RBI stuns the Street; holds rates, but says war against inflation continues

The six-member rate-setting panel voted unanimously to 'pause on the repo rate for this meeting only' with a 'readiness to act should the situation so warrant'

Reserve Bank of India (RBI) Governor Shaktikanta Das and deputy governor Michael Patra attend a news conference after a monetary policy review in Mumbai, India, April 6, 2023.

Image: Francis Mascarenhas / Reuters

Reserve Bank of India (RBI) Governor Shaktikanta Das and deputy governor Michael Patra attend a news conference after a monetary policy review in Mumbai, India, April 6, 2023.

Image: Francis Mascarenhas / Reuters

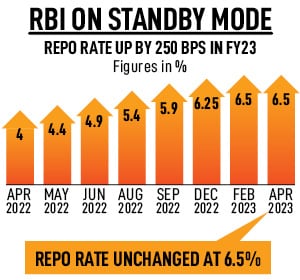

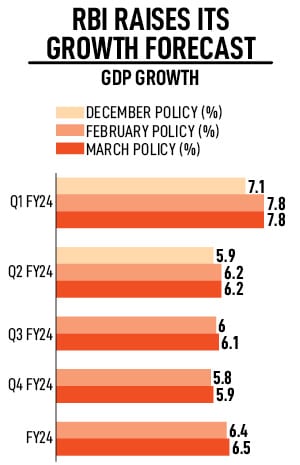

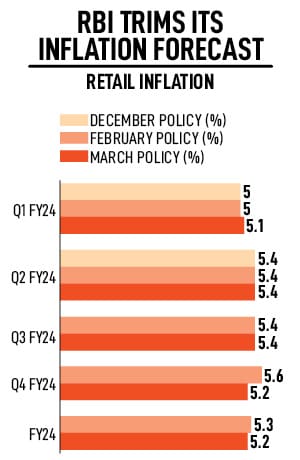

In a surprise move, all six members of the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) decided to keep the key lending rate unchanged at 6.5 percent, and five out of six members voted for a continued focus on withdrawal of accommodation. Intriguingly, the central bank bucked consensus as it marginally trimmed its inflation forecast and raised its growth outlook—by 0.1 percent to 5.2 percent and 6.5 percent respectively—even as headline inflation remains elevated beyond 6 percent in a highly volatile and uncertain global economy.

But this is a ‘hawkish’ pause as the RBI steers monetary policy for a “non-disruptive normalisation” and says it is “unwaveringly focussed on inflation”.

“The monetary policy actions taken since May 2022 are still working through the system. Accordingly, the MPC decided to keep the policy rate unchanged to assess the progress made so far, while closely monitoring the evolving inflation outlook. The MPC will not hesitate to take further action as may be required in its future meetings,” RBI Governor Shaktikanta Das asserted as he announced the first bi-monthly credit policy of the current fiscal year.

In February, retail inflation stood at 6.44 percent, and is likely to remain sticky. The recent development of a possible cut in production of crude oil by OPEC countries and Russia is a looming concern for price stability, as is the adverse impact of extreme weather conditions on food prices and the upcoming state elections. The RBI has factored average crude oil price at $85 per barrel and a normal monsoon for its lower projection of inflation at 5.2 percent in FY24.

In February, retail inflation stood at 6.44 percent, and is likely to remain sticky. The recent development of a possible cut in production of crude oil by OPEC countries and Russia is a looming concern for price stability, as is the adverse impact of extreme weather conditions on food prices and the upcoming state elections. The RBI has factored average crude oil price at $85 per barrel and a normal monsoon for its lower projection of inflation at 5.2 percent in FY24.

“The messaging is subtle that the MPC expects the economy to fare well on both [inflation and growth] counts this year. This comes at a time when the World Bank has just lowered its GDP forecast for India. The RBI does believe that both the domestic and external sectors are doing well to warrant such optimism,” says Madan Sabnavis, chief economist, Bank of Baroda.

In fact, not much has improved on the global and domestic front since the February meeting. Headline inflation inched up and was higher-than-expected. The world economy is witnessing new headwinds as the banking sector crisis unfolds in key western markets and fears of contagion threaten financial stability even as stubborn inflation persists.

In fact, not much has improved on the global and domestic front since the February meeting. Headline inflation inched up and was higher-than-expected. The world economy is witnessing new headwinds as the banking sector crisis unfolds in key western markets and fears of contagion threaten financial stability even as stubborn inflation persists. Aditi Nayar, ICRA’s chief economist, says, "Financial stability concerns appear to have pre-empted a pause as the MPC assesses the impact of its cumulative 250 basis points of rate hikes. If inflation does not fall in line with the MPC's assessment for Q1FY24, another hike could be in the offing, especially if the financial stability situation stabilises."

Aditi Nayar, ICRA’s chief economist, says, "Financial stability concerns appear to have pre-empted a pause as the MPC assesses the impact of its cumulative 250 basis points of rate hikes. If inflation does not fall in line with the MPC's assessment for Q1FY24, another hike could be in the offing, especially if the financial stability situation stabilises."