Is the worst over for India's rural economy?

Lower inflation, a good harvest, and continued government spending on rural infrastructure will see demand pick up in India's villages in FY24

According to retail intelligence platform, Bizom, rural consumer goods sales rose by 16.8 percent in the quarter ended March 31 (Q4), marking an 8.9 percent growth for the full financial year (FY23). Image: Vivek Prakash / Reuters

According to retail intelligence platform, Bizom, rural consumer goods sales rose by 16.8 percent in the quarter ended March 31 (Q4), marking an 8.9 percent growth for the full financial year (FY23). Image: Vivek Prakash / Reuters

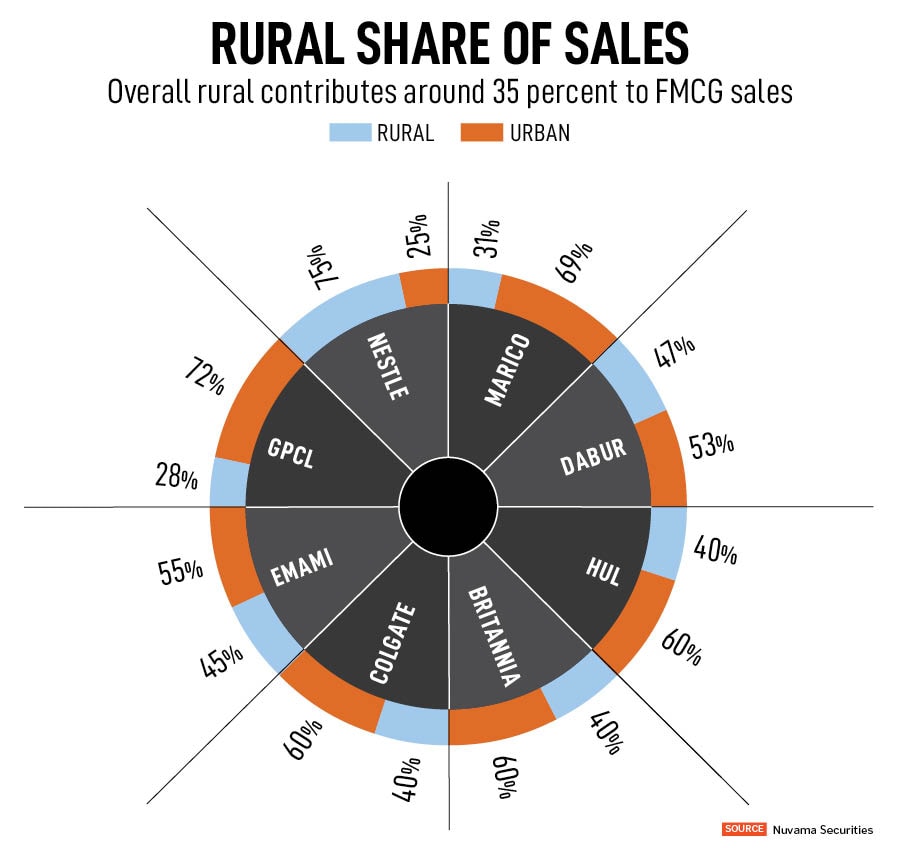

After hitting a rough patch for 18 to 20 months, rural demand is beginning to return. India's villages contribute more than 35 percent to overall annual FMCG sales, as per various estimates, and are therefore crucial for the overall revival of the sector.

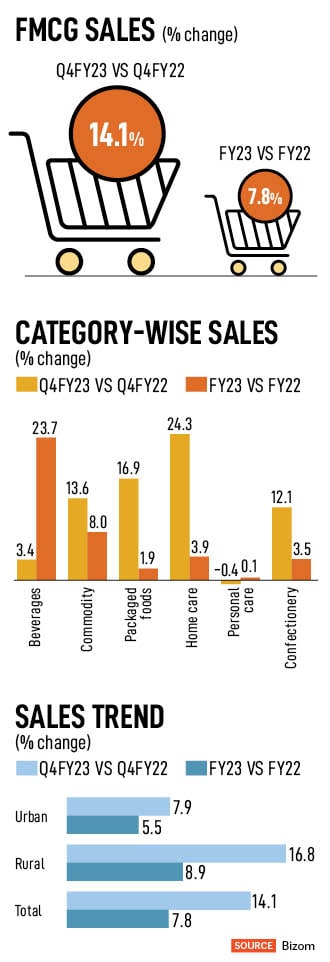

According to Bizom, a retail intelligence platform that tracks consumer product sales across 7.5 million outlets, rural consumer goods sales rose by 16.8 percent in the quarter ended March 31 (Q4), marking an 8.9 percent growth for the full financial year (FY23). Urban sales, on the other hand, grew by 7.9 percent in Q4, ending the full year with 5.5 percent.

Overall, FMCG sales, urban and rural combined, grew by 14.1 percent in Q4 and 7.8 percent in the full year, Bizom said.

Crisil Ratings’ estimates rural growth is outpacing urban growth by almost 2:1 in the last quarter of fiscal 2023, says Anuj Sethi, Senior Director of the rating agency.

Inflation is gradually cooling off from earlier highs. “The sluggish phase in rural growth appears to be behind us,” says Sethi.

FMCG volume growth should be “at least 4 to 5 percent” even as commodity prices remain steady; only then the “volatile scenario can turn a corner”, said Mehta.

FMCG volume growth should be “at least 4 to 5 percent” even as commodity prices remain steady; only then the “volatile scenario can turn a corner”, said Mehta.