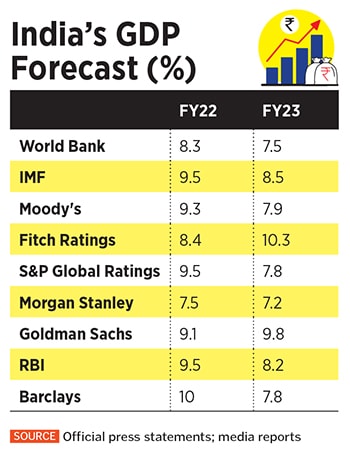

The omicron reset: Near 8% GDP likely in FY23 for India

The Covid-19 variant is disrupting businesses and social activity again. But economists are confident that India will trend close to the 8 percent growth path in FY23, aided by exports, government capex and private consumption

For the growth momentum to sustain in FY23, private consumption will be a critical factor. This will be driven by urban demand, in the form of more jobs, better wages and activity of contact-intensive services, including malls, restaurants, retail stores, movie halls and gyms

For the growth momentum to sustain in FY23, private consumption will be a critical factor. This will be driven by urban demand, in the form of more jobs, better wages and activity of contact-intensive services, including malls, restaurants, retail stores, movie halls and gyms

Image: Prashanth Vishwanathan/ Bloomberg via Getty Images

The year just gone would seem dichotomous for most in India. For the professionals, it would have meant adjusting to a hybrid model of working remotely from homes during the scarring second pandemic wave and then back to office towards the end of the year. Jobs and salaries in the metros and large cities were secure and grew, if you were in the IT/ITES, pharmaceuticals, health care, financial services and chemicals space. But for the self-employed who ran small business it meant seeing their revenues dwindle.

By mid-2021—as vaccinations gathered pace and new Covid-19 cases slowed—business activity and sentiment improved. India’s GDP had soared by a robust 20.1 percent by June-end, simply due to a statistical low base of 2020. Investor sentiment boosted stock indices, rising 22 percent in 2021 and assisting corporates to raise fresh capital through record initial public offerings (IPO). But, by the end of the year, much of the euphoria turned into concern: The markets corrected over 10 percent from a Sensex peak of 62,254 points in October.

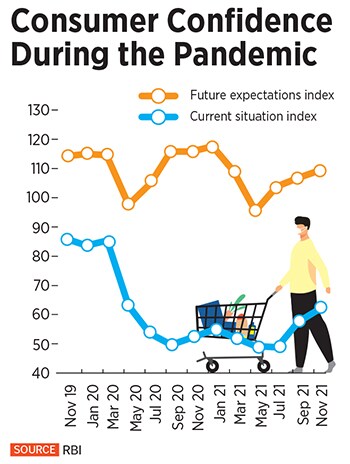

Foreign investors had intensified sales by then as global central banks announced plans to tighten liquidity and focus on battling inflation by raising interest rates. The Covid-19 virus was not done yet and the new variant B.1.1.529 (Omicron) spread across 125 countries from late November, hurting mobility and consumer sentiment.

The Centre for Monitoring Indian Economy (CMIE) recorded a fall in consumer sentiment in December 2021. The weekly index of consumer sentiments for the week ended December 26 was at 55.1, down from a year’s peak of 61.9 on November 21. “The fall in consumer sentiments in December after five months of an impressive rise raises some questions regarding the recovery of the economy,” says Mahesh Vyas, managing director and CEO of CMIE, in his website column.

The Nomura India Business Resumption Index inched p to 120.3 for the week ending January 2 from an upwardly revised 120.2 during the prior week. But Nomura’s chief India economist Sonal Verma says, “India seems to be on the cusp of a third wave” and warns of a rise in more cases due to “elevated mobility and a rising positivity rate”. “While early signs point to a lower mortality rate, it bears close monitoring,” she adds. India’s number of Covid cases (seven-day average) is back to a three-month high, at 22,939 on January 3.

The Nomura India Business Resumption Index inched p to 120.3 for the week ending January 2 from an upwardly revised 120.2 during the prior week. But Nomura’s chief India economist Sonal Verma says, “India seems to be on the cusp of a third wave” and warns of a rise in more cases due to “elevated mobility and a rising positivity rate”. “While early signs point to a lower mortality rate, it bears close monitoring,” she adds. India’s number of Covid cases (seven-day average) is back to a three-month high, at 22,939 on January 3. But for the growth momentum to sustain, private consumption will be a critical factor. This, in all likelihood, will, in FY23, need to be driven by urban demand, possibly in the form of more jobs, better wages and the activity of contact-intensive services, including malls, restaurants, retail stores, movie halls and gyms. Joshi admits consumption at this stage is not broad based. “Contact-based services will take longer to recover. The urban poor have been hit harder than the rural poor who were benefited by several fiscal measures last year,” says Joshi. Income disparity is being reflected in consumption disparity.

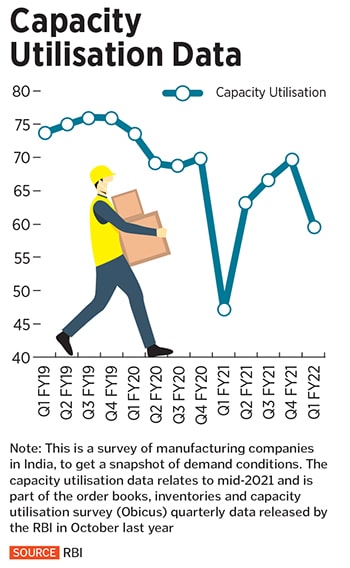

But for the growth momentum to sustain, private consumption will be a critical factor. This, in all likelihood, will, in FY23, need to be driven by urban demand, possibly in the form of more jobs, better wages and the activity of contact-intensive services, including malls, restaurants, retail stores, movie halls and gyms. Joshi admits consumption at this stage is not broad based. “Contact-based services will take longer to recover. The urban poor have been hit harder than the rural poor who were benefited by several fiscal measures last year,” says Joshi. Income disparity is being reflected in consumption disparity. Economists feel the economy will bounce back from the Omicron threat this year. Construction, manufacturing and agriculture sectors are likely to remain unaffected in this fresh wave

Economists feel the economy will bounce back from the Omicron threat this year. Construction, manufacturing and agriculture sectors are likely to remain unaffected in this fresh wave

RBI’s Monetary Policy Committee is likely to keep interest rates unchanged in its February 2022 meeting. With the rise in the positivity rate in Covid-19 cases and spread of Omicron, there could be more restrictions on mobility which could prompt the RBI to not tighten rates and support domestic economic recovery and growth for some more time. The RBI has forecast India to grow by a lower 8.2 percent in FY23, compared to 9.5 percent growth estimate for the current fiscal.

RBI’s Monetary Policy Committee is likely to keep interest rates unchanged in its February 2022 meeting. With the rise in the positivity rate in Covid-19 cases and spread of Omicron, there could be more restrictions on mobility which could prompt the RBI to not tighten rates and support domestic economic recovery and growth for some more time. The RBI has forecast India to grow by a lower 8.2 percent in FY23, compared to 9.5 percent growth estimate for the current fiscal.