Betting on beauty: What's driving sudden investor interest in the business

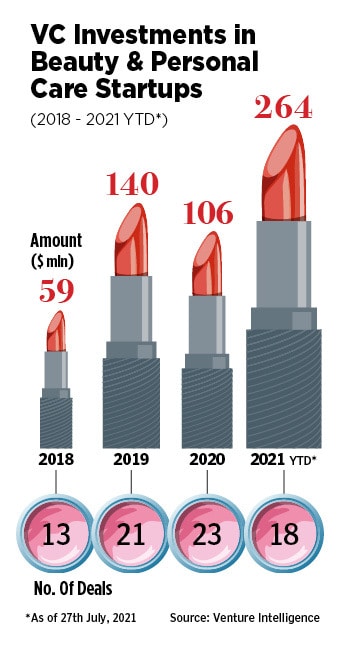

The beauty and personal care space saw $264 million in funding in the seven months to July 2021 compared to $106 million in all of 2020. While the returns are higher, awareness among investors about the attractive category is increasing too

The beauty and personal care market is attractive: Gross margins tend to be high at 65 to 70 percent, unit economics are good, and products need regular replenishmentImage: Shutterstock

The beauty and personal care market is attractive: Gross margins tend to be high at 65 to 70 percent, unit economics are good, and products need regular replenishmentImage: Shutterstock

When she’s not busy readying for the launch of her prêt line of clothing, Shivani Kher spends her time scrolling through Instagram for the latest beauty tutorials. “I love makeup,” gushes the 27-year-old over phone from Faridabad in Haryana. She usually buys her supplies from Nykaa and says she spends about Rs 5,000 to Rs 6,000 on average per month on beauty products.

Meanwhile, in Mumbai’s Dombivli, an eastern suburb, once Kirti Shah, 34, wraps up her hectic morning—she’s up at 5 am, cooks lunch, readies her kids for online school and bids goodbye to her husband who recently started work from office—she settles down with a cup of tea, and her phone. She checks out beauty tutorials on YouTube and enjoys scrolling through beauty e-tailer Purplle’s website even if she doesn’t intend to buy anything. “Mazaa aata hai… mann halka ho jaata hai (It’s fun… it lightens my mind),” she says. She does this two to three times a day whenever she gets a breather, she confesses. “Customers like her usually visit our website or app 10 times over 30 days before actually placing an order. The average basket size is about Rs 900,” says Manish Taneja, co-founder and CEO of Purplle that lists about 500 brands on its marketplace.

“Girls in Tier III cities know if Kylie Kardashian has launched a new beauty product just as well as someone in a metro. They’re on top of the latest trends. That’s the power of social media,” says Darpan Sanghavi, co-founder and CEO of direct-to-consumer (D2C) beauty brand MyGlamm. Taneja concurs: “Every city, small or large, has a Tier I, II and III type of customer. In Mumbai, for example, you have people living in slums; wealthy people live in non-metros too. Customers today, especially the middle bracket Tier II type of customers, [like Shah] are more aware. For example, they’ll diligently follow a CTSM (cleanse, tone, serum and moisturise] skincare routine in the morning and at night. It might just be a Rs 200 serum that they buy, but they stick to a routine. Social media has brought about that awareness.”

“Girls in Tier III cities know if Kylie Kardashian has launched a new beauty product just as well as someone in a metro. They’re on top of the latest trends. That’s the power of social media,” says Darpan Sanghavi, co-founder and CEO of direct-to-consumer (D2C) beauty brand MyGlamm. Taneja concurs: “Every city, small or large, has a Tier I, II and III type of customer. In Mumbai, for example, you have people living in slums; wealthy people live in non-metros too. Customers today, especially the middle bracket Tier II type of customers, [like Shah] are more aware. For example, they’ll diligently follow a CTSM (cleanse, tone, serum and moisturise] skincare routine in the morning and at night. It might just be a Rs 200 serum that they buy, but they stick to a routine. Social media has brought about that awareness.”

Awareness among investors is also increasing. The beauty and personal care space (BPC) has been on a tear since the start of this year. A total of $264 million in funding has flowed into startups just in the seven months to July 2021, compared to $106 million in the whole of 2020. A total of 18 deals have been struck in the year so far compared to 23 in 2020.

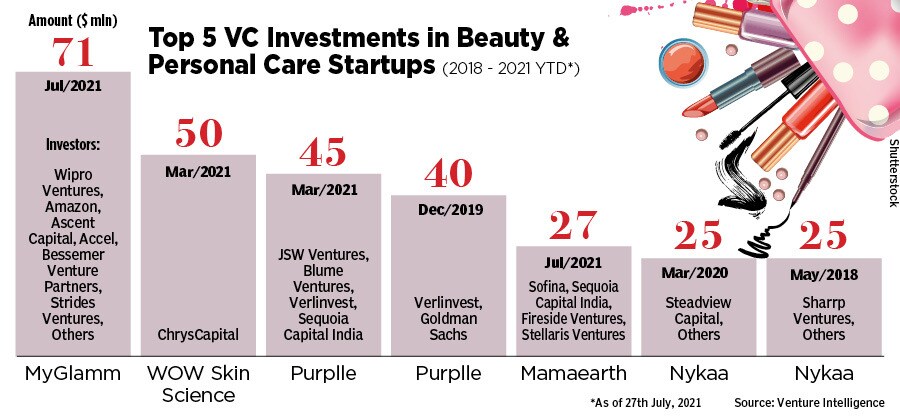

Mega deals like the Wipro Ventures and Amazon-led $71 million Series C round in MyGlamm in July 2021, ChrysCapital’s $50 million investment in Wow Skin Science and the Sequoia Capital India-led $45 million fundraise in beauty marketplace Purplle, both in March 2021, are the largest fund raises in the space since 2018.

"Girls in Tier III cities know if Kylie Kardashian has launched a new beauty product just as well as someone in a metro. They’re on top of the latest trends. That’s the power of social media,” says Darpan Sanghavi, co-founder and CEO of direct-to-consumer (D2C) beauty brand MyGlamm

"Girls in Tier III cities know if Kylie Kardashian has launched a new beauty product just as well as someone in a metro. They’re on top of the latest trends. That’s the power of social media,” says Darpan Sanghavi, co-founder and CEO of direct-to-consumer (D2C) beauty brand MyGlamm