Post ZestMoney closure: Finding peace with BNPL credit

Stringent RBI regulations have forced fintechs, which once experimented with buy now pay later (BNPL), to pivot into more robust business models. BNPL will continue to survive but only with guardrails

Image: Shutterstock

Image: Shutterstock

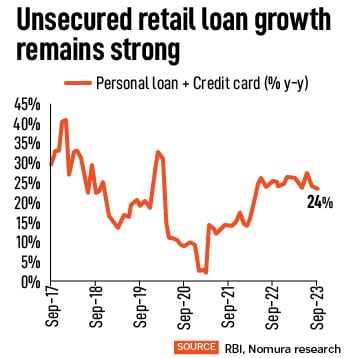

The Reserve Bank of India (RBI), over the past 18 months, has done enough to ensure that there are curbs on uncontrolled credit growth, particularly in the unsecured consumer and personal loans space. This is the segment which India’s youth is tapping to meet their aspirational needs, seeking short-term loans, demand for which have spiralled post the pandemic.

The central bank has, this year, hiked the minimum amount of capital which banks and non-banking financial companies (NBFCs) need to hold in relation to a loan. In 2022, the RBI introduced measures to curtail credit lending by non-banks through prepaid cards and digital wallet products.

The clear signal to lenders is that there is a need to be aware of the risks and they need to have the ability to safeguard themselves and the lending ecosystem from the rising concerns of unsecured retail loans.

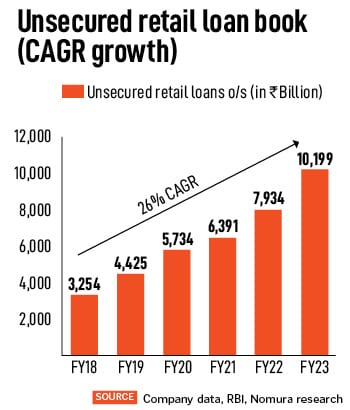

Nomura’s research shows that NBFCs have seen the sharpest increase in exposures to unsecured retail (see chart). Most of the NBFCs (excluding Bajaj Finance and the unlisted HDB Financial Services) have scaled up this segment, from near-zero to 7 percent to 22 percent of their portfolio in just over the past 18-24 months. In the past 18 months, around 25 to 30 percent of incremental growth for NBFCs came from unsecured retail, the Nomura report said.

Nomura’s research shows that NBFCs have seen the sharpest increase in exposures to unsecured retail (see chart). Most of the NBFCs (excluding Bajaj Finance and the unlisted HDB Financial Services) have scaled up this segment, from near-zero to 7 percent to 22 percent of their portfolio in just over the past 18-24 months. In the past 18 months, around 25 to 30 percent of incremental growth for NBFCs came from unsecured retail, the Nomura report said.

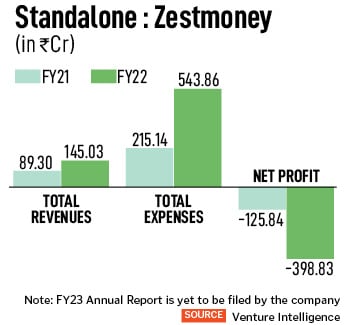

Lending is a business that needs discipline. “The weakness of a lending business is that there is a long tail of risk and earnings. A financial lending company gives money but it comes back anywhere between 6-12 months or even 24-36 months later,” the promoter of a top fintech firm said, declining to be named. “Prudence is not often being maintained.”

Some alarm bells have started to ring, getting founders of fintech firms to tweak their business models and diversify into more secured forms of lending. It has also raised the compelling debate of whether pure BNPL has a positive role to play in India’s lending ecosystem.

Some alarm bells have started to ring, getting founders of fintech firms to tweak their business models and diversify into more secured forms of lending. It has also raised the compelling debate of whether pure BNPL has a positive role to play in India’s lending ecosystem.  In December, fintech giant Paytm, backed by Softbank, said it has “recalibrated the portfolio” of less than Rs 50,000 ticket loans—prominently the BNPL Postpaid loan product—and will now be a smaller part of its loan distribution business going forward. With Postpaid, users got credit of up to Rs 60,000 every month at 0 percent interest for up to 30 days, to make purchases, bill payments, recharges and bookings. Now Paytm says it will focus on expanding its offering to include higher ticket personal and merchant loans to lower risk and high credit-worthy customers.

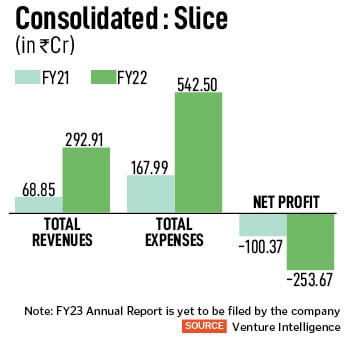

In December, fintech giant Paytm, backed by Softbank, said it has “recalibrated the portfolio” of less than Rs 50,000 ticket loans—prominently the BNPL Postpaid loan product—and will now be a smaller part of its loan distribution business going forward. With Postpaid, users got credit of up to Rs 60,000 every month at 0 percent interest for up to 30 days, to make purchases, bill payments, recharges and bookings. Now Paytm says it will focus on expanding its offering to include higher ticket personal and merchant loans to lower risk and high credit-worthy customers.  Slice took an NBFC licence and—after steady funding from marquee investors—launched prepaid credit card products with SBM Bank (India), which became a hugely successful and rapidly expanding venture. But then the 2022 RBI guidelines came and pinched its growth prospects, forcing Slice to rethink its business model. Bajaj is now working on his dream to make Slice a bank through its

Slice took an NBFC licence and—after steady funding from marquee investors—launched prepaid credit card products with SBM Bank (India), which became a hugely successful and rapidly expanding venture. But then the 2022 RBI guidelines came and pinched its growth prospects, forcing Slice to rethink its business model. Bajaj is now working on his dream to make Slice a bank through its  In its early days, Moneytap had experimented with the BNPL model and then transitioned from a lending business into a digital banking platform. “We understood early on that there were challenges in being just a lending business,” Varma said, adding that product lines had to go beyond lending lines, which now include credit cards, savings and deposits accounts.

In its early days, Moneytap had experimented with the BNPL model and then transitioned from a lending business into a digital banking platform. “We understood early on that there were challenges in being just a lending business,” Varma said, adding that product lines had to go beyond lending lines, which now include credit cards, savings and deposits accounts.  With the current regulatory restrictions in place—including the capping of the first loss default guarantee (FLDG) of the loan portfolio at just five percent—pure BNPL companies are unlikely to continue to lend rampantly. But there is no doubt that it still forms an essential form of credit.

With the current regulatory restrictions in place—including the capping of the first loss default guarantee (FLDG) of the loan portfolio at just five percent—pure BNPL companies are unlikely to continue to lend rampantly. But there is no doubt that it still forms an essential form of credit.  “BNPL firms will need to stay disciplined. Promoters need to ascertain if they can hold back on growth; it will be a growth verses profitability issue,” Hathi said. In the current scenario then, banks and NBFCs will be circumspect in funding for these loans and entities in the next few quarters.

“BNPL firms will need to stay disciplined. Promoters need to ascertain if they can hold back on growth; it will be a growth verses profitability issue,” Hathi said. In the current scenario then, banks and NBFCs will be circumspect in funding for these loans and entities in the next few quarters.