Budget 2022: Mind the (fiscal) gap

Unless India sustains a relatively high growth trajectory, the road to fiscal consolidation is long and winding, especially in a highly volatile global environment

Nirmala Sitharaman to increase spending on social welfare schemes and infrastructure development by up to ₹40 lakh crore. But there are strings attached, which has the money market tied up in knots

Nirmala Sitharaman to increase spending on social welfare schemes and infrastructure development by up to ₹40 lakh crore. But there are strings attached, which has the money market tied up in knots

Illustration: Chaitanya Dinesh Surpur

In a few days, the finance ministry will roll out Budget 2022 preparations with the traditional halwa ceremony amidst lofty wish lists of India Inc and the sharp scrutiny of economists. Grappling with unprecedented challenges posed by the coronavirus pandemic two years ago, the government moved the goalpost by raising the FY22 fiscal deficit target to 6.8 percent from 3 percent. It aims to reduce it to 4.5 percent in FY26.

This plan has allowed Finance Minister (FM) Nirmala Sitharaman to increase spending on social welfare schemes and infrastructure development by up to ₹40 lakh crore. But there are strings attached, which has the money market tied up in knots. For one, government borrowing is likely to remain elevated at around ₹12 lakh crore. The Centre’s debt burden, as a percentage of GDP, has considerably increased to 60.5 percent in FY21 from 51.6 percent in FY20. Some economists expect it to touch 85 percent in the current fiscal. “A big concern for the markets is that fiscal deficit can remain higher for the next couple of years,” says R Sivakumar, head of fixed income at Axis Mutual Fund. Unless India sustains a relatively high growth trajectory, the road to fiscal consolidation is long and winding, especially in a highly volatile global environment.

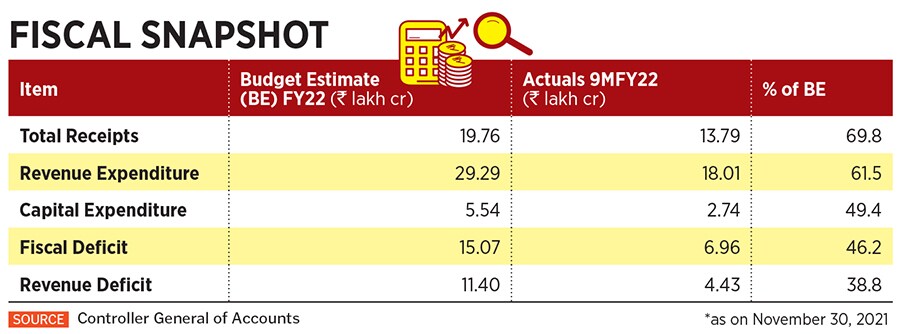

As of end-November, incremental revenues comfortably exceeded expenditures, and fiscal deficit stood at ₹6.96 lakh crore or 46.2 percent of the budget estimate. If data for the first nine months released by the government is a fair indicator, then it seems unlikely that the North Block will deviate from its indicated fiscal agenda.

Most economists Forbes India interacted with largely echo this view. Devendra Pant, chief economist, India Ratings and Research, is hopeful that the fiscal gap will shrink by 20 basis points to 6.6 percent in FY22. Suvodeep Rakshit, chief economist, Kotak Institutional Equities, says, “6.8 percent is not a difficult target for the FM to achieve.” He does not rule out the possibility of fiscal deficit in the range of 6 to 6.5 percent in the current financial year. Nikhil Gupta, chief economist at Motilal Oswal Financial Services, is of the view that fiscal deficit is likely to be pegged at 6.8 percent. Public finance expert M Govinda Rao, former director, National Institute of Public Finance and Policy, expects the government to marginally overshoot the fiscal deficit target by 20 basis points.

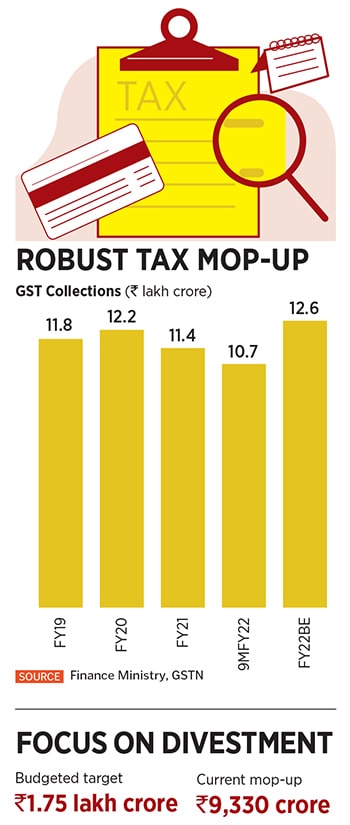

The windfall on the GST front has come as a huge relief for the government as it has once again failed to meet its disinvestment target. It was confident of monetising assets worth ₹1.75 lakh crore, but so far has sold assets to the tune of ₹9,330 crore. All eyes are on the LIC IPO, which the government is keen to execute this fiscal, but currently there are no definite details available on valuation and offer size. “I expect the LIC IPO this fiscal, but the process is longer than expected due to the complexities involved. The sale of BPCL can spill over to the next fiscal though,” Rao says. Gupta has a different perspective on the disinvestment debacle. He points out that total revenue receipts could exceed budget estimates by ₹2 lakh crore in FY22. “Considering the robust pace of tax growth, the government may actually want to push the divestment plan to next year—when tax growth perhaps will not be as strong,” he says.

The windfall on the GST front has come as a huge relief for the government as it has once again failed to meet its disinvestment target. It was confident of monetising assets worth ₹1.75 lakh crore, but so far has sold assets to the tune of ₹9,330 crore. All eyes are on the LIC IPO, which the government is keen to execute this fiscal, but currently there are no definite details available on valuation and offer size. “I expect the LIC IPO this fiscal, but the process is longer than expected due to the complexities involved. The sale of BPCL can spill over to the next fiscal though,” Rao says. Gupta has a different perspective on the disinvestment debacle. He points out that total revenue receipts could exceed budget estimates by ₹2 lakh crore in FY22. “Considering the robust pace of tax growth, the government may actually want to push the divestment plan to next year—when tax growth perhaps will not be as strong,” he says.

“The market is not just reacting to the FY22 fiscal target, but the fiscal deficit for the coming year. The government has stayed away from giving any guidance on the future path of fiscal consolidation given the uncertainties around the Covid situation,” explains R Sivakumar of Axis Mutual Fund. The government is likely to stick to its growth agenda and support the nascent signs of economic recovery, implying the need for higher borrowing to finance the deficit. Kotak Institutional Equities expects the central government’s fiscal deficit at around 5.8 percent in the next fiscal; 5 to 5.5 percent in FY24; 4 to 5 percent in FY25; and between 3.5 percent and 4.5 percent in FY26.

“The market is not just reacting to the FY22 fiscal target, but the fiscal deficit for the coming year. The government has stayed away from giving any guidance on the future path of fiscal consolidation given the uncertainties around the Covid situation,” explains R Sivakumar of Axis Mutual Fund. The government is likely to stick to its growth agenda and support the nascent signs of economic recovery, implying the need for higher borrowing to finance the deficit. Kotak Institutional Equities expects the central government’s fiscal deficit at around 5.8 percent in the next fiscal; 5 to 5.5 percent in FY24; 4 to 5 percent in FY25; and between 3.5 percent and 4.5 percent in FY26.