RBI increases repo rate, keeps door open for possible hike in April

The situation remains fluid and uncertain, and the stickiness of core inflation is a concern, says RBI Governor Shaktikanta Das while increasing repo rate by 25 bps to 6.5 percent

The Reserve Bank of India (RBI) Governor Shaktikanta Das arrives to address a press conference at the RBI head office in Mumbai on February 8, 2023. India's central bank slowed the pace of interest rate hikes on February 8 but warned that core inflation in the world's fifth-biggest economy remained stubbornly high.

Image: Punit Paranjpe / AFP

The Reserve Bank of India (RBI) Governor Shaktikanta Das arrives to address a press conference at the RBI head office in Mumbai on February 8, 2023. India's central bank slowed the pace of interest rate hikes on February 8 but warned that core inflation in the world's fifth-biggest economy remained stubbornly high.

Image: Punit Paranjpe / AFP

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) increased the benchmark rate by 25 basis points to 6.5 percent and voted to remain focussed on withdrawal of accommodation. This was not a unanimous decision. Two members, Ashima Goyal and Jayanth Varma, voted against the repo rate hike and continuation of the policy stance. The difference in opinion within the six-member rate-setting panel suggests the rate hike cycle may ease in the coming months.

Analysts and economists had pencilled in a rate hike of 25 basis points in the February policy and believe this could be the last of the rate hikes seen since the off-cycle MPC meeting in May last year. The RBI raised the benchmark rate by 2.25 percent from its historic low of 4 percent in April 2022.

“The global economic outlook does not look as grim now as it did a few months ago. Growth prospects in major economies have improved, while inflation is on a descent, though it still remains well above the target in major economies,” said RBI Governor Shaktikanta Das.

However, tighter financial conditions caused by aggressive monetary policy actions, volatile financial markets, debt crisis, protracted geopolitical hostilities, and fragmentation continue to impart high uncertainty to the outlook for the global economy, Das cautioned.

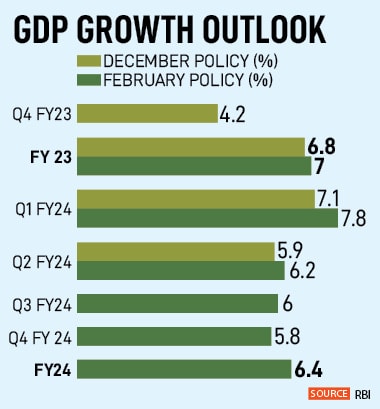

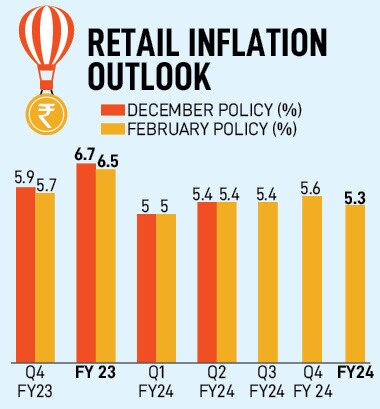

In light of the many moving parts in the global economy, the central bank adjusted its growth and inflation outlook, assuming oil prices at $95 per barrel. It marginally raised its GDP growth outlook for FY23 to 7 percent and lowered its inflation forecast to 6.5 percent (see table). It expects GDP to grow by 6.4 percent and CPI inflation to rise by 5.3 percent in FY24.

“Urban consumption demand has been firming up, driven by sustained recovery in discretionary spending, especially on services such as travel, tourism and hospitality.

“Urban consumption demand has been firming up, driven by sustained recovery in discretionary spending, especially on services such as travel, tourism and hospitality.  “The RBI governor’s communication struck a somewhat hawkish note, flagging concerns on high core inflation, projecting headline inflation at 5.3 percent for FY24, projecting confidence on growth, and flagging that monetary policy conditions are still not as tight as pre-pandemic levels—which doesn’t bolt the door completely on further tightening,” says Aurodeep Nandi, India economist, Nomura.

“The RBI governor’s communication struck a somewhat hawkish note, flagging concerns on high core inflation, projecting headline inflation at 5.3 percent for FY24, projecting confidence on growth, and flagging that monetary policy conditions are still not as tight as pre-pandemic levels—which doesn’t bolt the door completely on further tightening,” says Aurodeep Nandi, India economist, Nomura.  “It also provides elbow room to weigh all incoming data and forecasts to determine appropriate actions and policy stance, going forward. Monetary policy will continue to be agile and alert to the moving parts in the inflation trajectory to effectively address the challenges to the economy,” he said in terms of guidance for the future rate trajectory.

“It also provides elbow room to weigh all incoming data and forecasts to determine appropriate actions and policy stance, going forward. Monetary policy will continue to be agile and alert to the moving parts in the inflation trajectory to effectively address the challenges to the economy,” he said in terms of guidance for the future rate trajectory.