When investing becomes a (risky) hedge to small business slowdown

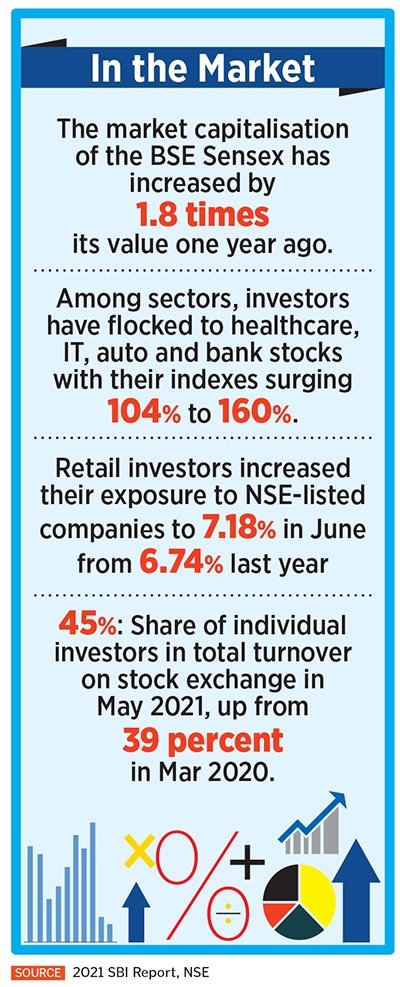

Newcomers have been flocking to the markets, learning the tricks of the trade and investing not just for the future but also as a way to keep income coming in to tide over the pandemic slump. But experts advise caution and warn against getting carried away by short-term gains

Twenty-year-old Nairit Gala has been doing long-term investing for two years, decided to dive into short-term trading this January; and Digital content creator & investor Raj Shamani has been investing since he was 18. He was into value investing before the pandemic hit and after the lockdown Shamani started exploring different avenues like Cryptocurrencies and NFT markets.

Twenty-year-old Nairit Gala has been doing long-term investing for two years, decided to dive into short-term trading this January; and Digital content creator & investor Raj Shamani has been investing since he was 18. He was into value investing before the pandemic hit and after the lockdown Shamani started exploring different avenues like Cryptocurrencies and NFT markets.

Image: Mexy Xavier

Fifty-eight-year-old Priya Thakur’s life came to a standstill in March last year as the nationwide lockdown was announced due to the onset of the Covid-19 pandemic. Delhi-based Thakur had been running a playschool and daycare center for over 20 years and not even in her wildest dreams did she imagine that her playschool, which was her source of fixed income, would be completely shut.

“During the initial months of the lockdown, I tried to keep myself engaged in different activities. Later on I started helping my daughter with her pet clothing online business which was booming and I started taking care of the production part. In March this year while speaking to my family friends I got to know about how they started trading in the stock market during the lockdown and are getting good results out of it. I was always interested in trading but had never thought of doing it in a full-fledged manner,” recalls Thakur, founder of Astro Playhouse. She then decided to open a trading and demat account with Zerodha, India’s largest stock broker. After taking suggestions and help from friends, Thakur played safe and invested in trusted companies like Tata Power, Infosys, Tata Motors, Reliance, State Bank of India and so on. To avoid losses and risk, she took the route of cash trading and invested in long-term stocks.

Starting off with an investment of Rs 1 lakh from her savings, she gradually kept adding Rs 50,000. After investing Rs 6 lakh, Thakur made a profit of Rs 1 lakh in two months. “From the last two weeks, I have been making a loss of Rs 20,000 daily, in fact earlier this week I lost Rs 40,000. So basically I lost all my profit but just two days back I recovered Rs 30,000. So now I’m Rs 8,000 down on my total investment. I’m confident to recover the same. From mid-July till now the markets have been very volatile but since I have invested in all top companies with zero debt, I’m not worried about losses.” Till date she has invested over Rs 15 lakh in the stock market.

Priya Thakur owns and runs a children day school at Delhi. The pandemic caused it to be shutdown, and she decided to get into stock market trading to keep her earnings coming in, and use the resources to renovate the space

.

Priya Thakur owns and runs a children day school at Delhi. The pandemic caused it to be shutdown, and she decided to get into stock market trading to keep her earnings coming in, and use the resources to renovate the space

.

Mukesh Pal Jagga owns and runs Viva Holidays Tours & Travel company in New Delhi. Business was badly hit due to the pandemic and to pay salaries to his employees, Jagga decided to aggressively dive into stock market so that he can spend the returns from trading on his business.

Mukesh Pal Jagga owns and runs Viva Holidays Tours & Travel company in New Delhi. Business was badly hit due to the pandemic and to pay salaries to his employees, Jagga decided to aggressively dive into stock market so that he can spend the returns from trading on his business. Aakarsh Shah is a lawyer, studying and working in Australia. He lost his job due to the pandemic and post that he started investing in the Indian stock market

Aakarsh Shah is a lawyer, studying and working in Australia. He lost his job due to the pandemic and post that he started investing in the Indian stock market