How India-China partnerships are reshaping component manufacturing

Chinese investments will help Indian electronics makers rise up the components manufacturing value chain. However, if geopolitical tensions escalate, they could jeopardise these joint ventures

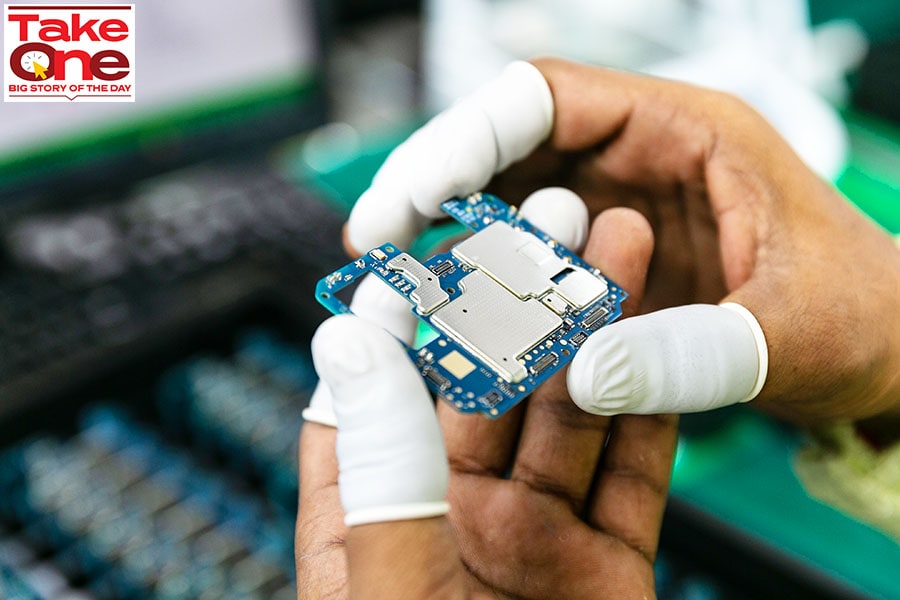

A production line at the Dixon Technologies electronics manufacturing facility in Noida, India

Image : Madhu Kapparath

A production line at the Dixon Technologies electronics manufacturing facility in Noida, India

Image : Madhu Kapparath

India-China relations have been sour for the past couple of years. Recent news reports, however, suggest that the government has been making a move on approving Chinese company investments into India. This has prompted companies, especially in the electronics manufacturing sector (EMS), to pursue joint ventures (JVs) with Chinese partners.

Press Note 3, issued in April 2020, mandates that Foreign Direct Investment (FDI) from entities or individuals based in countries sharing land borders with India require prior government approval. But Chinese counterparts cannot be majority stakeholders in the JVs. “This move aims to prevent opportunistic takeovers of Indian companies that lead to economic vulnerabilities,” explains Kathir Thandavarayan, partner, consulting, Deloitte India. “By encouraging partnerships and JVs with neighbouring countries, India can leverage their technical expertise while maintaining control over critical sectors.” Recent news reports suggest that India is looking to offer short-term visas to Chinese technicians, for no more than six months, to help with the implementation of projects related to the PLI scheme. Given the existing skill gap in the industry, the knowledge and expertise of Chinese workforce will further help boost domestic manufacturing.The Dixon-HKC Corporation partnership might be the first of many to help Indian EMS companies to climb up the components manufacturing value chain faster.

State of Components Manufacturing

As per Deloitte, electronics component manufacturing in India is currently estimated at $11 billion with ~$10 billion of components consumed in India, while the remaining are exported. “If we want the success that we’ve seen in finished products manufacturing to be sustainable, components have to be ‘Made in India’,” Sunil Vachani, chairman, Dixon Technologies, tells Forbes India in an exclusive conversation.The government of India has earmarked $30 billion of fiscal incentives for the manufacturing of electronics and its allied sectors, which includes component manufacturing. These demand factors augmented with support from scaling the supply are expected to boost the electronics component manufacturing in India to $18 billion by FY26, as per Deloitte.

“While the domestic production of electronic components has been on the rise, more than 70 percent of the market demand is still met through imports,” says Thandavarayan. About $11 billion worth of electronics components are manufactured in India and around $30 billion of electronic component requirement is met with imports, across products such as integrated circuits, diodes & transistors, and capacitors. Around 37 percent of the total imports are from China, as per Deloitte. While domestic production of electronics items has grown by about 2.5 times over the last five years, the domestic value addition is only around 15 to 20 percent, as most of the critical components are imported.

Also read: What does the Modi 3.0 government need to do to scale India's electronics manufacturing industry?

How will India-China partnerships help?

Over the last 10 to 20 years, China has built a lot of infrastructure and scale for component manufacturing. Though India might be slightly behind, it is also looking to replicate that success to become a global electronics manufacturing powerhouse.“Let’s appreciate that Taiwanese, Korean and Chinese companies have a huge head-start in certain areas, a lot of technology and manufacturing capabilities are already there. Since we don’t have time on our side as an industry, these partnerships help speed up the process,” says Vachani.

Component manufacturing in India is on the rise, and has grown significantly over the last few years. “For instance, India does PCB assembly for which a lot of the parts are sourced locally. However, key components still need to be imported. And to do that, these India-China JVs will help. Once we start locally manufacturing these key components, our value addition would be much higher,” says Prachir Singh, senior research analyst at Counterpoint Research. While it will definitely be a ‘win’ for Indian companies, he says, “it will also benefit the Chinese counterparts in getting more business, given the size of the Indian market. This is more relevant since many of them have been losing business, with MNCs looking outside China for OEMs”.

But these partnerships will only be for certain components. Sailesh Rao, EY-Parthenon India Strategy Leader, reckons, “For certain components, India has already got all the necessary skill sets, and we don’t need them. If at all, we would need some technology transfers from the Chinese. These will be limited, as over time, as we build our own capacity, this will whittle down, simply because in most electronics items India itself is a large market.”

Press Note 3 could ensures long-term sustenance of Indian economic interests and manufacturing ecosystem development of critical industry sectors, including EMS. “However, the restrictions could also lead to retaliatory measures from countries sharing land border with India, affecting investment and trade flows,” says Thandavarayan. Industry experts also warn that if political tensions between India and China worsen, they will adversely affect these partnerships.

Also read: Indian companies should focus on high value manufacturing: Vijay Govindarajan

Much Ground to Cover

While significant opportunities exist in component manufacturing, there are also multiple issues. “We had challenges in scaling up because the ecosystem was not there. In China, for instance, the ancillary infrastructure like worker dorms were built by the Chinese local government entities. This is something no company wants to do because it has no direct impact on production,” explains Rao.“Developing technology-intensive components requires investment in research & development, and skilled labour. Infrastructure improvements and targeted policies are essential for growth. While the government is already doing this, it requires the industry and academia to also provide the backbone for the ecosystem to be strengthened,” says Shekhar Sanyal, country head and director, IET India.

Additionally, explains Thandavarayan, “zero or minimal duty on imported inputs has favoured low value-added assembling over component manufacturing, discouraging investments in domestic manufacturing”. To address this, the basic customs duty on PCBAs for mobile phones was increased from 10 percent to 20 percent, and tariffs for televisions, set-top boxes, LED lights and mobile phones were adjusted to boost domestic value addition.

Indian manufacturers experience an 8 to 10 percent cost disadvantage compared to global competitors. However, government’s policy initiatives such as the Production Linked Incentive Scheme (PLI), Scheme for Promotion of Manufacturing of Electronic Components (SPECS) and Semiconductors and Modified Electronics Manufacturing Clusters Scheme address these cost disadvantages of manufacturing in India.

The government has announced the Semicon India Program to develop the semiconductors and display fab ecosystem, with an outlay of $10 billion. Industry sources believe that the government is working on a scheme to encourage component manufacturing, which would be a mix of PLI and SPECS—so a combination of opex and capex benefits.