From Zomato to Paytm: The missing piece in the jigsaw puzzle of internet companies

Most Indian internet stocks have plunged on the back of dismal Q3 earnings coupled with nervousness post the massive slump in US and China tech stocks. And lack of substantial data doesn't help when it comes to investment decisions

Experts are sceptical of adding these new-age companies to investment portfolios of retail investors.

Experts are sceptical of adding these new-age companies to investment portfolios of retail investors.

Image: Francis Mascarenhas / Reuters

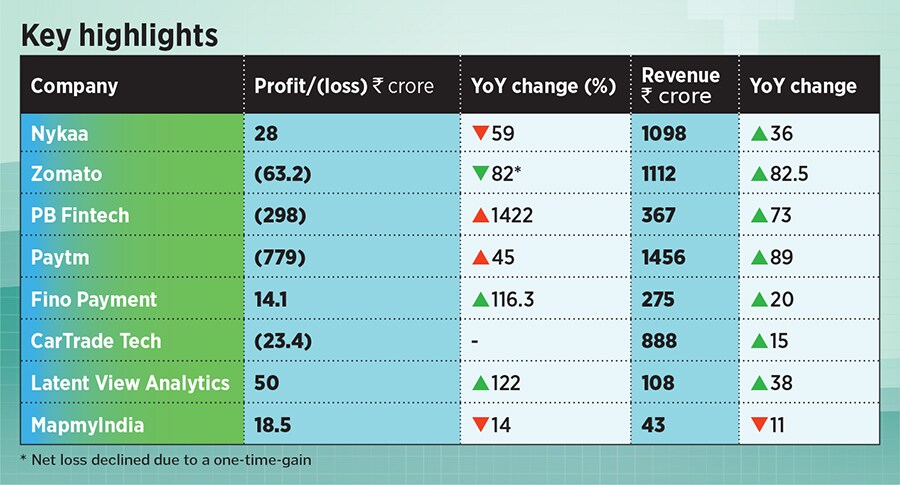

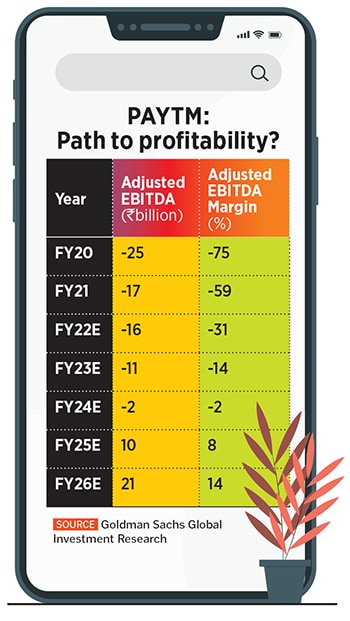

New-age technology companies that debuted on Dalal Street last year have so far reported a mixed bag of earnings for the December quarter. At least half of these companies are in the red, and have indicated no urgency to turn to black in the coming quarters. A few have posted rather cryptic earnings releases, confounding investors on important financial metrics and strategy.

On the face of it, brokerages have cut their price targets for most of these stocks but they are far from writing off these companies. In fact, several have initiated coverage of these companies, and a few have shifted their position to a buy call, and are recommending investors to add scrips of select new-age companies on ‘expectations of a pick-up’ given the ‘long-term growth potential’.

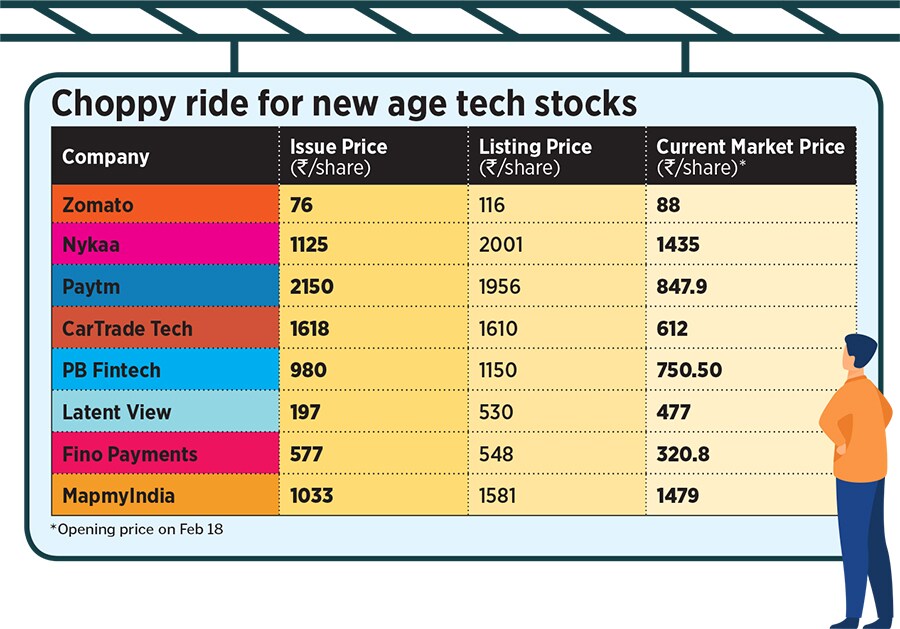

Importantly, all these companies are trading below their listing price and hit all-time lows, raising red flags on the projected growth trajectory, and denting investor confidence.

Market participants are divided on whether these newly listed tech companies are attractive at current valuations after the steep correction from the listing price. Many see a further decline in the coming months.

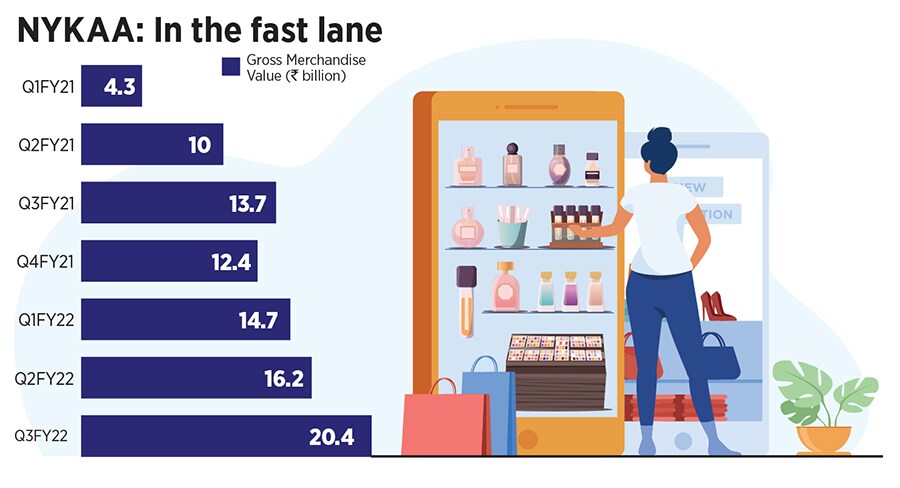

Similarly, Kotak Institutional Equities initiated coverage of Nykaa with an ‘add’ rating, although it has cut its 12-month price target to Rs 2,120 from Rs 2,480. Its analysts say, “

Similarly, Kotak Institutional Equities initiated coverage of Nykaa with an ‘add’ rating, although it has cut its 12-month price target to Rs 2,120 from Rs 2,480. Its analysts say, “