Vodafone Idea: Running to stand still

The government getting a substantial stake in VI does not change much for the Centre or the company. Its attractiveness as a corporate seeking urgent funding remains in question

No one doubts VI’s ability to either be able to borrow more from banks or even find a new investor, but it needs to be a substantial amount of money

No one doubts VI’s ability to either be able to borrow more from banks or even find a new investor, but it needs to be a substantial amount of money

Image: Punit Paranjpe / AFP

Vodafone Idea (VI), has, once again, taken a corporate decision, which for all practical purposes, will help it run to stand still. This month, the VI board approved of a government option (aid) -– to convert the full amount of interest on spectrum auction and AGR (adjusted gross revenue) dues, which it owes to the government, into equity.

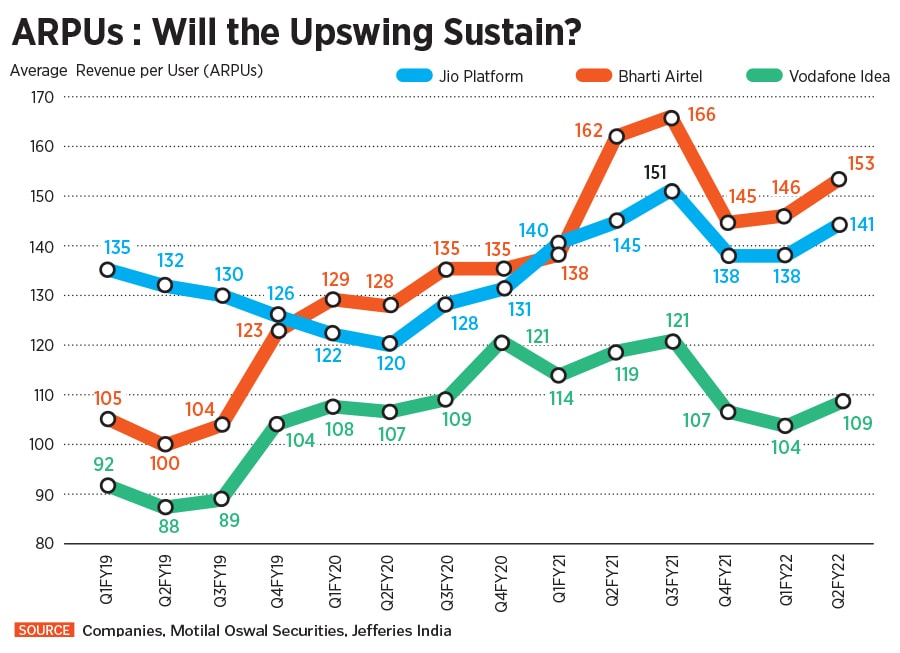

With this move, the government will soon become VI’s largest shareholder with a 35.8 percent stake, followed by UK’s Vodafone Group holding a lower 28.5 percent stake (44.39 percent earlier) and Aditya Birla Group 17.8 percent (27.66 percent earlier). The process is expected to be completed in a few months, the company said. This essentially implies that a potential investor may end up getting a lower stake -– unless the government sells its stake -- and have to invest more into VI. Unless VI can continue to raise its product prices, increase its average revenue per unit (ARPU) and turn profitable.

Vodafone Idea has reported nine successive quarterly losses, including a quarterly loss of Rs 7,132.3 crore for the three months to September 2021 on a 2.8 percent rise in revenues from the previous quarter to Rs 9,410 crore.

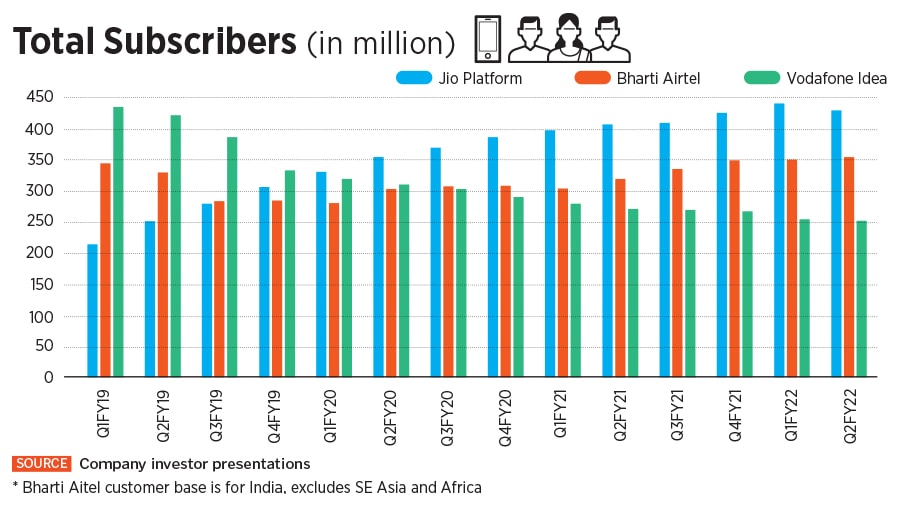

Once the fastest-growing telecom company, VI has continued to lose subscribers and market share to leader Reliance’s Jio Platforms and rival Bharti Airtel over the past three years (see charts). VI is scouting for fresh capital which would help the company lower its gross debt of Rs 1.94 lakh crore, as of September-end quarter. It also needs to invest in the upcoming 5G technology network expansion and compete with Jio and Airtel, while also trying to arrest its falling market share.