IDBI Bank: Time to revisit its vision

IDBI Bank has exited the PCA framework with its brand value intact. But it needs to restart its growth engine to succeed as a turnaround bank, and make money for primary investor LIC

Rakesh Sharma, MD & CEO, IDBI Bank; Image: Neha Mithbawkar for Forbes India

Rakesh Sharma, MD & CEO, IDBI Bank; Image: Neha Mithbawkar for Forbes India

What does a turnaround bank need to do right to ensure sustainability in earnings? This is the critical issue that the management of re-classified private sector lender IDBI Bank faces, after emerging from an arduous four-year period, during which its endurance was tested by the Reserve Bank of India (RBI).

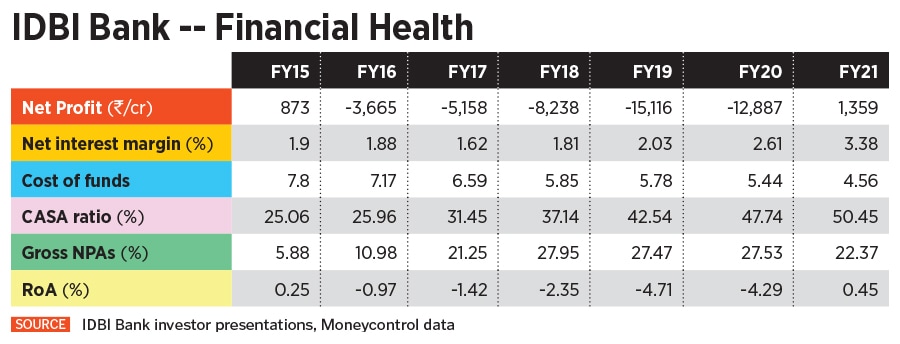

For nearly four years, profitability and managing asset quality were major challenges for IDBI Bank, which forced the RBI, in May 2017, to place it under the Prompt Corrective Action (PCA) framework. This meant restrictions in lending, business expansion and accessing costly deposits. In March this year, the bank was freed from these restrictions, and also showed full-year profits for the first time in five years, in its latest March 2021 earnings. All the IDBI group subsidiaries reported profits.

These are massive kudos for the bank’s management team, led by its managing director and CEO Rakesh Sharma, which succeeded in lowering costs, sale of non-core assets, increasing interest income and recoveries in non-performing assets, thus boosting the bank’s financial health.

But bigger challenges for the bank—in which Life Insurance Corporation (LIC) holds a majority stake–are appearing now. It will be in a position to grow its business, but is looking into a future that is uncertain, and yet resourceful.

The next 12 to 18 months will also determine whether LIC will be able to reap any benefits from the investments it has made in IDBI Bank since 2018. Any exit at current levels will only result in losses for the insurer.

To avoid indiscriminate exposure within sectors, it has divided lending opportunities based on grades and ratings. Engineering, procurement and construction (EPC), shipping, gems and jewellery, are placed as a ‘highly cautious’ category; commercial real estate, power generation and mining as ‘cautious’; NBFCs, textiles, trading and paper as ‘selective’, and pharmaceuticals/drugs, cement, power transmission and distribution as ‘normal’.

To avoid indiscriminate exposure within sectors, it has divided lending opportunities based on grades and ratings. Engineering, procurement and construction (EPC), shipping, gems and jewellery, are placed as a ‘highly cautious’ category; commercial real estate, power generation and mining as ‘cautious’; NBFCs, textiles, trading and paper as ‘selective’, and pharmaceuticals/drugs, cement, power transmission and distribution as ‘normal’.