Paytm turns operationally profitable. But can it sustain the momentum?

After its disastrous IPO, the fintech giant has turned adjusted Ebitda positive nine months before its initial guidance

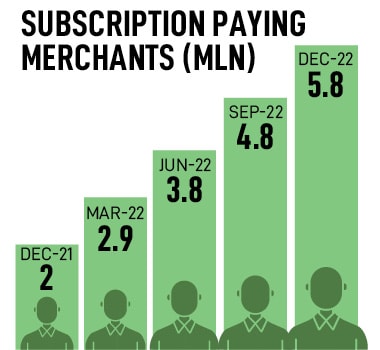

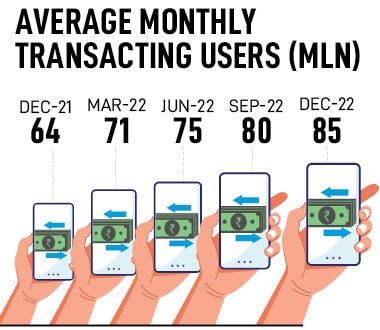

Paytm’s core payments services business, which comprises consumers who use its app and merchants’ device subscriptions, rose 43 percent to Rs 1,599 crore, accounting for 78 percent of the total revenue

Image: Debarchan Chatterjee/NurPhoto via Getty Images

Paytm’s core payments services business, which comprises consumers who use its app and merchants’ device subscriptions, rose 43 percent to Rs 1,599 crore, accounting for 78 percent of the total revenue

Image: Debarchan Chatterjee/NurPhoto via Getty Images

In the days after Paytm reported its October-December quarter results on February 3, shares of the payments platform shot up 35 percent in four straight sessions. Revenues were up 42 percent from the year-ago quarter, to Rs 20,630 crore.

Importantly, the Noida-based company, which listed on the bourses in November 2021, reported its first-ever quarterly profits: Adjusted Ebitda, that is Ebitda before employee stock option costs—a metric used by all new-age listed firms—stood at Rs 31 crore in Q3FY23, up from a loss of Rs 393 crore in the year-ago period. Adjusted Ebitda margin rose 1.5 percent, from negative 27 percent a year earlier. On a consolidated level, however, Paytm continues to be loss-making, although it has nearly halved its losses to Rs 392 crore in Q3FY23, as against a loss of Rs 779 crore in the year-ago period.

On February 10—the fifth session of trading post the quarterly results—the upward rally came to an abrupt halt. Shares sank 9 percent after Alibaba, the Chinese ecommerce giant and an investor in Paytm since 2015, offloaded its remaining 3.3 percent stake in the company in a block deal worth Rs 1,378 crore, at Rs 642.74 a share. Alibaba, an affiliate of Ant Group, had previously sold roughly 3 percent of its stake in Paytm in January 2023. Ant, however, still holds a 24 percent stake in the fintech firm.

The following week, shares recovered partly, rising 4.4 percent to Rs 679 on the Bombay Stock Exchange on February 13. Although this is 55 percent higher than the low of Rs 438 Paytm’s stock hit in November 2022, a year after listing, the stock is still down two-thirds from its listing price of Rs 2,150 in November 2021.

“We see a very visible change in approach of the management to deliver profits as evidenced by core Ebitda profitability reported recently. We were earlier expecting losses to continue but at current rate of revenues and operating leverage kicking in, we expect accounting profits to be delivered by FY26,” said Suresh Ganapathy, a Macquarie analyst, in a note.

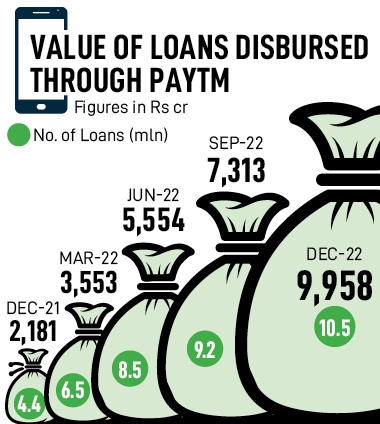

“We see a very visible change in approach of the management to deliver profits as evidenced by core Ebitda profitability reported recently. We were earlier expecting losses to continue but at current rate of revenues and operating leverage kicking in, we expect accounting profits to be delivered by FY26,” said Suresh Ganapathy, a Macquarie analyst, in a note.  Second, Paytm’s financial services arm, which primarily comprises buy-now-pay-later (BNPL), personal and merchant loans, accounted for 22 percent of the total revenue. The number of such loans distributed through Paytm rose 137 percent to 10.5 million, while the value of loans disbursed soared 357 percent to Rs 9,958 crore in Q3FY23. It was led by a four-fold jump in BNPL loans. Paytm doesn’t lend on its own but does so through its lending partners, earning a 2.5 to 3 percent commission on every loan disbursed through its platform.

Second, Paytm’s financial services arm, which primarily comprises buy-now-pay-later (BNPL), personal and merchant loans, accounted for 22 percent of the total revenue. The number of such loans distributed through Paytm rose 137 percent to 10.5 million, while the value of loans disbursed soared 357 percent to Rs 9,958 crore in Q3FY23. It was led by a four-fold jump in BNPL loans. Paytm doesn’t lend on its own but does so through its lending partners, earning a 2.5 to 3 percent commission on every loan disbursed through its platform.  Moreover, since the loan distribution business is a high-margin one, at around 70 percent, it is the biggest driver of profitability. Its addition, contribution profit is significant, which in turn has helped shore up the adjusted Ebitda. Paytm defines contribution profit as revenue from operations less payment processing charges, promotional cash back and incentive expenses, and logistic, deployment and collection cost of its business.

Moreover, since the loan distribution business is a high-margin one, at around 70 percent, it is the biggest driver of profitability. Its addition, contribution profit is significant, which in turn has helped shore up the adjusted Ebitda. Paytm defines contribution profit as revenue from operations less payment processing charges, promotional cash back and incentive expenses, and logistic, deployment and collection cost of its business.