Financial inclusion: How the India Mortgage Guarantee Corporation ensures low-risk mortgage loans for low credit score individuals

Mortgage guarantees ensure risk of lending to certain consumers is reduced, promise to make home loans more accessible

Mahesh Misra, CEO, India Mortgage Guarantee Corporation

Mahesh Misra, CEO, India Mortgage Guarantee Corporation

Sample this: Two borrowers with similar age, income profiles and credit scores put in an application for a home loan. One is granted a loan with a 20-year tenure and at an 8.25 percent interest–the same rate the bank offers to customers with a high credit score. The second is sanctioned a lower amount and at a higher rate. He’s also made to provide further documentary evidence of his creditworthiness. Simply put, the bank is wary of the loan going bad.

This is a situation faced regularly by borrowers without a regular salaried income. Banks and other mortgage finance institutions find it hard to assess their repayment capability and err on the side of caution. Such customers are at a disadvantage and find themselves shut out of the market for home loans. They end up going to institutions that charge higher interest rates to take on the additional credit risk. Those in the informal economy–vegetable vendors, truck drivers, daily wage labourers–find it hard to get any mortgage finance at all.

Globally mortgage guarantees provide a workaround to this problem. This concept has begun to gain traction in India as well through the India Mortgage Guarantee Corporation (IMGC), which works with banks and mortgage finance companies to ensure that the risk of lending to certain consumers is reduced. “We are designed to be an independent third-party shock absorber,” says Mahesh Misra, chief executive officer at IMGC.

Over the last decade IMGC has guaranteed Rs15,400 crore worth of home loans benefitting 85,200 borrowers. It now expects the scale of its operations to grow rapidly and plans to guarantee Rs10,000 crore worth of loans in the next financial year. The company counts among its shareholders the National Housing Bank, Genworth and Sagen. The business is making an operating profit but accounting rules require it to amortize revenues over the life of the loan and so it is not yet making cash profits.

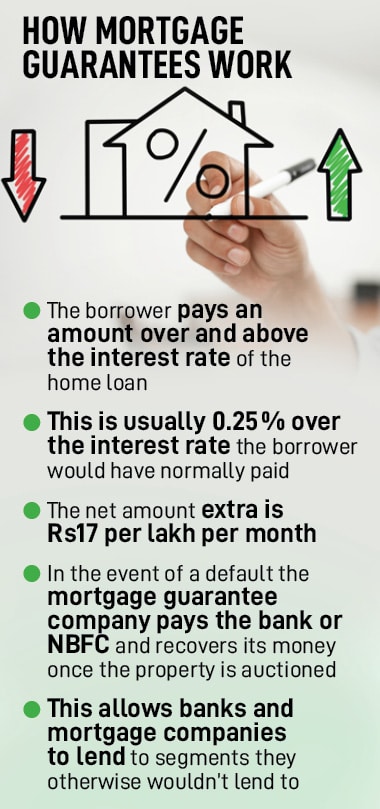

Here’s how it works. When applying for a mortgage loan a borrower who may not be in a bucket that a bank or non-banking finance company lends to is told of an option whereby for a small fee he can get either a higher loan amount or a longer tenure.

The fee typically works out to a 0.25 percent addition to the interest rate the borrower would pay. So, if the loan were to be offered at say 8.5 percent to a normal customer, for 8.75 percent this borrower could get the loan. The extra payment amounts to Rs17 per month on every Rs1 lakh borrowed. On its part IMGC receives 1.3 percent of the loan amount upfront as its fee for providing the guarantee.

The fee typically works out to a 0.25 percent addition to the interest rate the borrower would pay. So, if the loan were to be offered at say 8.5 percent to a normal customer, for 8.75 percent this borrower could get the loan. The extra payment amounts to Rs17 per month on every Rs1 lakh borrowed. On its part IMGC receives 1.3 percent of the loan amount upfront as its fee for providing the guarantee.