How Tata Consumer Products grew despite the pandemic

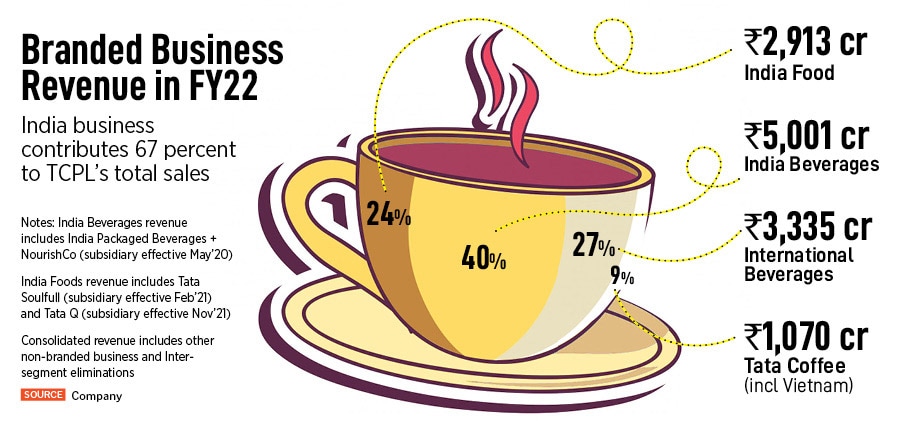

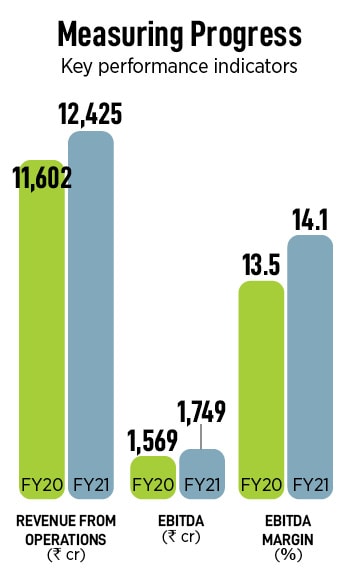

TCPL, formed in February 2020 by integrating the Tata's group's food and beverage interests, delivered strong results on the back of innovation, brand building and distribution

Sunil D'Souza, CEO & Managing Director, Tata Consumer Products

Images: Neha Mithbawkar for Forbes India

Sunil D'Souza, CEO & Managing Director, Tata Consumer Products

Images: Neha Mithbawkar for Forbes India

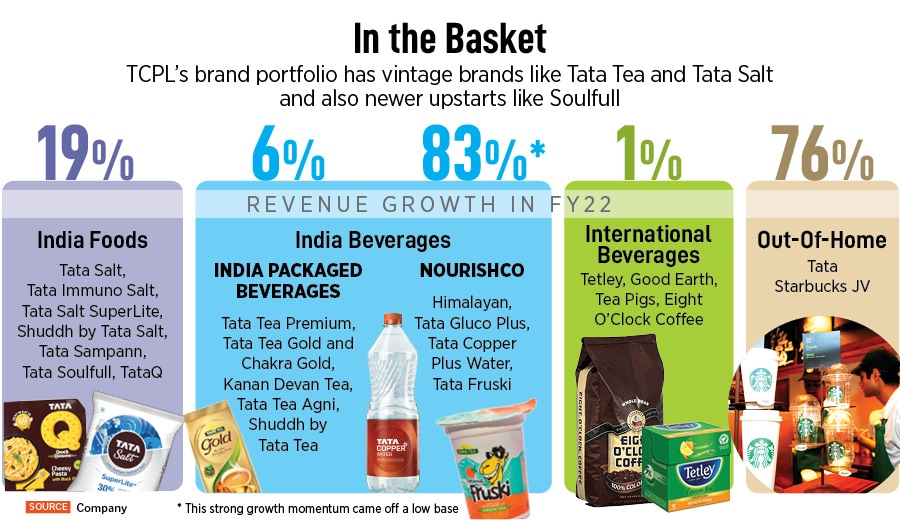

Chaiwalas that dot the roadsides of Uttar Pradesh’s cities—India’s biggest loose tea market –recently became a part of a pilot by Tata Consumer Products (TCPL). Shuddh by Tata Tea, a low cost but high-quality variant, was soft-launched some months ago to help upgrade loose tea users—who make up roughly 35 percent of India’s Rs 26,000 crore tea market—to branded tea.

At the other end of the market, TCPL launched 1868 by Tata Tea, a range of luxury black and green teas paired with fruits and spices for more discerning customers, in March 2021. An online-only brand, 1868 marked Tata Tea’s entry into the fast emerging direct-to-consumer (D2C) segment as well as into the premium tea space.

Together, the moves sum up TCPL’s strategy of chasing the mass consumer while still enticing the more premium one. It’s also going after all those in between, hoping to further strengthen its position in the tea market where it commands a 20-24 percent share—a neck-and-neck second to Hindustan Unilever, which sells Brooke Bond tea.

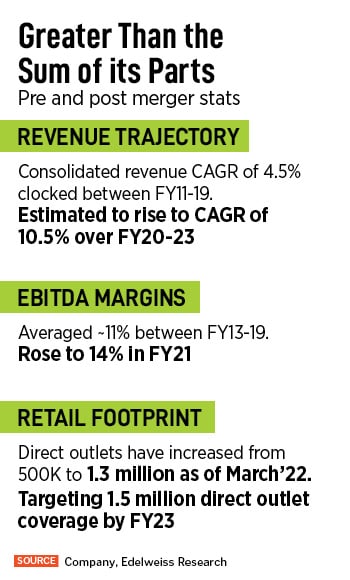

Borne out of a merger between Tata Chemicals’ consumer-focussed arm that sold brands such as Tata Salt and pulses-to-poha-seller Tata Sampann, with Tata Global Beverages, the maker of Tata Tea, TCPL was minted in February 2020. The idea was to integrate the food and beverage interests of the Tata Group into a single company to help drive efficiencies and realise synergies.

“TCPL was formed as an organisation to deliver the aspirations of the Tata group in the FMCG space,” says Sunil D’Souza, the former managing director of Whirlpool India and PepsiCo veteran who was brought in to lead TCPL. But little did he—or anyone—know that a month into the company’s formation, a nationwide lockdown would be imposed as Covid-19 loomed large.

“The last 24 months have been like changing all four tyres of a car while driving at 120 km per hour and by the way giving it a new coat of paint. The good part is that the Tata brand name carries enormous equity in the market. That was the single biggest thing that helped us drive this whole business forward,” says D’Souza.

“The last 24 months have been like changing all four tyres of a car while driving at 120 km per hour and by the way giving it a new coat of paint. The good part is that the Tata brand name carries enormous equity in the market. That was the single biggest thing that helped us drive this whole business forward,” says D’Souza.  Like salt, in the tea business too—

Like salt, in the tea business too—