- Home

- UpFront

- Take One: Big story of the day

- Go First wants to keep going. But can it fly any higher?

Go First wants to keep going. But can it fly any higher?

The airline is positioning itself as the country's first ultra-low-cost carrier and has put in place a turnaround plan that has begun showing results. An IPO is also in the works. But will it succeed at a time when the aviation industry is dealing with devastating losses?

Manu Balachandran is a writer for Forbes India, based in Bengaluru. At Forbes India, Manu writes on automobiles, aviation, pharmaceuticals, banking, infrastructure, economy and long profiles among many others. He also moderates many of Forbes India's CEO and CXO events and hosts Capital Ideas, a podcast on the most riveting success stories from the business world. He has previously worked with Quartz, The Economic Times and Business Standard in Mumbai and New Delhi. Manu has a master's degree in journalism from Cardiff University and a degree in economics from the Loyola College. When not chasing stories, he is most likely obsessing over Formula 1 (Read: Lewis Hamilton), historical events and people, or planning long weekend drives from Bengaluru

Taking off on a different flight path

Taking off on a different flight path

It perhaps comes naturally to Go First to put up a fierce fight when the chips are down.

After all, Nusli Wadia, chairman of the Wadia group which owns Go First, had built up a stellar reputation of a fearless corporate gladiator, sometimes fighting his own battles or of those around him, over the past few decades. While he may have won some, and lost some others, the Wadia scion whose business legacy dates back some 285 years, is certain to never give up without a fight.

Among others, over the past few decades, Wadia’s corporate battles include the fabled tiff with the Reliance Group in the 1980s, the feisty boardroom saga involving food and beverage company Britannia in the 1990s, and recently, siding with Cyrus Mistry in what Wadia called an “unjust” removal from the helm of Tata Sons, even taking on his childhood friend, Ratan Tata. Interestingly, Wadia’s first corporate battle was with his own father when he fought him to stop the sale of the Wadia group’s flagship company, Bombay Dyeing.

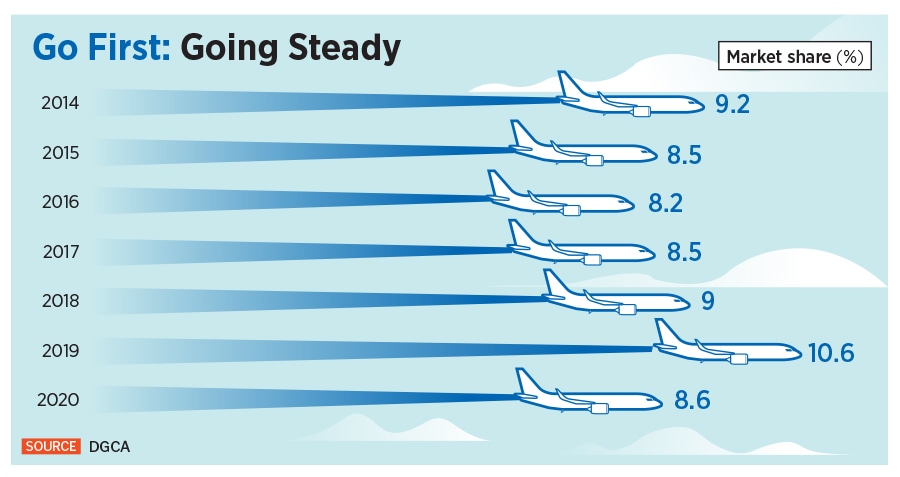

Perhaps, it’s a slice of that fighting spirit that Go First, an arm of the Wadia group, is now banking on in its attempt to turn around its fortunes, after nearly a decade-and-a-half without much success. For 16 years, since it took to the Indian skies, alongside IndiGo and SpiceJet, the Mumbai-based airline has largely remained on the fringes, retaining a paltry fourth position among India’s top airlines. In the last decade, the airline has managed to raise its market share from about 6 percent to around 8 percent.

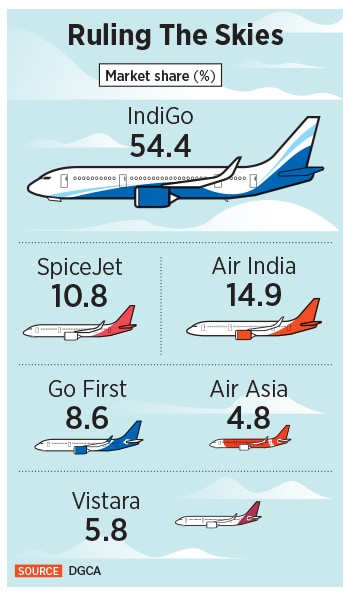

Between April and June this year, the airline had a market share of 8.6 percent in the Indian skies. In the quarter before that, it was 7.6 percent. In all, Go First carried 27.71 lakh passengers in the first six months of 2021. In contrast, IndiGo carried some 185 lakh passengers, while the Gurugram-headquartered SpiceJet carried 41.42 lakh passengers. Go First is currently fourth behind IndiGo, SpiceJet, and Air India in the Indian skies when it comes to market share. The Tata group-owned Vistara, which began operations a decade after Go Air, has a market share of 6 percent.

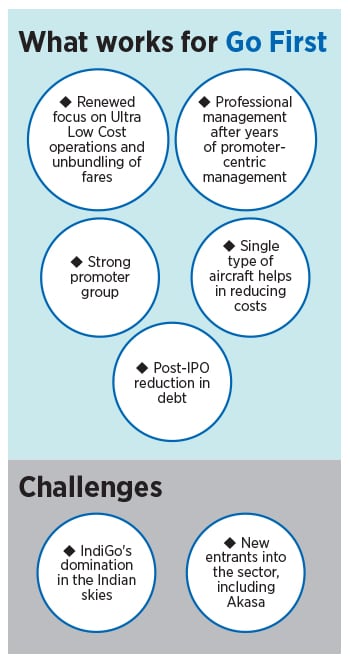

Yet, all that could possibly change if a new plan set in by the management at Go First finds shape. Over the next two years, the airline wants to corner 20 percent of the domestic market—with a fleet size of 87 aircraft from 55 aircraft currently. The company operates the Airbus A320 Neos and is expected to add over 78 aircraft after 2023.

As part of its turnaround plan—which had been in the works for almost a year and something that has begun to show results, according to company insiders—the airline rechristened itself to Go First from GoAir. The move, it reckons, will help in creating a stronger brand identity as it positions itself as the country’s first ultra-low-cost carrier (ULCC). A ULCC, unlike a low-cost carrier, operates with unbundled fares, making it cheaper for customers, which means that apart from the seat, all other extras such as baggage, seat preference or food are subject to an additional fee. ULCCs usually have fewer amenities than low-cost carriers, which provides a bigger revenue source from ancillary services for airline operators. In simple terms, apart from the seat fare from point A to point B, everything else will be charged.

Helming that transition is Ben Baldanza, who has taken charge as the vice chairman. He is a pioneer in the ultra-low-cost airline model, having served as CEO of Spirit for over a decade. Baldanza also has Kaushik Khona, a long-time Wadia group veteran who has returned to Go First after leaving as its CEO in 2011. Baldanza has been part of the airline’s board since 2018 and has a reputation for transforming US-based Spirit Airlines into the first ULCC in North America with cheap fares while ensuring high-profit margins. During his tenure, Spirit Airlines increased its fleet from 32 to 100.

“Consumers in India are hugely value-conscious, but are quite demanding when it comes to the flying experience,” Baldanza had said at the time of the rebranding. “The combination of attractive air fares, a squeaky-clean flying experience, well sanitised flights and on-time performance is what Go First is designed to deliver.”

By September-end, the company plans to mop up some Rs 3,600 crore from the bourses as part of its plan to go public. Go Air wants to use the proceeds towards largely repaying its debt, including dues for fuel supplies. “We believe that the pre-payment or scheduled repayment will help reduce our outstanding indebtedness and finance cost, assist us in maintaining a favourable debt-equity ratio and enable utilisation of our internal accruals for further investment in business growth and expansion,” the company said in its draft red herring prospectus.

While India’s market regulator, the Securities and Exchange Board of India, has temporarily halted the initial public offering (IPO) due to a pending inquiry against Bombay Dyeing Manufacturing Company Ltd and its promoters, the Wadias, the company expects clearance to come through in August. It plans to raise money by October. Go First is trying to raise money at a time when the aviation industry has flown into turbulence with cumulative losses of Rs 15,086 crore in the previous fiscal, according to government estimates.

“For a carrier to access a fairly substantial amount indicates it is in dire straits,” says Shukor Yusof, founder and analyst of Malaysia-based aviation consultancy firm Endau Analytics. “It isn't clear if investors are keen to fund it given that the airline has already accumulated sizeable debts. I suspect it will be tough to raise that kind of money.” Part of the scepticism, Yusof reckons, is largely due to the poor management decisions in the past few decades. “Go Air didn't have as good a business model and management as Indigo or even SpiceJet. It was slow to react to the lucrative Indian market that is now overwhelmingly controlled by IndiGo.”

Dealing with turbulence

Go First began operations at a time when India’s low-cost airline boom was just about starting. By then, Air Deccan had showcased the massive opportunity underlying in the low-cost airline business, prompting many others to make a beeline for the sector.

The Mumbai-headquartered airline launched its services in November 2005, a few months before rival IndiGo started operations in 2006. Go First’s parent group, the Wadia group, comprises the Rs 87,000 crore Britannia Industries, the 150-year-old Bombay Burmah company and 140-year-old textile company Bombay Dyeing. The company started with three leased aircraft and was widely touted as the brainchild of Nusli Wadia’s younger son, Jeh Wadia.

Jeh Wadia has stepped down from his role as managing director in March this year

Jeh Wadia has stepped down from his role as managing director in March this year

However, despite India’s rapid growth in the aviation sector, Go First could never capitalise on the growth. “GoAir was never as aggressive as its peers in chasing market share, as it prioritised conservatism in a highly competitive sector,” Varun Ginodia, analyst at financial advisory firm Ambit, wrote in a recent report. “Consequently, its market share rose to only 11 percent in 2019 versus 6 percent in 2010. In comparison, IndiGo’s market share rose to 47 percent in 2019 from 16 percent in 2010. SpiceJet’s market share gains also appear muted (15 percent in 2019 versus 13 percent in 2010), but note that it saw a big decline in 2014-15 when it nearly faced bankruptcy. GoAir is also the truest LCC in the Indian aviation with a single-type fleet structure and point-to-point travel.”

In comparison, IndiGo and SpiceJet operate a two-fleet structure within their fleet, with the smaller aircraft catering to Tier II and Tier III towns. “However, conservatism did not help the balance sheet,” adds Ginodia of Ambit in his report. “GoAir had leverage levels like SpiceJet, driving finance cost per ASK (available seat kilometres) higher. Hence, the bulk of IPO proceeds will go towards debt repayment.” Available ASK or available seat miles are key finance metrics in the aviation business and are calculated by multiplying the number of kilometres that an airplane will be flying with the number of seats available for a given flight.

“Market share and load factors are perhaps the most misunderstood metrics in Indian aviation,” says Satyendra Pandey, partner at advisory firm AT-TV and former head of strategy at GoAir. “Cash-flow and sustainable profits matter, and both need a clear strategy, prudent capital allocation, and a management team that can deliver. GoAir should have grown faster to capitalise market opportunities which could have positioned it well. It was one of the first LCCs to launch in India and at one time had a stronger presence than carriers that have now become behemoths. Being overly cautious has come with its costs.”

Over the past few years, apart from Jeh Wadia, the company never had a steady leadership at the top with CEOs coming and leaving within short spans. The latest to be appointed, Kaushik Khona, joined the company a year ago, after Vinay Dube, a former CEO of Jet Airways, left the company after six months at the helm. Incidentally, Khona’s appointment was the fourth in the past five years. In 2018, Wolfgang Prock-Schauer, then CEO of GoAir, had left the airline to join IndiGo. The company then appointed Cornelis Vrieswijk, who quit in nine months. That was followed by Dube’s appointment.

“Unless the owners are ready to allow professionals to take over and restructure the carrier to prepare for a post-Covid recovery, it may not be easy,” says Yousof.

In March, Jeh Wadia stepped down as managing director of Go First and handed over the reins to a professional management, akin to a move at Britannia, where the promoters exercise little control over the day-to-day operations. “With the goal of taking GoAir to its next phase of growth, the promoters and its board came together to formulate a long-term plan,” Go First said at the time of Jeh’s departure. “Among other initiatives, a key element of this plan, forged over weeks of discussions and consultation, was to further strengthen the management by bringing on board proven industry professionals, a strategy that has worked well for the group in its other ventures, including Britannia.”

Pivot to ULCC

Yet, turning around fortunes won’t be easy, more so when the aviation sector has been stuck in a quagmire.

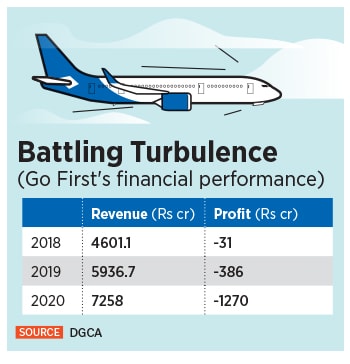

Years of cautious approach to growth also came to haunt the airline in the past few years, particularly as airlines across the country struggled in the wake of the Covid-19 crisis. India’s airlines are likely to register a consolidated loss of about $4.1 billion during FY22, according to aviation consultancy firm CAPA India. Between 2021 and 2023, the sector will require additional funding of between Rs 35,000 crore and Rs 37,000 crore to stay afloat.

“GoAir’s conservatism is not backed by strong balance sheet though, as it has the highest net debt/Ebitda (including lease liabilities) among its LCC peers,” the Ambit report says. “The cash balance at the end of December 2020 was a mere Rs 11.6 crore compared to Rs 120 crore at the end of FY20.” The net debt-to-Ebitda ratio is a ratio that shows the number of years it would take for a company to pay back its debt if net debt and earnings before interest depreciation and amortisation are held constant.

All that has meant that the airline is now looking at transitioning itself into what it calls an ultra-low-cost model. In February, the Directorate General of Civil Aviation (DGCA) allowed airlines to unbundle certain services such as preferential seats, meals, use of airport lounges, check-in baggage, transport of sports and musical equipment, and make them chargeable. It helps that Baldanza had pioneered the ULCC model in the US.

Ben Baldanza who pioneered the ultra low cost model with US based Spirit Airlines is now vice chairman at Go First

Ben Baldanza who pioneered the ultra low cost model with US based Spirit Airlines is now vice chairman at Go First

“The rule… where they allow to unbundle the fares by allowing airlines to charge for 15 kg baggage which otherwise was free for all these years was critical,” according to a company insider. “That helped in our thinking process. We thought why not evaluate ourselves as a ULCC instead of the LCC. Because, when you do costing, you are also incorporating the cost of handling and fuel consumption for the baggage. And, therefore, when we got an opportunity to unbundle, we repositioned ourselves and decided that we will be a ULCC.”

The company has already begun seeing growing revenue ancillary streams, and today those contribute to 15 percent of the total income compared to about 7 to 8 percent earlier. “This is even when we are not selling the merchandise on board,” says the company insider. “We are not selling food on board now because of Covid-19. But we have already achieved around 15 to 16 percent of the total income as our ancillary revenue. We believe this is a major attribute which will help us.”

Yet, it won’t be as easy as Go Air expects, particularly since passengers have only begun to take to flying after the second wave of Covid-19. About 3.11 million passengers travelled by air in June, compared with 2.12 million passengers in May, according to data released by the DGCA on August 9

“A ULCC model is easier said than done. Structurally, there are very few costs that can be further lowered,” adds Pandey. “To deliver on lower costs, the airline will require extreme efficiency, examination of each cost with a fine toothcomb, and by consistently improving volumes. Within the existing players, IndiGo, perhaps, does this the best because of its long-term planning and huge volumes. For Go to do this, it will require a stable management team that can consistently deliver. Unfortunately, that has not been the case and to change directions in-between has proven to be disastrous.”

To help with the transition is also the plan to raise money from the capital markets. The company intends to raise Rs 3,600 crore, of which Rs 2,015 crore, or 56 percent, is planned for prepayment of its outstanding borrowings. Up to Rs 279 crore is earmarked for the replacement of letters of credit issues to certain aircraft lessors and Rs 254 crore for repayment of dues to the Indian Oil Corporation. That would mean, another Rs 1,000 crore will be made available for expansion needs.

“The debt repayment is more of a treasury function,” the company insider says. “It is more to do with saving interest cost. The company can add Rs 170 crore to the bottom line because the interest cost will be saved.”

“The debt repayment is more of a treasury function,” the company insider says. “It is more to do with saving interest cost. The company can add Rs 170 crore to the bottom line because the interest cost will be saved.”

It helps that India’s bourses have seen a bull run with strong interest from retail investors. This year, the IPOs of companies such as Nureca, Nazara Technologies and Easy Trip Planners saw retail subscriptions of 166.65 times, 75.29 times, and 70.4 times respectively.

“The timing is a bit of a surprise, given the state of the aviation industry,” Pranav Haldea, managing director at Prime Database Group, a capital market research firm, tells Forbes India. “Typically, companies launch their IPO after a few quarters of strong growth in financials. However, given the liquidity in the market, if the valuation is attractive vis-a-vis listed peers, you could see strong demand.”

Meanwhile, Go Air’s plans to restructure itself into a ULCC will also mean that the company will have to take on Akasa, a new airline to be launched by Rakesh Jhunjhunwala, known as the Big Bull of the stock markets. Akasa is reportedly in talks with Boeing for buying up to 100 737 Max aircraft. Jhunjhunwala is joined by former Jet Airways and Go Air CEO Dube and his family members, while ex-IndiGo president Aditya Ghosh is a board member of the airline. Then, there is also Jet Airways, which is looking to stage a comeback under a new management after the company shut down operations in 2019.

“Go finds itself in a market that is intensely competitive and driven by paradoxes,” adds Pandey. “Discounting is common and airlines in the country have witnessed tremendous losses due to a lack of pricing and capacity discipline. Six airlines are competing for a piece of the pie that has shrunk and if this was not bad enough, there is a new entrant on the horizon and a grounded airline trying to revive itself. For any airline, absence of a clear direction, capital infusion and stable management will make for an extremely turbulent ride.

History suggests that the Wadias are unlikely to give up without a fight. With a new management at the helm, Go First might be in for some tailwinds.