Govt to miss divestment target; LIC elephant in the room

The government is set to miss its budgeted divestment targets yet again, even as the shortfall could be partly offset by buoyancy from other tax revenues this fiscal

The initial public offering (IPO) of LIC, the largest insurer in the country, is expected to fetch anywhere between ₹80,000 crore and ₹1 lakh crore

The initial public offering (IPO) of LIC, the largest insurer in the country, is expected to fetch anywhere between ₹80,000 crore and ₹1 lakh crore

Image: Shutterstock

The sale of debt-laden carrier Air India to the Tata Group in October 2021 was the highlight of the year for the government when it comes to its ambitious disinvestment programme. After all, it took the government over four years to find a buyer for the Indian airline. But that deal alone is not close enough to reach the target the government has set for itself.

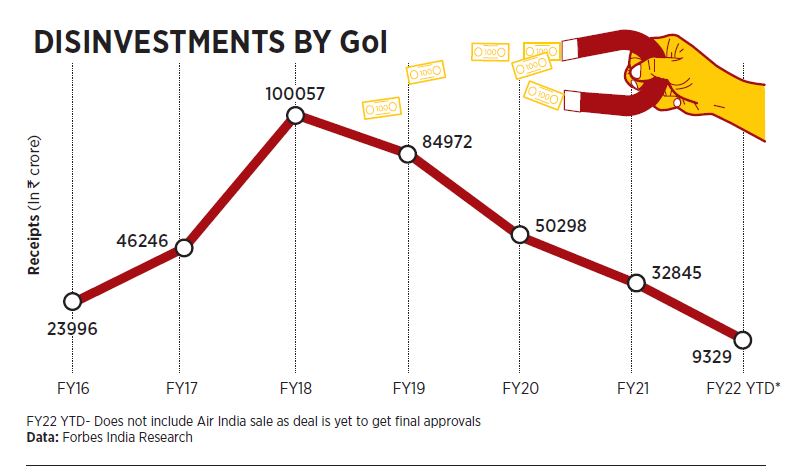

During the budget in February 2021, Finance Minister Nirmala Sitharman had set a target of ₹1.75 lakh crore for the year and was hoping to sell some of the assets that the government had put on the block in the last few years. The target was a downward revision from the ambitious target of ₹2.1 lakh crore the year before, which it could not meet. For FY21, the government managed to raise ₹32,845.18 crore.

“The government is unlikely to reach the budgeted divestment target in FY22. We are pencilling in a shortfall of ₹75,000-1 lakh crore. However, the revenues’ upside will offset the divestment shortfall,” says Suvodeep Rakshit, senior economist at Kotak Institutional Equities.

The government signed the agreement for the sale of Air India to the Tata Group in October

The government signed the agreement for the sale of Air India to the Tata Group in October