Cracking the code for high growth, low inflation

Policymakers gave growth a chance at the cost of inflation, but now they are struggling to put the genie back in the bottle, even as growth remains elusive. Can rate hikes do the job?

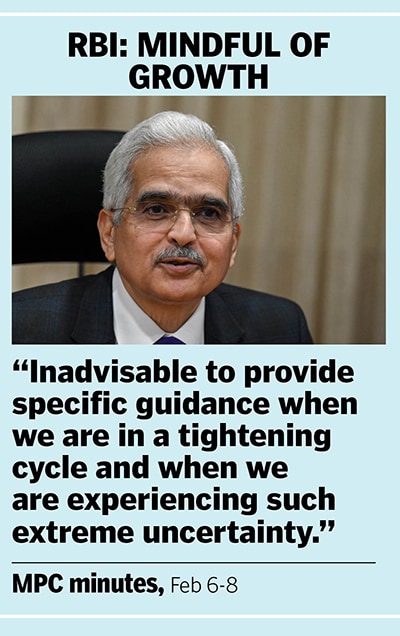

The Reserve Bank of India (RBI) Governor Shaktikanta Das arrives to address a press conference at the RBI head office in Mumbai on February 8, 2023. India's central bank slowed the pace of interest rate hikes on February 8 but warned that core inflation in the world's fifth-biggest economy remained stubbornly high.

Image: Punit Paranjpe / AFP

The Reserve Bank of India (RBI) Governor Shaktikanta Das arrives to address a press conference at the RBI head office in Mumbai on February 8, 2023. India's central bank slowed the pace of interest rate hikes on February 8 but warned that core inflation in the world's fifth-biggest economy remained stubbornly high.

Image: Punit Paranjpe / AFP

The world is navigating a transition that many policymakers have little first-hand experience of charting. An unprecedented and once-in-a-lifetime pandemic necessitated an avalanche of liquidity. The same liquidity that made the boats float during the crisis, later risked sinking ships when the situation turned, and raging inflation wrought havoc across countries.

The quick U-turn from ‘stimulating’ growth to ‘curbing’ inflation has presented policymakers with challenging and risky trade-offs. Uncontrolled and rampant inflation can wipe out decades of growth and upset macroeconomic stability, which can take years to restore. But, beyond a point, to water down growth to cool inflation can rust the economic engine and result in an equally adverse chain of outcomes.

The uniqueness of this conundrum means the pivot point is open to a range of interpretations--of the same data points--in an uncertain and volatile global economy. So, when the world’s largest economy and the biggest source of capital says it is determined to stamp out inflation even at the cost of a recession, it has a forceful impact on markets worldwide.

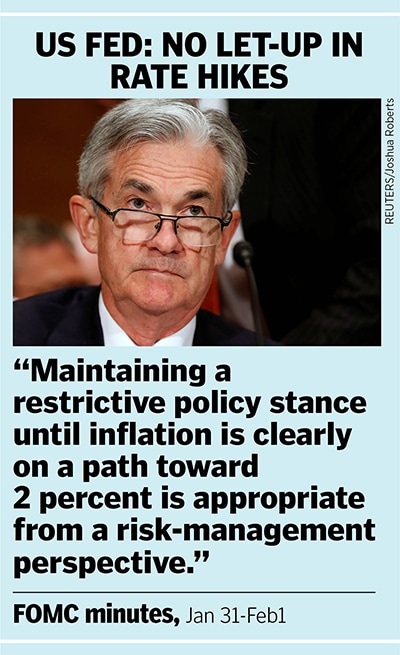

US Fed: Expect more rate hikes

After decades of low interest rates and easy money, the US Fed has hiked interest rates by 450 basis points since March 2022 to bring down inflation to its target of 2 percent. Minutes of the Federal Open Market Committee (FOMC) meeting on January 31-February 1 suggest a wide majority of its members believe that the upside risks to inflation persist. “Participants observed that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2 percent, which was likely to take some time,” said the minutes of the previous FOMC meeting.

“Participants observed that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2 percent, which was likely to take some time,” said the minutes of the previous FOMC meeting.

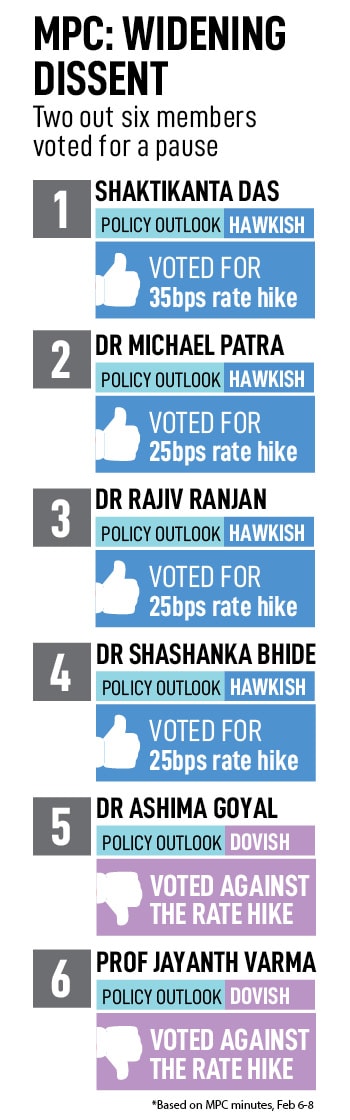

“In the second half of 2021-22, monetary policy was complacent about inflation, and we are paying the price for that in terms of unacceptably high inflation in 2022-23. In the second half of 2022-23, monetary policy has, in my view, become complacent about growth, and I fervently hope that we do not pay the price for this in terms of unacceptably low growth in 2023-24,” Varma argued.

“In the second half of 2021-22, monetary policy was complacent about inflation, and we are paying the price for that in terms of unacceptably high inflation in 2022-23. In the second half of 2022-23, monetary policy has, in my view, become complacent about growth, and I fervently hope that we do not pay the price for this in terms of unacceptably low growth in 2023-24,” Varma argued.  “The minutes of the MPC meeting showed diverging policy priorities for the hawks and doves-–the former expressing concerns about the stickiness of inflation, while the latter warned of the risk of a policy overshoot. After 325bp of cumulative rate hikes having already been delivered in a span of 10 months, assessing the policy impact is critical and merely reacting to past inflation readings will be backward-looking monetary policy. We believe this is what is driving the divergence between the two external MPC members, who are forward-looking, versus the hawks, who are more focused on concurrent data,” say brokerage firm Nomura’s economists.

“The minutes of the MPC meeting showed diverging policy priorities for the hawks and doves-–the former expressing concerns about the stickiness of inflation, while the latter warned of the risk of a policy overshoot. After 325bp of cumulative rate hikes having already been delivered in a span of 10 months, assessing the policy impact is critical and merely reacting to past inflation readings will be backward-looking monetary policy. We believe this is what is driving the divergence between the two external MPC members, who are forward-looking, versus the hawks, who are more focused on concurrent data,” say brokerage firm Nomura’s economists.