How Gupshup turned into a profitable unicorn despite a pivot and two near-deaths

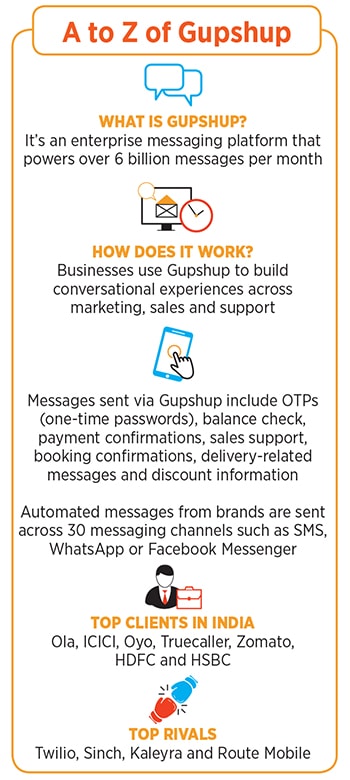

The company has emerged as a global leader in B2B conversational messaging and claims to have over a lakh developers and businesses as its clients

Beerud Sheth, co-founder and CEO, Gupshup (Image: Nadine Priestley)

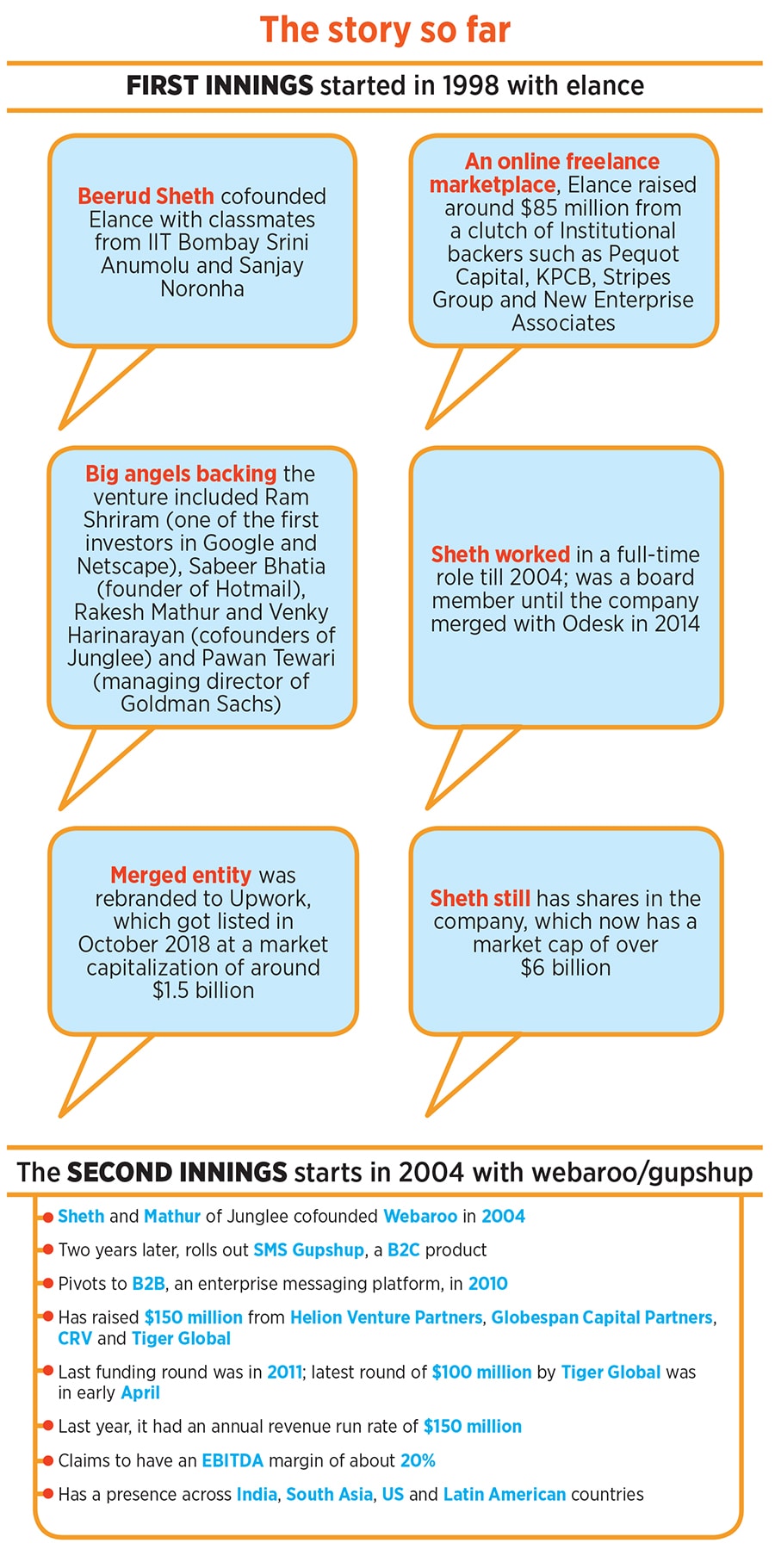

In 2010, Beerud Sheth found the going exhilarating. “Oh my God! Look at the growth,” exclaimed the second-time entrepreneur towards the end of the year. The pace of the growth at SMS Gupshup—a Twitter-like community site that enabled users to join groups of their interests and get updates through SMS (short message service) on mobile—was astounding: 70 million users in over three years since its launch in April 2007. “It was the largest social network in India by a huge margin,” claims Sheth, who managed to raise $10 million in 2008. The timing of the funding--barely a few days before a global financial meltdown—was perfect. Getting big backers on board such as Helion Venture Partners and Charles River Ventures at such a time was the initial thrill.

Then, in 2010, SMS Gupshup raised another $10 million. The bigger thrill this time around for Sheth and his cofounder Rakesh Mathur was that their baby had massively outpaced Facebook, which then reportedly had over 8 million users in India. Even when combined with Twitter, it was no match for SMS Gupshup. “When a person would send a message, SMS Gupshup would send it to all her followers—even if there were 10,000 of them,” says Sheth, explaining how the network worked. The service was free and the company, he lets on, would pay the telecom operator for sending all messages. The focus, Sheth underlines, was on getting users. “A big community could be monetised later,” Sheth believed. The hard part, he was convinced, was building a large pool of consumers. “SMS Gupshup was turning into an extremely successful product,” he adds. A year later, the company managed to raise another $10 million.

The success, though, turned into a kiss of death. “OMG! Look at the growth. How will we pay for it,” Sheth panicked in 2011. The hard part—building a big community—brought a harder problem. As the community bloated, so did the cost of subsidising all messages. The company was hemorrhaging because of two reasons. First, the cost of SMS—which Sheth presumed would decline as telecom operators started getting big volumes—didn’t come down. “We were sending billions of messages and spending crores of rupees every month,” he rues. SMS Gupshup was fast running out of cash. Second, the monetisation plan could never play out. Reason: The company planned to put footer advertisements at the bottom of the messages but the regulations didn’t give Sheth such an option. “We could neither subsidise nor monetise.” The company was gasping for breath. Though the VCs were ready to pump in some money, it was not sufficient. “Some of these problems take a lot more money. You cannot solve them with little money,” he says.