Why Info Edge lost faith in 'bijnis'

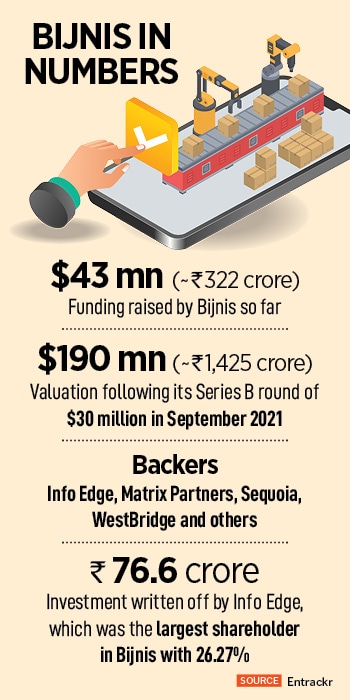

Sanjeev Bikhchandani backed B2B marketplace bijnis in 2018 and remained bullish on the startup for five years, owning the biggest stake with 26.27percent. He eventually realised that with high cash burn, unsustainable unit economics and a funding winter, bijnis didn't make sense

Sanjeev Bikhchandani, Founder and executive vice chairman of Info Edge Image: Madhu Kapparath

Sanjeev Bikhchandani, Founder and executive vice chairman of Info Edge Image: Madhu Kapparath

September 2021, New Delhi. Let’s start the story from the climax. It was September 2021. Bijnis, a B2B platform for the unorganised retail segment such as footwear and apparel, raised $30 million in a series B round of funding led by WestBridge Capital. Existing investors such as Info Edge, Matrix Partners India, Sequoia Capital, and WaterBridge Ventures too participated in the round. Big backers, a big round of funding, and big prospects… everything was going well for bijnis.

The CEO laid down the grand vision of the startup which was started in 2015 by Siddharth Vij, Chaitanya Rathi, Siddharth Rastogi, and Shubham Agarwal. “We want to take factories to the world by digitising and building a globally integrated network of manufacturers on one platform,” underlined co-founder and CEO Vij in the funding media release, claiming that over 5,000 manufacturers were running their businesses on the startup’s app. “We are grateful to all our investors for the faith they have shown in our mission,” he added a note of thanks.

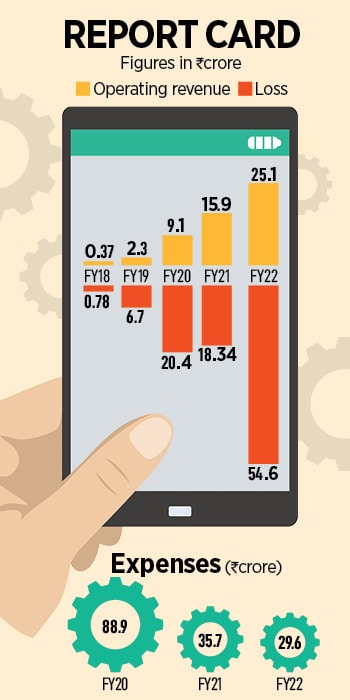

Well, bijnis did need a huge leap of faith. The reason was its gloomy report card since inception. From Rs 37 lakh in operating revenue in FY18, the numbers increased to Rs 15.91 crore in FY21. During the same period, however, losses jumped from Rs 78.5 lakh to Rs 18.34 crore. The most interesting point, though, happened to be the most alarming point. There was no single fiscal year of operations when the revenue was more than the loss. The bottom line was always much bigger than the top line. (see box).

The backers, though, were least bothered. Reason: They were glued to a bigger picture, and the prospects of a promising future. bijnis, they argued, was operating in the over $100 billion largely unorganised categories of fashion, footwear and lifestyle. The headroom to grow business, undoubtedly, was immense. A bloating loss, most of them reckoned, could be ignored as promising businesses need time to grow and post profit. Kitty Agarwal, the then partner at Info Edge Ventures, gave a peep into the mindset and approach of all the VCs on the board. “We are fortunate to be close partners with the bijnis team since their seed round in 2018,” Agarwal highlighted in the media release, proudly stressing that the fund had doubled down in every round of investment. “(We have) our deep faith in the founders and their passion for truly changing how Indian factories do business with the world,” the VC noted.

The backers, though, were least bothered. Reason: They were glued to a bigger picture, and the prospects of a promising future. bijnis, they argued, was operating in the over $100 billion largely unorganised categories of fashion, footwear and lifestyle. The headroom to grow business, undoubtedly, was immense. A bloating loss, most of them reckoned, could be ignored as promising businesses need time to grow and post profit. Kitty Agarwal, the then partner at Info Edge Ventures, gave a peep into the mindset and approach of all the VCs on the board. “We are fortunate to be close partners with the bijnis team since their seed round in 2018,” Agarwal highlighted in the media release, proudly stressing that the fund had doubled down in every round of investment. “(We have) our deep faith in the founders and their passion for truly changing how Indian factories do business with the world,” the VC noted.

Agarwal’s optimism and exuberance was matched by other fellow VCs. Take, for instance, Shraeyansh Thakur. “The team is very excited about bijnis's vision and look forward to partnering them on this mission,” the vice president at Sequoia India reckoned. Ashish Jain of WaterBridge Ventures too sounded quite upbeat. "bijnis represents quintessential Tech disruption… and is on track to create a scaled-up game-changing company," the partner outlined.