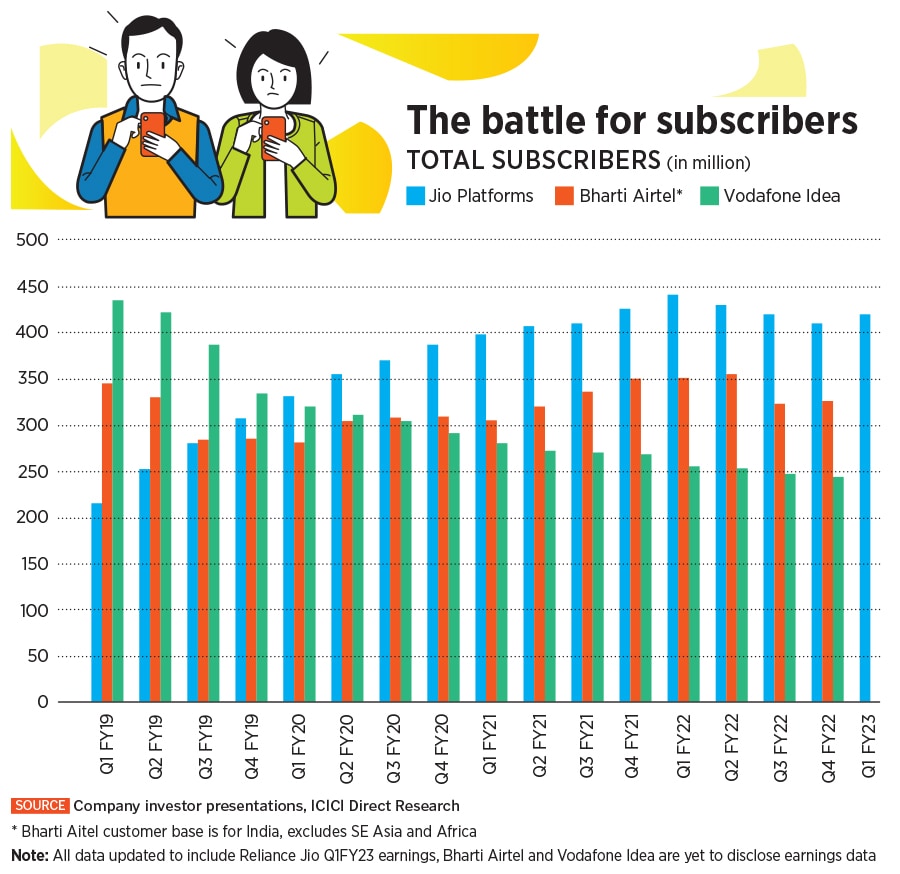

India’s first ever 5G spectrum auction has not only seen a record number of bids in its three-day auction, but the pattern of bidding has also indicated what some major telecom companies might be planning for the future. The auction for 72 GHz of airwaves, which is now expected to close on July 29, means, of course—not just three days of successful and competitive bidding across various bands but also at least over the near term—some pressure on the balance sheets for operators such as market leader Reliance Jio and nearest rival Bharti Airtel in the coming two to three quarters, as network and operating costs towards 5G infrastructure and expansion continue to climb.

But future spectrum auctions are likely to become even more competitive, experts say. The infrastructure-focussed Adani Group, whose subsidiary Adani Data Networks has put in an earnest token deposit (EMD) of Rs100 crore—which indicated muted and limited action in this year’s auction—might be testing the waters. By next year, there will be visibility on Vodafone Idea (VI) ability to find that magical investor to ensure long-term financial viability and also what the government plans to do with the near-33 percent stake it holds in the company.

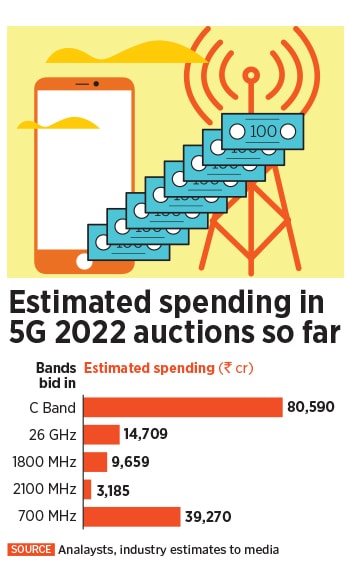

“The ratio of EMD bids and Day 1 strategy focussed on specific bands and laid out the right foundation for a very positive 5G spectrum auction in 2022. On Day 1, telcos in aggregate committed to Rs1.45 lakh crore and utilised more than 75 percent of the EMD amount allocated to the spectrum; Day 2 was expected to be focussed on 3.5 Ghz for the telcos to focus on 900, 1800 and 2100 MHz bands,” says Purushothaman KG, partner and head (digital solutions and telecom leader), KPMG India. “It was unexpected for the whole EMD to be utilised and bidding to close within Rs1.55 lakh crore.”

The Premium Band

The government has received record bids of Rs1.49 lakh crore after at least 16 rounds in the three days of auctions till July 28, including demand towards the costlier 700 MHz band, says Union Minister of Telecom Ashwini Vaishnaw. He adds that he was “pleasantly surprised” that the auction was moving into Day 3 (Thursday) adding that the sector is starting to look past legacy issues. 5G spectrum allocation is expected by mid-August, the minister had said earlier.

The 700 MHz is a premium spectrum band which can provide enhanced network coverage for customers. However, until now, telcos had stayed away from bidding for this band due to its price.

The 700 MHz is a premium spectrum band which can provide enhanced network coverage for customers. However, until now, telcos had stayed away from bidding for this band due to its price.