Why the Reserve Bank's rate-setting panel is unlikely to press pause

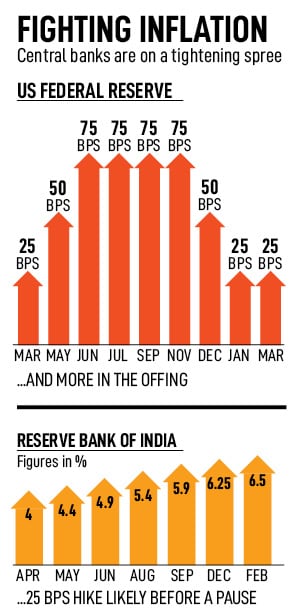

The US Fed, ECB, BoE raised rates even as the global banking system reels under losses, credit squeeze, and growth concerns. In tow, the RBI's MPC is likely to lift rates by 25 bps this week in the face of global uncertainty and stubborn headline inflation

(L) RBI Governor Shaktikanta Das and (R) Jerome Powell, Chairman of the Board of Governors of the Federal Reserve System

Images: Shaktikanta Das: Indranil Aditya/NurPhoto via Getty Images; Jerome Powell: Leah Millis / Reuters

(L) RBI Governor Shaktikanta Das and (R) Jerome Powell, Chairman of the Board of Governors of the Federal Reserve System

Images: Shaktikanta Das: Indranil Aditya/NurPhoto via Getty Images; Jerome Powell: Leah Millis / Reuters

Global markets are in a strange and uneasy place as easy money dries up and contagion fears linger after the big policy reset by central bankers in the last twelve months.

Never in recent history has the world witnessed a more synchronised pace of relentless rate hikes to tame stubbornly high inflation levels. The sudden financial tightening has choked growth and squeezed many banks out of shape. This, combined with the ongoing war between Russia and Ukraine, and the strained relations between China and the US, has put the world economy on tenterhooks.

Geopolitical concerns aside, the unfolding turmoil in the global banking industry underlines financial stability issues given how interconnected money markets are worldwide. The global financial crisis of 2008 is a reminder of possible shocks of varying degrees the world at large is exposed to when its biggest capital provider faces trouble. This will occupy a place of importance for central banks as markets chew over whether the quantitative tightening cycle is approaching its peak.

Perfect Storm: US Fed, ECB on the Edge

Since March 2022, the US Federal Reserve has lifted rates by 475 basis points to 4.75-5 percent target range. The terminal rate is seen around 5.6 percent by year-end. In March, it raised the policy rate by 25 basis points even as it took note of spill over risks in the financial system. There are signs of stress in many regional banks after the collapse of Silicon Valley Bank (SVB) set off alarm bells. US Federal Reserve Chair Jerome Powell mentioned that most committee members did take the spill over risks into account but “some additional policy rate firming may be appropriate.” Bank of America believes some amount of unexpected tightening in bank lending standards may be in the offing. “The US economy may see tighter lending standards than what could be explained by macroeconomic fundamentals. If so, our view is that it could indeed substitute for further rate hikes. Hence, we no longer expect a 25bp rate hike in June and now foresee a terminal target funds rate of 5.0-5.25 percent reached in May,” its economists said.

Bank of America believes some amount of unexpected tightening in bank lending standards may be in the offing. “The US economy may see tighter lending standards than what could be explained by macroeconomic fundamentals. If so, our view is that it could indeed substitute for further rate hikes. Hence, we no longer expect a 25bp rate hike in June and now foresee a terminal target funds rate of 5.0-5.25 percent reached in May,” its economists said.

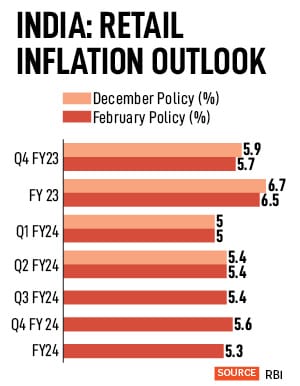

Now, that looks unlikely, as most analysts and economists have pencilled in a repo rate hike of 25 basis points given the higher-than-expected retail inflation print of 6.44 percent in February and the ensuing global chaos. Unlike some global banks, Saugata Bhattacharya, EVP and chief economist, Axis Bank, explains Indian financial institutions are on firm footing. The painful clean-up of bad loans exposed chinks and led to stronger bank balance sheets.

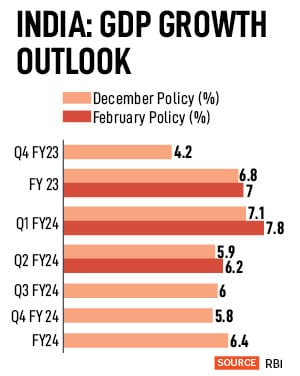

Now, that looks unlikely, as most analysts and economists have pencilled in a repo rate hike of 25 basis points given the higher-than-expected retail inflation print of 6.44 percent in February and the ensuing global chaos. Unlike some global banks, Saugata Bhattacharya, EVP and chief economist, Axis Bank, explains Indian financial institutions are on firm footing. The painful clean-up of bad loans exposed chinks and led to stronger bank balance sheets. “We remain concerned about growth prospects this year, primarily factoring in the impact of the global slowdown on exports and investment. A global soft landing will have limited positive spill over effects for India, as higher-for-longer global rates will weigh on financial conditions and hurt capex, while China’s services-led reopening is unlikely to benefit India. Monetary policy also acts with long and variable lags, so the full impact of tighter domestic monetary policy and liquidity conditions on growth is yet to materialise. Meanwhile, continued weakness in the rural sector, and K-shaped trends in consumption make it an unreliable driver of growth in the near term,” say the economists at Nomura.

“We remain concerned about growth prospects this year, primarily factoring in the impact of the global slowdown on exports and investment. A global soft landing will have limited positive spill over effects for India, as higher-for-longer global rates will weigh on financial conditions and hurt capex, while China’s services-led reopening is unlikely to benefit India. Monetary policy also acts with long and variable lags, so the full impact of tighter domestic monetary policy and liquidity conditions on growth is yet to materialise. Meanwhile, continued weakness in the rural sector, and K-shaped trends in consumption make it an unreliable driver of growth in the near term,” say the economists at Nomura.