The LIC draft prospectus for IPO screams, 'all is not well'

Forbes India has analysed the 652-page offer document filed by India's largest insurer to present quick takeaways on what the numbers say

LIC has filed its draft red herring prospectus (DRHP) for its initial public offering (IPO) on February 13

LIC has filed its draft red herring prospectus (DRHP) for its initial public offering (IPO) on February 13

Image: Ashish Vaishnav/SOPA Images/LightRocket via Getty Images

India’s largest insurer and the fifth largest insurer globally, the Life Insurance Corporation of India (LIC) filed its draft red herring prospectus (DRHP) for its initial public offering (IPO) on February 13. The government of India, which is the sole owner of the insurance company, holds 632 crore shares in LIC and plans to offload five percent stake or 31.6 crore shares.

Forbes India breaks down quick takeaways from the 652-page offer document:

How big is LIC?

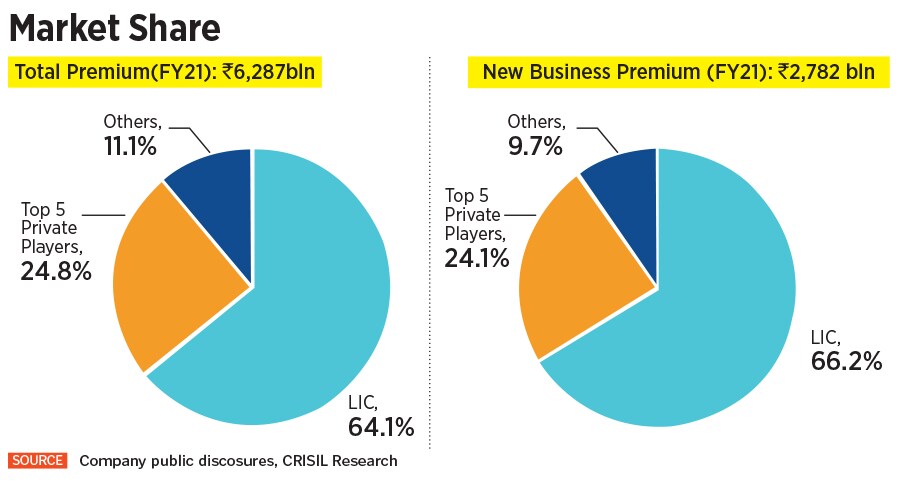

LIC has been providing life insurance service in India for more than 65 years. While there are 24 life insurance companies in India, LIC commands the largest market share. The size of the Indian life insurance industry was Rs6.2 lakh crore on a total premium basis in fiscal 2021, up from Rs5.7 lakh crore in FY20. LIC’s gross written premium share is 64.1 percent as on FY2021.

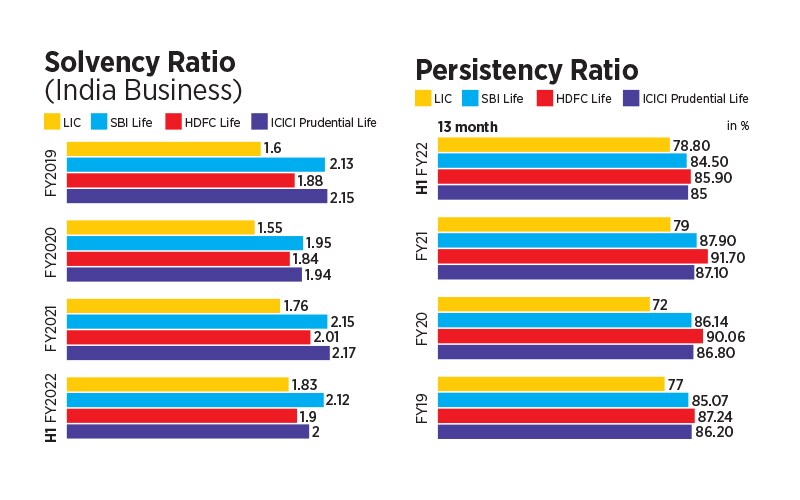

What does persistency ratio really mean and why falling persistency is tied to the solvency ratio of LIC?

What does persistency ratio really mean and why falling persistency is tied to the solvency ratio of LIC?