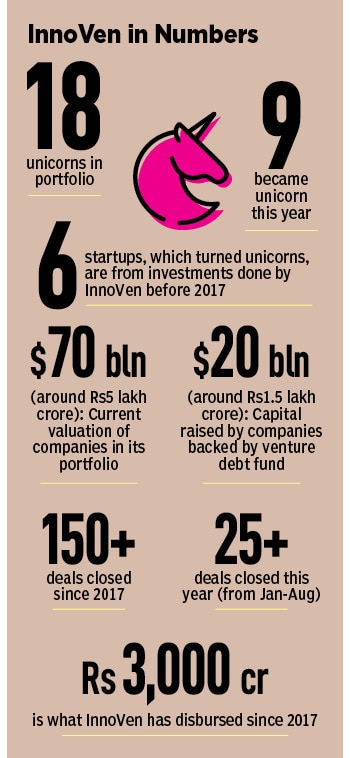

Jet, Set, Debt: How InnoVen built its equity among unicorns

India's biggest venture debt fund has enabled unicorn founders to strike a delicate balance between less dilution and more growth

Ashish Sharma, CEO, InnoVen Capital India

Ashish Sharma, CEO, InnoVen Capital India

Image: Madhu Kapparath

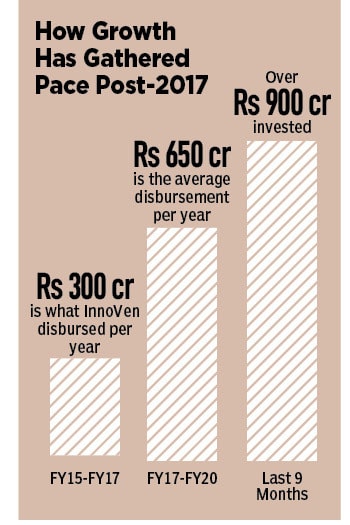

In 2017, when Ashish Sharma was taking a fresh guard, the financial market veteran found something weird about the startup pitch on which he was about to play his new innings. The track looked dry and it did not have blades of grass. After spending two decades with GE Capital, where he was president and chief executive officer (CEO) for a good three years between 2014 and 2017, Sharma joined venture debt fund InnoVen Capital as the CEO. As an outsider venturing into the startup world, he had one big comfort factor. His previous company and the new one, both had the word ‘Capital’ in their names. The similarities, however, ended right there.

The game at InnoVen was insanely different. Sharma explains. At GE Capital, there were thousands of people reporting to the CEO and the lending business was growing at a brisk pace. The ‘push and pull’ worked brilliantly as the lender and the borrower understood the need, and the rules of the game. GE Capital, as a brand name, was massive. Familiarity and credibility worked like a flywheel.

At InnoVen, in 2017, Sharma struggled to make founders aware of the need to raise venture debt. Four years ago, India was in the thick of intense funding activity, and founders loved venture capital (VC) for two reasons. First, it brought instant money for growth. Second, founders have mentors on board to counsel according to their needs.