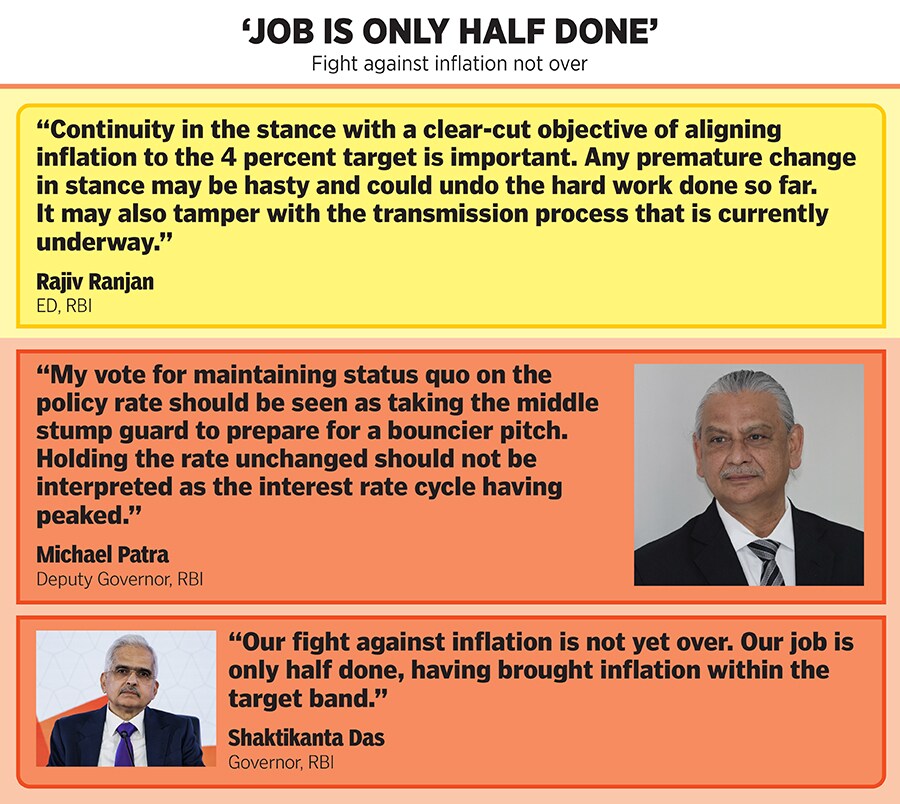

Holding the rate unchanged should not be interpreted as the interest rate cycle having peaked: RBI

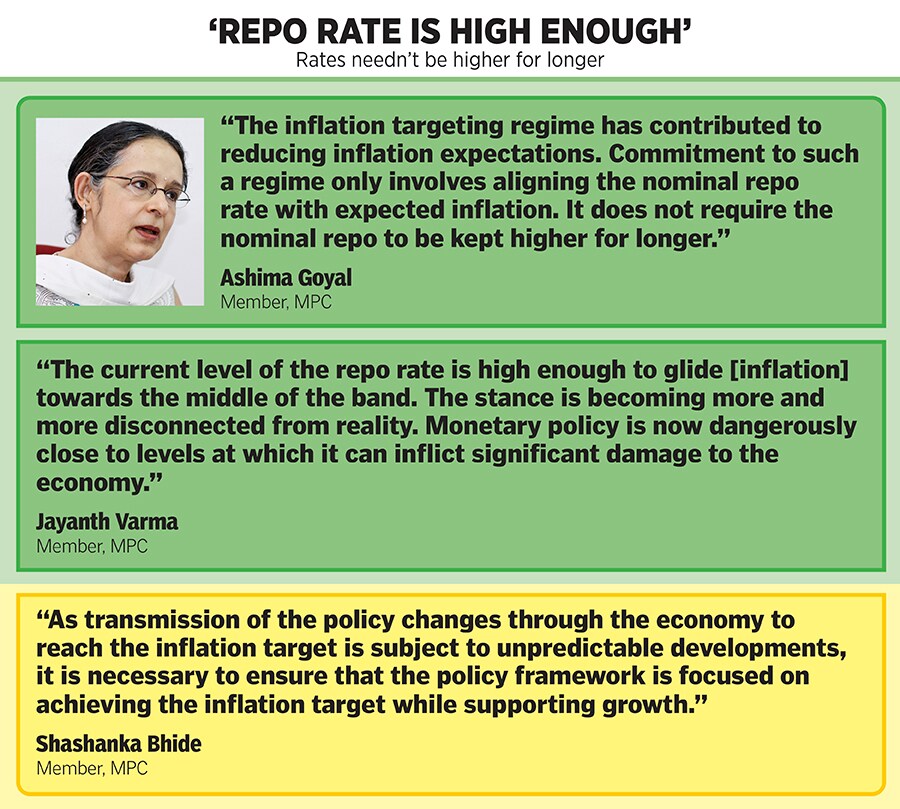

One half of the six-member rate-setting panel believes the repo rate is high enough and rates need not be kept higher for longer, but the other half argues that uncertainties on the inflation front have not abated and policy needs to remain in the 'brace' mode. Will rates change this year?

The Reserve Bank of India’s year-long battle to rein in inflation—within its target of 4 percent with a margin of plus or minus 2 percent—is showing some results.

The Reserve Bank of India’s year-long battle to rein in inflation—within its target of 4 percent with a margin of plus or minus 2 percent—is showing some results.

The plain vanilla monetary policy announcements on June 8 did not suggest the three-day meeting was full of fireworks. All six members of the Monetary Policy Committee (MPC) decided unanimously to hold the benchmark repo rate at 6.5 percent for the second consecutive time after having raised rates by 250 basis points in FY23. All but one member voted to keep the policy stance of ‘withdrawal of accommodation’ unchanged. The market was unmoved. But the minutes of the meeting reveal a divergence on the rate trajectory and policy stance.

In the previous meeting the Reserve Bank of India (RBI) marginally lowered its inflation forecast to 5.1 percent from 5.2 percent but kept its GDP growth estimate unchanged at 6.5 percent for FY24. Even though the RBI tweaked its inflation forecast it is very much on the front foot. A closer look at the growth and inflation projections shows that the RBI is cautious about the second half of FY24 because it expects growth to lose momentum and inflation to rise.

The Reserve Bank of India’s year-long battle to rein in inflation—within its target of 4 percent with a margin of plus or minus 2 percent—is showing some results. In May, retail inflation cooled off to a 25-month low at 4.25 percent from 7.04 percent in the year-ago period. But despite the recent ‘moderation’ in price levels, the central bank’s war against inflation is far from over. There are concerns about higher government spending in the run-up to elections and the impact of extreme weather conditions on food prices.

“Uncertainties on the inflation outlook for H2 FY24 have not abated,” RBI Governor Shaktikanta Das said as per the minutes of the June MPC meeting. “The spatial and temporal distribution of the south-west monsoon in the backdrop of a likely El Nino weather pattern needs to be watched carefully, especially for its impact on food prices. Adverse climate events have the potential to quickly change the direction of the inflation trajectory.”

Das also cautioned that geopolitical tensions, uncertainty on crude price trajectory and volatile financial markets pose further upside risks to prices. “These considerations warrant close monitoring of the evolving price dynamics,” he said.

She adds that the quick succession of

She adds that the quick succession of