Context & alphabets: Creative Galileo & the samosa act

Prerna Jhunjhunwala's venture for early learning for children is focusing on schools. The founder, though, is equally animated about a D2C play. But can B2C be as easy as ABC?

Prerna Jhunjhunwala, Founder of Creative Galileo

Prerna Jhunjhunwala, Founder of Creative Galileo

Prerna Jhunjhunwala talks about the power of context, and picks up three settings. The first one is the dynamics of funding in the edtech market. The ‘Pre-K’ sub-category within edtech—prep, play school and nursery—never caught the fancy of venture capitalists (VCs), underlines the founder of Creative Galileo, a character-based early learning platform for kids between 3 and 10 years of age. Look at the numbers. In 2020, $2.1 billion venture money flowed into K12 (kindergarten to Class 12). The next year, which was the peak of funding ‘aberration’, the numbers leapfrogged to $2.9 billion. When seen in the right context—in 2019, K12 scooped just $454.9 million in funding—K12 saw more than a generous flow of money in 2020 and 2021.

Now, let’s see how many dollars poured into the Pre-K segment. The numbers are miniscule: $11.4 million and $31 million in 2020 and 2021, respectively. And the context? In 2019, it was $18.8 million. Still, the funding looks Lilliputian when compared with K12. Now let’s inject some meaning into the context, and the data. Many edtech founders raised fast, scaled fast, and failed fast. There were many who made most of the ‘bull run’ in the stock market across the world, and sprinted at a furious pace. There was a land grab, there was a scramble, and everybody wanted to cross the finish line as a winner.

Take, for instance, Teachmint. A classroom management platform started in May 2020, it reportedly raised over $110 million, was valued at $500 million (it was billed as a soonicorn—a venture with the potential to cross the $1 billion-mark in valuation), and closed FY22 with an operating revenue of Rs 77.45 lakh, and a loss of Rs 131.7 crore. This May, the edtech startup undertook its second round of job cuts in six months and reportedly laid off 70 employees. Clearly, ‘pace’ and ‘panic’ go hand in hand. Interestingly, both start with ‘P’.

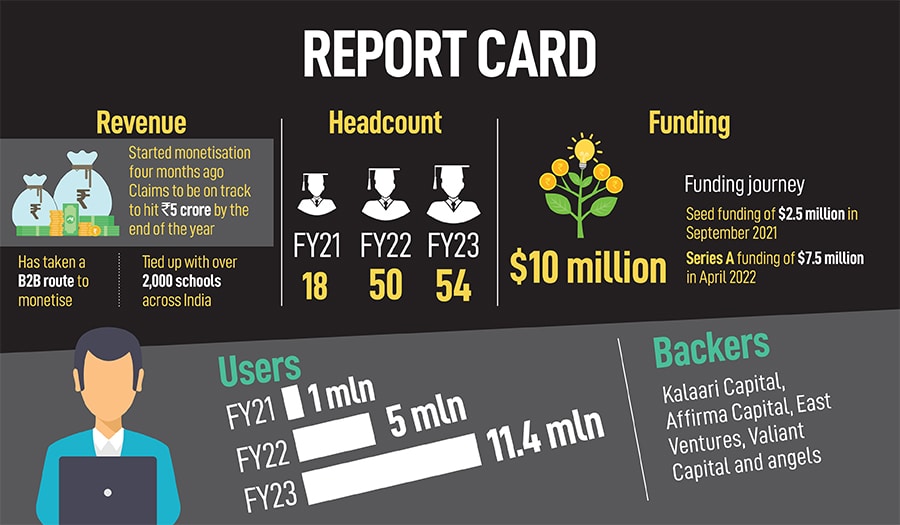

Meanwhile in Bengaluru, Jhunjhunwala tells us what the edtech world at large failed to realise, and factor in: Bull markets eventually end, and what replaces it is a bear market. “Bears maul,” she says, declining to comment on other edtech players. She, though, prefers to talk about the power of alphabets. If B stands for bull, then B also stands for bear. The context changes everything. Creative Galileo, she underlines, never became an obese child. In three years, the edtech startup raised just $10 million. “We were not fat. So we kept running,” she reckons.

Meanwhile in Bengaluru, Jhunjhunwala tells us what the edtech world at large failed to realise, and factor in: Bull markets eventually end, and what replaces it is a bear market. “Bears maul,” she says, declining to comment on other edtech players. She, though, prefers to talk about the power of alphabets. If B stands for bull, then B also stands for bear. The context changes everything. Creative Galileo, she underlines, never became an obese child. In three years, the edtech startup raised just $10 million. “We were not fat. So we kept running,” she reckons.

Jhunjhunwala now talks about the second context. Alphabets in themselves don’t make sense. “One has to arrange them, use them, and then form a word and a sentence,” she says, underlining that she is planning to hit the funding street in the midst of a winter chill. “I am getting ready for the series B round of funding,” she says. “But why do founders talk about A, B, C and other rounds of funding,” I ask her. Jhunjhunwala answers the question by using another alphabet ‘R’. Risk and reward, she underlines, both start with R. Venture capital, she reckons, is the risk capital that will help her play a long business-to-consumer (B2C) game. She explains. The ‘Little Singham’ app had 1 million users in FY21. The numbers ballooned to 5 million over the next fiscal. “In FY23, we had 11.4 million users,” she claims. “It’s rewarding to have such a massive user base especially when one has to democratise online learning,” she adds.

Okay, Jhunjhunwala figured out the chutney. But where’s the context? “We also made samosa,” she smiles, explaining her samosa pricing. The edtech company is piloting a model that has an annual tag of Rs 999. If one breaks it into average cost per month, it is under Rs 100. “Affordability is the key. Everybody loves and buys samosa,” she smiles, adding that one needs to think of something which doesn’t burn holes in the pockets of parents. She repeatedly harps on context. Schools have reopened, kids are going back to classes, and parents need a sticky proposition to subscribe to an online plan. “Quality of content alone won’t work. It has to be quality and pricing, much like samosa and chutney,” she adds. The pilot, she claims, is working.

Okay, Jhunjhunwala figured out the chutney. But where’s the context? “We also made samosa,” she smiles, explaining her samosa pricing. The edtech company is piloting a model that has an annual tag of Rs 999. If one breaks it into average cost per month, it is under Rs 100. “Affordability is the key. Everybody loves and buys samosa,” she smiles, adding that one needs to think of something which doesn’t burn holes in the pockets of parents. She repeatedly harps on context. Schools have reopened, kids are going back to classes, and parents need a sticky proposition to subscribe to an online plan. “Quality of content alone won’t work. It has to be quality and pricing, much like samosa and chutney,” she adds. The pilot, she claims, is working.