FY23 growth: Finding a way amid uncertainties

High frequency economic indicators for India all point to a positive bounce-back for FY22. But there are several moving parts and uncertainties which could still impact normalisation of growth in FY23

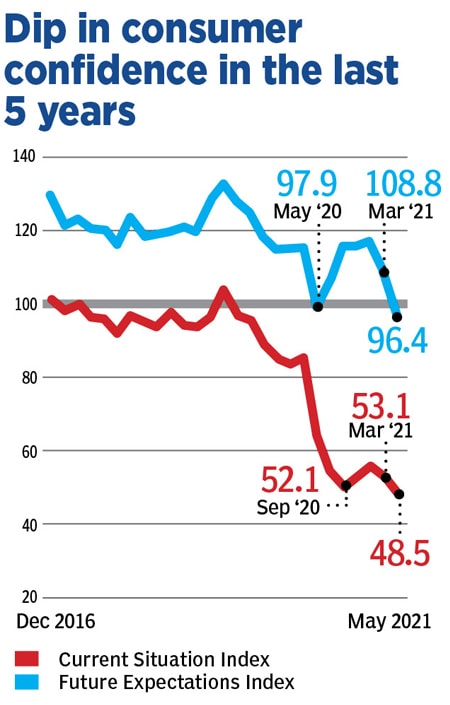

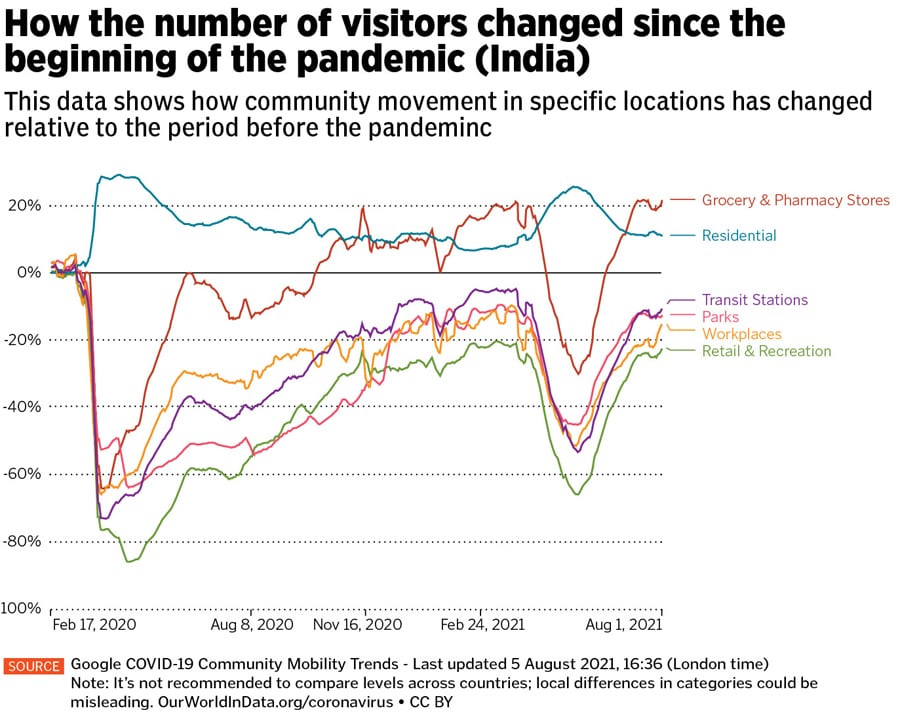

Eighteen months since the outbreak of the first coronavirus case in the country, India’s economy has started to breathe easier due to a relaxation of lockdown curbs and mobility. Most high frequency economic indicators have bounced back: Manufacturing activity in July is at a three-month high of 55.3 reflected through the IHS Markit Purchasing Managers’ Index, merchandise exports are at a record high of $35.2 billion in July and Google mobility trends (visitors to grocery stores, workplaces and recreation areas) showed a 10 to 40 percentage points’ improvement in July from their lows in May.

Elevated commodities prices will see steel and cement companies at the cusp of a fresh capex cycle. Ecommerce and fintech firms have also started to raise capital for growth and Indian equities have seen fresh investment inflows, all of which has pushed stock market indices to record highs.

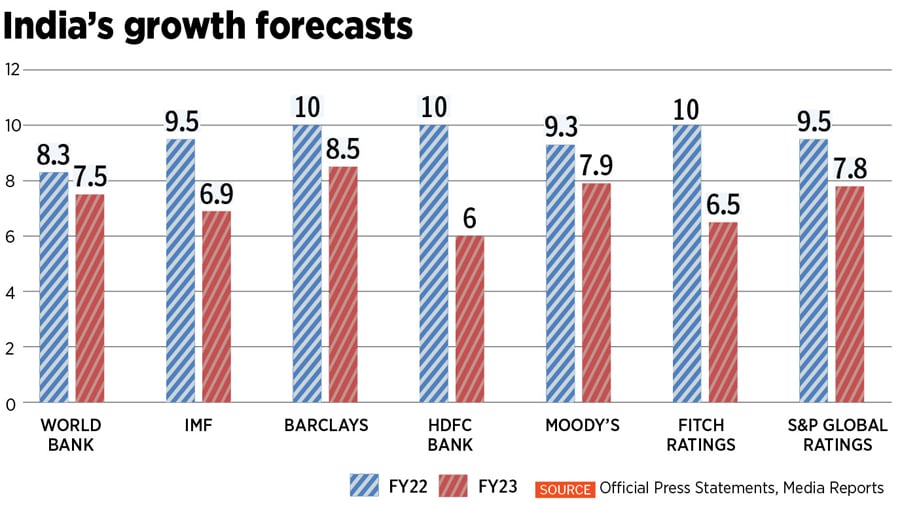

But is this enough to indicate that India will see normalisation of growth in FY23? This would be the first normal financial year since FY19, considering that even the next 12 months were hit by the global slowdown. The IMF has projected India to grow faster, at 8.5 percent in FY23, compared to an estimate of 6.9 percent earlier. The World Bank forecasts a 7.5 percent growth for India while several equity research firms are pegging growth to be slower at between 6 to 6.5 percent.

Capex growth improving

Growth rates are not great, but are improving; Q12021 saw a capex growth of 11 percent which was on the back of a low base. “We will see levels shift [upwards] next year. Sectors outperforming this year will see capex growth next year,” says Rahul Bajoria, chief India economist at Barclays. But whether this will merely be a replacement cycle or investment towards a new greenfield project is difficult to ascertain at this stage.